Review of the Current Offshore Decommissioning Practices and Guidelines in Five Southeast Asia Countries

1Department of Civil and Environmental Engineering, Universiti Teknologi PETRONAS, Seri Iskandar, Perak Darul Ridzuan, Malaysia

2Department of Research & Knowledge Exchange, University of Nottingham Malaysia, Jalan Broga, Semenyih Selangor Darul Ehsan, Malaysia

3Aerodyne Group, Cyberjaya, Selangor, Malaysia

4Marine Technology Center, Institute for Vehicle Systems and Engineering, Faculty of Mechanical Engineering, Universiti Teknologi Malaysia, Johor, Malaysia

5Department of Civil and Environmental Engineering, Faculty of Engineering, Mahidol University, Salaya Campus, Nakhonpathom, Thailand

6Department of Petroleum Drilling and Production, Petroleum Faculty, PetroVietnam University, Ba Ria City, Ba Ria - Vung Tau Province, Vietnam

7Department of Ocean Engineering, Institut Teknologi Bandung, Bandung, Indonesia

8Marine Technology Programmes, Newcastle University, Singapore

9Liverpool Logistics, Offshore and Marine (LOOM) Research Institute, Liverpool John Moores University, Liverpool, Merseyside, UK

10Department of Computer Science, Universiti Teknologi PETRONAS, Seri Iskandar, Perak Darul Ridzuan, Malaysia

*Correspondence to: Noor Amila Wan Abdullah Zawawi, PhD, Associate Professor, Department of Civil and Environmental Engineering, Universiti Teknologi PETRONAS, Persiaran UTP, Bandar Seri Iskandar, Perak Darul Ridzuan, 32610, Malaysia; Email: amilawa@utp.edu.my

Abstract

This paper review addresses the decommissioning legislations, guidelines, and practices within Southeast Asia countries, specifically Malaysia, Indonesia, Thailand, Vietnam, and Brunei, along with a comparison of their decommissioning practices. Presently, these countries have no regional regulations specific to decommissioning, relying instead on guidelines and technical standards. In contrast to the Gulf of Mexico, Southeast Asia countries have limited knowledge and experience in offshore decommissioning. This study compiles and assesses existing information on decommissioning legislations, guidelines and practices obtained from representative of each country. Consequently, it was observed that the decommissioning practices among Southeast Asia countries are almost similar with Thailand is slightly ahead of the pack in terms of prescriptive regulations, level of detail, and decommissioning experience.

Keywords: offshore decommissioning, abandonment, decommissioning regulations, southeast asia decommissioning

1 INTRODUCTION

According to ASEAN Council on Petroleum (ASCOPE)[1], decommissioning is the final phase of oil and gas operation and must be considered in all phases of the life cycle of the facility. The facility should be planned to have cost effective total disposal at the end of its useful life. A decommissioning operation requires involvement of international and national government agencies, oil, and gas companies, third parties, local communities, and non-government organizations. International conventions have stipulated that all offshore platforms must be decommissioned at the end of their useful life. Decommissioning also can be described as the process of removal, disposal and dismantling of a structure[2,3]. In comparison to Gulf of Mexico, Southeast Asia countries have limited knowledge and experience regarding offshore decommissioning. Approximately 2,600 offshore structures and 35,000 wells that cost US $100 billion in the Asia Pacific are expected approaching the end of production. These assets will become the next potential market in the decommissioning sector, with more than 1,700 fixed offshore structures and over 7,000 wells that require decommissioning[4]. The decommissioning activity brings up the biggest challenge for operators, governments, and service providers[5-7] with an estimated 2,000 of structures likely to stop production by 2040[8]. More than 1,700 fixed offshore platforms and half of the offshore structures in Southeast Asia region, particularly in Malaysia, Thailand, Indonesia, Vietnam, and Brunei are more than 20 years old and will be decommissioned[9].

The global decommissioning market size is projected to expand at a CAGR of 4.8%, from an estimated USD 6.2 Billion in 2019 to USD 8.9 Billion by 2027[10]. However, decommissioning activities in the Southeast Asia region face limitations due to unclear regulations and guidelines for offshore decommissioning. Moreover, inadequate enforcement of regulations stands out as a significant issue in the region. Additionally, the decommissioning industry is still in its stages of development, resulting in a scarcity of experienced regional manpower in this sector. In creating the expertise, it may take a few years to deeply explore and understand the decommissioning industry. The countries may seek experts from other regions for sharing knowledge, skills, and experience.

Another challenge is lack of literature on offshore decommissioning, specifically the unforeseen impacts on marine fauna and flora. Common issues in decommissioning includes the safety and health risks for manpower and other sea users during operation on structures older than 40 years, the complex and challenging nature of the decommissioning process; ensuring clean and effective removal of offshore installation to maintain the surrounding environment; and lack of infrastructure, including storage and disposal for hazardous waste[11].

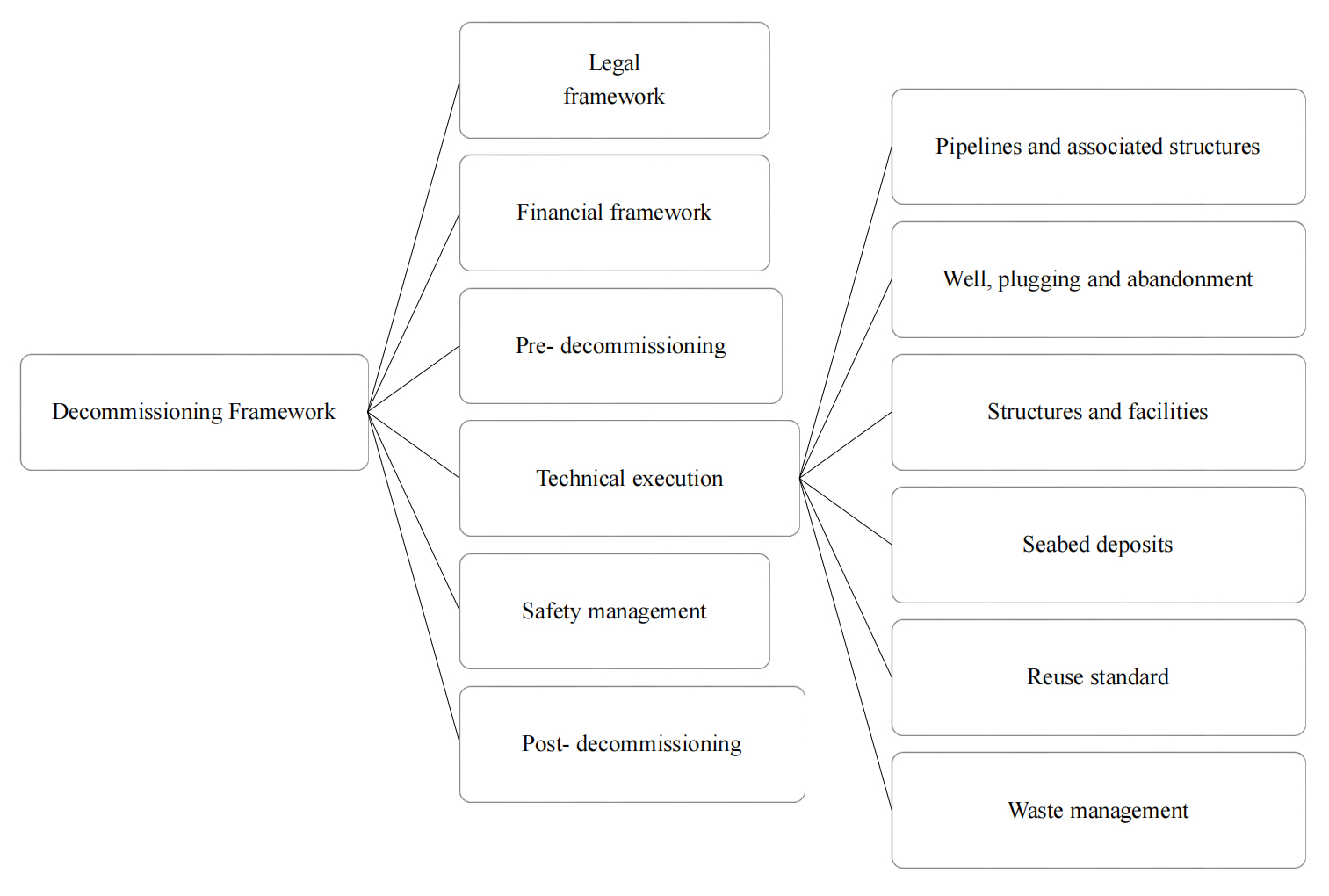

This article begins by providing an overview of the decommissioning process in 5 countries in Southeast Asia: Malaysia, Indonesia, Thailand, Vietnam, and Brunei. Figure 1 illustrates the map of the components for comparison decommissioning regulation. Next, the article reviews the existing decommissioning legislation, guidelines, and practices of each country. Following that, the article delves into the financial practices among these countries. Sections 5-7 cover decommissioning activities, including pre-decommissioning, technical execution (such as pipelines and associated structures, well plugging and abandonment, structures and facilities, seabed deposit management, reuse standards, waste management), safety management, and post-decommissioning compliance with each country’s legal framework. Additionally, this section explains the options for decommissioning oil and gas structures of each country.

|

Figure 1. Map of the components for comparison decommissioning regulation.

2 DECOMMISSIONING OVERVIEW IN SOUTHEAST ASIA COUNTRIES

In Malaysia, there are over 390 of offshore structures and subsea structures in an area of 343,447 square kilometres, with most of them are reaching the end of their 25 years’ service of life. Approximately, 11% or 35 structures are older than 40 years old and, more than 200 wells have been identified to be decommissioned. Between 2022 and 2024, around 120 wells are scheduled for decommissioning[3]. The shallow water in Malaysia range from 30 to 80 meters in depth and are located in three regions of Malaysian waters: Peninsular Malaysia Operation, Sarawak Operation and Sabah Operation[12]. Malaysia’s 19 years of decommissioning experience to date has recorded 8 decommissioned structures from the year 2003 to 2019, which are Ketam (2003), Baram 8 (2004), Samarang Vent Platform and Samarang 4 (2012), Cendor MOPU (2014), Kapal (2017), Dana/D30 (2017) and Ophir (2019)[3]. Decommissioning in Malaysia face several challenges, primarily the lack of publicly accessible data, difficulty in doing the benchmarking due to limited decommissioning experiences, unclear financial framework, and requirements for executions as well as the absence of guidelines for the reuse of offshore structures. Developing a ranking system for decommissioning that integrates with existing asset databases while considering economic factors, asset lifespan, and reputation management poses significant challenges. Furthermore, repurposing existing infrastructure primarily suited for new development and new-built projects for decommissioning presents additional costs and complexities[7].

Indonesia conducts offshore operations in both shallow and deep waters, with the average depth of shallow water ranging from approximately 50 to 100m[13]. The country recorded more than 600 fixed offshore structures, with nine have been identified to be decommissioned[14,15]. 70% of these structures have reached the end of their useful life[16]. Approximately 65% are over 30 years old. Additionally, about 300 structures have been in operation for more than 20 years. Indonesia reported seven platforms decommissioned[15].

In Thailand, the Gulf of Thailand hosted over 450 offshore structures, with less than 10% aged more than 40 years. Over the next 5 years, approximately 23 topsides and jacket will be reuse, dismantling or convert to rig to reef projects[17]. The water depth range in Thailand is similar to Malaysia and Indonesia, approximately 60 to 80m[13]. By December 2021, 25 installations have been decommissioned in the Gulf of Thailand[18].

Vietnam operates 60 offshore structures, some of which have been in operation for more than 35 years[13,19]. Despite this, Vietnam lacks of decommissioning experience and has not yet identified any structures for decommissioning[20]. The water depth identified in Vietnam ranged from 15 to 60m[21].

As for Brunei, the oil and gas have been the mainstay of Brunei’s economy for over 85 years. All offshore oil fields operate in water depth between 20 to 65m. Brunei Shell Petroleum undertook decommissioning work towards the end of the 1980s. Brunei has identified 53 structures to be decommissioned by 2030[13].

3 DECOMMISSIONING LEGAL FRAMEWORKS IN SOUTHEAST ASIA COUNTRIES

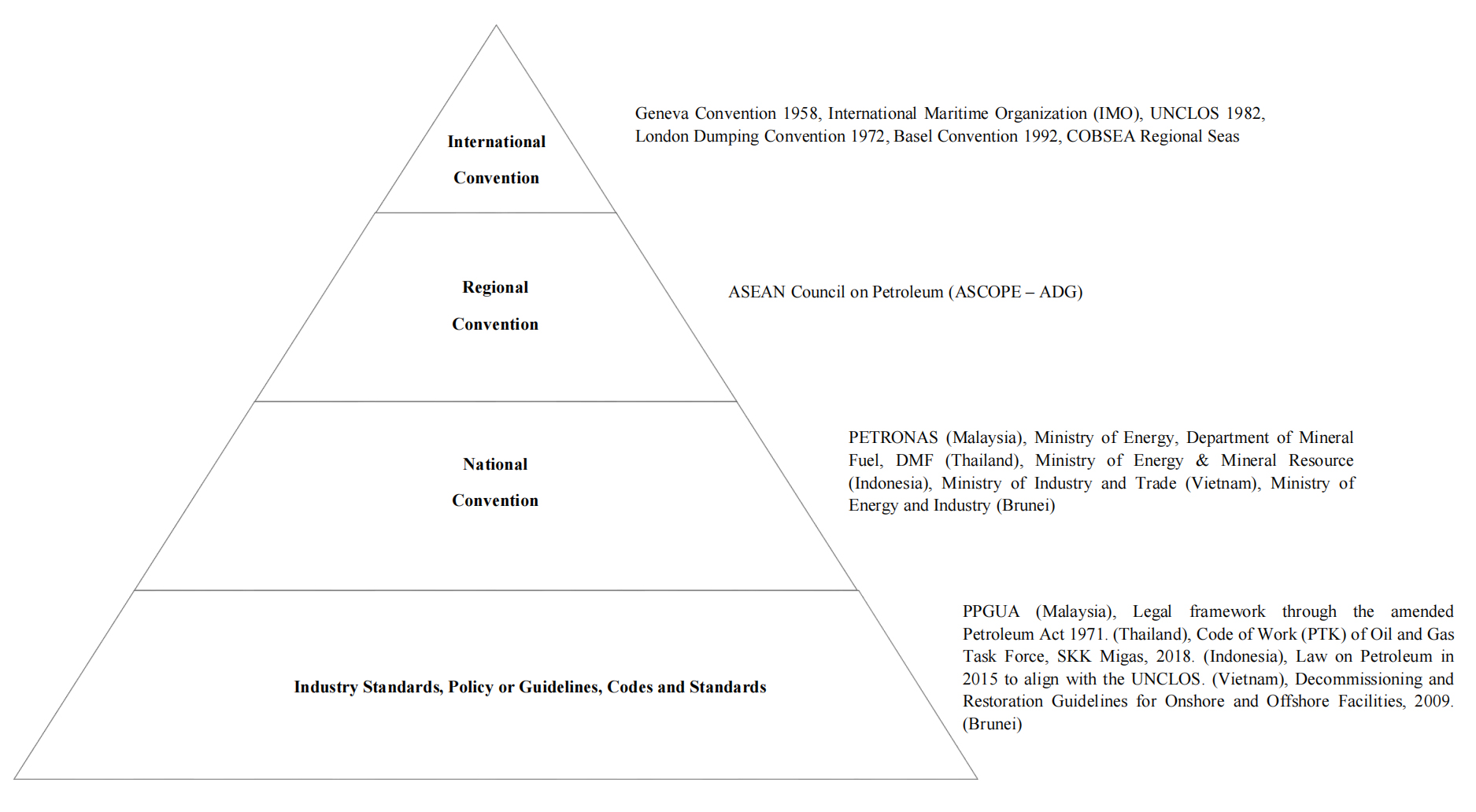

Although there is no specific decommissioning regulation for the oil and gas industry for these 5 countries, guidelines and practices have been implemented by the countries based on the national regulations for reference as shown in Figure 2. For example, Malaysia relies on PETRONAS Procedure and Guidelines for Upstream Activities (PPGUA) as its primary decommissioning guidelines. Indonesia follows the Code of Work (PTK) of Oil and Gas Task Force, No.40/2018 Abandonment and Site Restoration[22]. Thailand has a decommissioning legal framework through the amended Petroleum Act 1971. Vietnam updated the 1994 Law on Petroleum in 2015 to align with the United Nations Convention Law of the Sea. In Brunei, Decommissioning and Restoration Guidelines for Onshore and Offshore Facilities were implemented in 2009.

|

Figure 2. Regulatory regime hierarchy in Southeast Asia.

The Southeast Asia countries also are members of the ASCOPE. The ASCOPE Decommissioning Guideline for Oil and Gas Facilities is a regional decommissioning guideline. Establishment of ASCOPE to provide the reference guidelines on technical offshore decommissioning and disposal options for 10 members (10 countries) in the Southeast Asia region including Malaysia, Thailand, Indonesia, Vietnam, and Brunei. Table 1 shows the ASCOPE Members’ countries ratified the international conventions respectively.

Table 1. ASCOPE Members and International Convention[1]

ASCOPE Member Country |

Malaysia |

Thailand |

Indonesia |

Vietnam |

Brunei |

Geneva Convention 1958 |

X |

X |

|

|

|

UNCLOS 1982 |

X |

X |

X |

X |

X |

Basel Convention (1989) |

X |

X |

X |

X |

X |

Notes: X: Ratification.

The national bodies and regulations involved in decommissioning activity in Malaysia are (i) Exclusive Economic Zone Act 1984, provides the regulation of activities in the zone and on the continental shelf and for matters related therewith. (ii) Environmental Quality Act (EQA), 1974 (Act 127) and subsidiary legislation made thereunder (2001) (EQA) for control pollution and enhance environmental quality, (iii) Department of Environment (DOE): established based on EQA to control, prevent and protect the quality of the environment, (iv) Occupational Safety and Health Act 1994 of Department of Occupational Safety and Health to ensure safety and health at the workplace and (v) Merchant Shipping Ordinance 1952 of Marine Department Malaysia for shipping activity in Malaysia. The guidelines based on the collected knowledge, experience, lessons learnt, and best practices developed by PETRONAS are PPGUA[23], Decommissioning Guidelines, PETRONAS HSSE minimum procedures and requirements for decommissioning of upstream installations, Decommissioning Option Assessment (DOA) Procedure and PETRONAS Basic Technical Requirement and Sustainable Artificial Reefing procedure[3]. Petroleum Development Act 1974 and exclusive economic zone (EEZ) 1984 implies that PETRONAS is the owner and regulator of petroleum facilities and has been entrusted for any decommissioning activity in Malaysia. This is an interesting position to observe.

4 national bodies are involved in decommissioning activity in Indonesia: (i) Ministry of Environment, Ministry of Energy and the Mineral Resources which also established the Satuan Kerja Khusus Pelaksana Kegiatan Usaha Hulu Minyak dan Gas Bumi that act as temporary regulatory, (ii) Ministry of Finance: establish regulation No.140 to manage the State-owned goods originating from the implementation of cooperation contracts for upstream oil and gas business activities, (iii) Ministry of Transportation (Directorate General of Sea Transportation), and Ministry of Ocean and Fishery and (iv) Ministry of Energy and Mineral Resources -published a Ministerial Regulation concerning platform decommissioning through decree No.01/2011 describing technical guidelines for dismantling of oil and gas structures. Indonesia government has implemented several regulations, namely Regulation No.35 of 2004 for upstream oil and gas business activities, Regulation No.17, 1974 for offshore oil and gas exploration sets out the requirement to dismantle oil and gas structure that are not use must notify the government prior to decommissioning. Furthermore, there are 3 laws regarding the abandonment and site restoration in Indonesia: Law No.22 of 2001- for business entity guarantees the health and safety of worker and environmental management, Law No.17 of 2008- shipping and Environmental and Law No.32 of 2009- environmental protection and management of abandonment and site restoration (ASR) activities in Indonesia[15].

The major legislation governing oil and gas in Thailand are (i) Petroleum Act B.E. 2514 (1971) - controls the oil and gas operations in Thailand[24], (ii) The Department of Mineral Fuels - main regulatory body for decommissioning, (iii) The Petroleum Income Tax Act B.E. 2514 (1971) - related to the direct tax charged on the revenue created from oil and gas exploration and production activities, (iv) Thailand - Malaysia Joint Authority Act B.E. 2533 (1990) - sets out the regulations for oil and gas exploration and production activities in the Malaysia Thailand Joint Development Area, (v) Act on Offences Relating to Offshore Petroleum Production Places B.E.2530, 1987- regulates the notification of offshore safety zones and every offence committed in the safety area or the production place, (v) Ministerial Regulation Prescribing Plan and Estimated Cost and Security for Decommissioning of Installation Used in the Petroleum Industry B.E.2259 (2016) - promulgation to fill in some of the gaps by detailing the designation of rules, procedures, conditions, schedules of submission and placement of financial security[25].

The principal governing body of the oil and gas industry in Vietnam are Ministry of Industry and Trade (MOIT), Ministry of Natural Resources and Environment, Ministry of Finance, Ministry of Transport, Ministry of Construction and State Bank of Vietnam. The Vietnamese government has issued several Decisions pertaining to decommissioning activities. These include The Prime Minister of Government[26], Decision No.49/2017/QD-TTg, which provides guidance on decommissioning of petroleum installations, equipment, and facilities, requiring operators to submit decommissioning plans for approval to the MOIT. The Prime Minister of Government[27], Decision No.41/1999/QD-TTg focuses on safety management in oil and gas activities, The Prime Minister of Government[28], Decision 04/2015/QD-TTg outlines specifications for safety management in oil and gas activities, particularly in Well plugging and abandonment (P&A), The Prime Minister of Government[29], Decision No.37/2005/QD-BCN involves the promulgation of the regulation on maintenance and abandonment of oil and gas wells and The Prime Minister of Government[30], Integrated document No.10/VBHN-BCT addresses the protection and abandonment of oil and gas wells.

The national law regulating oil and gas in Brunei decommissioning are (i) Petroleum Mining Act[31], (ii) Petroleum (Pipe-lines) Act[32], (iii) Territorial Waters of Brunei Act[33] and (iv) Land Code (Strata) Act[34]. The national bodies that is responsible for monitoring and facilitating the oil and gas activities companies in Brunei are Energy Upstream Business unit, which is under the Energy and Industry Department, Prime Minister’s Office (Ministry of Energy Brunei Darussalam), The Safety, Health, and Environmental National Authority oversees the improvement of the health and safety legal framework, DOE, Parks, and Recreation under the Ministry of Development for waste management, environmental related and Environmental Protection and Management Order (EPMO) (2016) and the Hazardous Waste[35].

4 DECOMMISSIONING FINANCIAL FRAMEWORK IN SOUTHEAST ASIA COUNTRIES

Each Southeast Asia Countries have established methods to ensure the decommissioning cost and activities are met and completed. Thailand’s financial framework is more detailed compared to the other four countries as it defines the conditions necessary for financial security. Malaysia, Indonesia, and Vietnam are requiring the operator to provide fund to handle the decommissioning cost. Yet the financial framework in Malaysia is less specific whereby the Production Sharing Contractor (PSC) shall provide the decommissioning work plan and budget (WP&B) with approval by PETRONAS before the decommissioning activities begin. Malaysia started cessation fund contributions for PSC after 1998. The cessation fund contributed by operators is to be used for decommissioning[36]. Referring to Clause 14th in Minister of Energy and Mineral Resources Regulation No.15 Post Operation Activities of Oil and Gas, the post-operation of upstream oil and gas activities in Indonesia is financed with a post-operation fund which is mandatory to be reserved by oil and gas operators. Clause 12 describes that the fund is treated as recovered operation cost in cost recovery type of partnership contract and as a deductible item from revenue of oil and gas operator in the tax revenue calculation[37]. In Thailand, financial security is required to guarantee both decommissioning and post-decommissioning monitoring will be conducted entirely. Financial security can be both individually and in combination[38]. The financial framework of Vietnam indicates that within one year after the production of the first oil and gas, the operators shall set up a financial guarantee fund for the decommissioning activities based on the approved decommissioning plan[26]. In Brunei, the guideline states that all operators of decommissioned fields should prepare cost estimation method for the decommissioning activities with details of cost estimation including the maintenance cost, if necessary, the specific timelines of measures are to be taken and the location of the structures or pipeline is to leave in place or to be removed[39].

5 PRE-DECOMMISSIONING IN SOUTHEAST ASIA COUNTRIES

In the case for Malaysia, pre-decommissioning phase consist of three stages. First, the framing stage which to select the best decommissioning option either to be left in-situ, partial or total removal and reuse according to Technical Standard, PETRONAS[40]. DOA shall be conducted to choose the best options. DOA requires various types of information including Environmental Impact Assessment, Environmental Management Plan and environmental monitoring data and it is required PETRONAS to review and submit to DOE for approval 6 months prior to the decommissioning[23]. Next is the evaluation stage, whereby an HSE risk assessment is conducted to identify and assess all risks of the decommissioning strategy and planning. The last stage is the planning stage, to develop plans for all decommissioning activities based on the decommissioning option selected. In Indonesia, WP&B or Plan of Development shall be prepared including economic value of the oil and gas field development prior to start decommissioning activity. ASR Jakarta specified it is mandatory for oil and gas companies to submit the planning of ASR activities complete with its cost estimation to SKK Migas for approval prior to starting decommissioning activities[22]. An ASR plan contains information on the equipment to be decommissioned, facilities including the well which will be permanently closed, and cost estimation of the ASR and submission should be 3 to 5 years and for well closure at least 1 year prior to execution schedule. The evaluation of ASR proposal considers technical study, Health, Occupational Safety, and Environmental Protection risk assessment, asset validation, inspection, and maintenance activity report, decommissioning option, technical method of execution assessment, project execution and project management plan, site restoration, cost, and legal aspect identification.

In Thailand, the Best Practicable Environmental Option (BPEO) is used as the preferred tool for selecting the optimal decommissioning approach, considering minimal environmental impact, community health and safety concerns, and technical feasibility. Throughout the production phase, the submission of the initial program in 2 years since production is compulsory if the total left reserve is lower than 40%. Otherwise, the final decommissioning program shall be submitted at a minimum of 2 years as of the beginning of decommissioning in case the total remaining reserve is higher than or equal to 40%[38]. In Vietnam, a report on environmental monitoring shall be prepared and submit to the Ministry of Natural Resources and Environment included the decommissioning plan. At present under Vietnam’s legislation, a complete removal is selected[26]. However, the installation can be retained if it does not harm people or affect the maritime environment. Some documents should be prepared that include all aspects of the decommissioning process from the cessation of operation of the structures until the final declared state is completed. Brunei operator shall refer to The Control of Major Accident Hazards Regulations (COMAH)[41]. Safety management should be considered by the operator as the field moves into its end of field life (EoFL) phase. This is also part of the operator’s submission, as part of the Decommissioning and Restoration (D&R) Notification and D&R Safety Case under the COMAH Regulations. Operators should develop the details of the selection process which includes specific project goals and values for the EoFL with approval of the authority[39].

6 TECHNICAL EXECUTION OF DECOMMISSIONING IN SOUTHEAST ASIA COUNTRIES

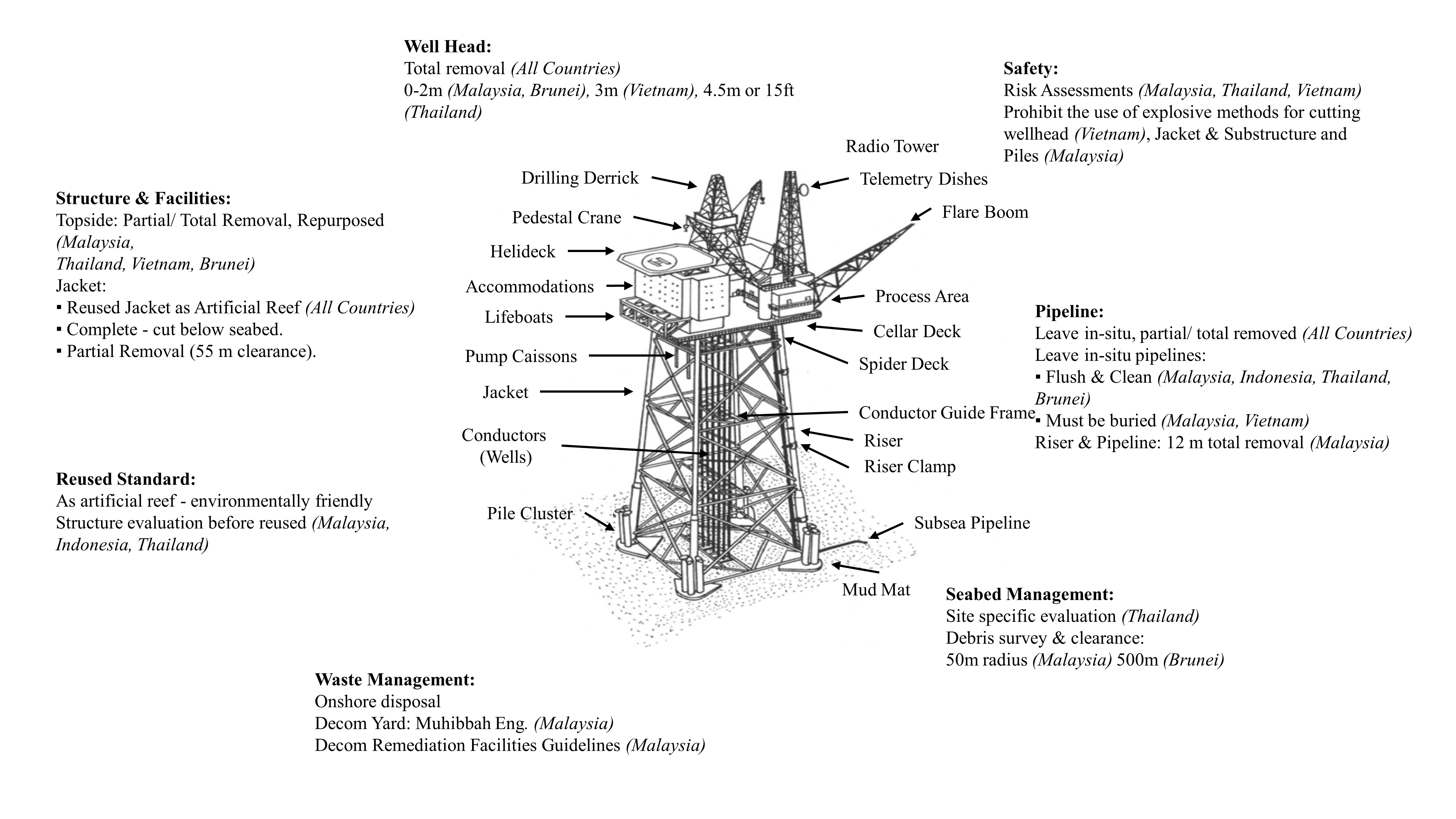

The technical execution emphasized in this paper is comprised of pipelines and associated structures, well plugging and abandonment, structures and facilities, seabed deposit management, reuse standards and waste management. The facts are sourced from the guidelines available from the respective countries and also from ASCOPE, a regional reference decommissioning guidelines in Southeast Asia Countries[22,26,38,42-44].

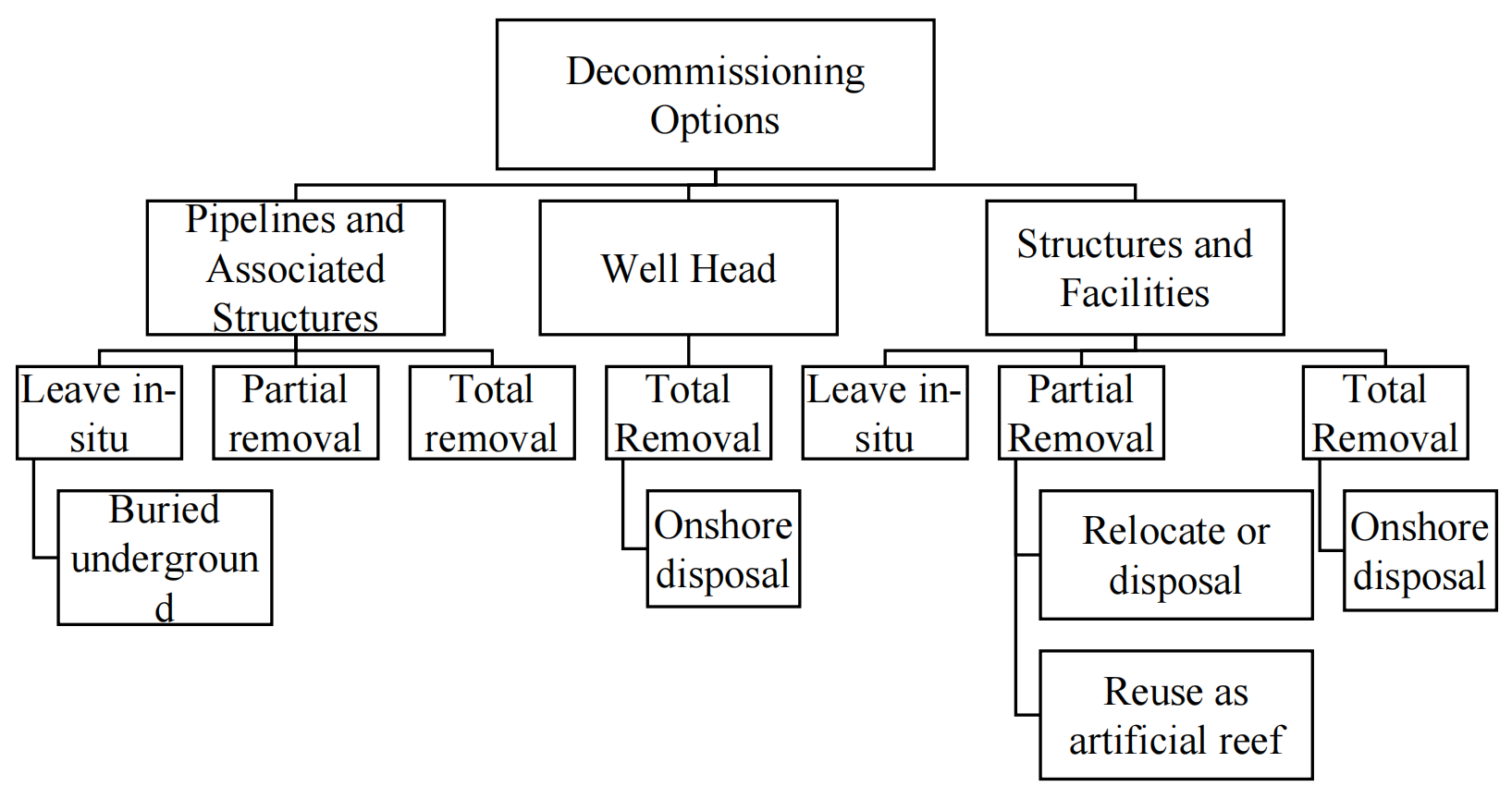

As shown in Figure 3, there are 3 decommissioning options: total removal, where the wellhead and floating pipelines are completely removed; partial removal, allowing for the relocation or disposal of structures without impacting marine activities and the environment; and leave in-situ, involving the cleaning and burial of pipelines.

|

Figure 3. Decommissioning options.

6.1 Decommissioning of Pipelines and Associated Structures

A pipeline is a system for transporting products over long distance, from production site to processing plants and consumers. Pipelines are typically buried at a certain depth below the seabed to avoid interfering with marine activities. When decommissioning pipelines, those left in place must be thoroughly cleaned to remove any hazardous substance and protect the surrounding environment. Between the years 2021 and 2030, a total of 83,000km of pipelines currently in operation are scheduled for decommissioning[45]. Malaysia has total of 10,500km of pipelines, with 38% operating beyond design life and 4% in operation for over 40 years as of March 2022[46]. The decommissioning options for pipelines in these 5 countries almost similar which are either to leave in-situ, partial or total removal. The guidelines in Malaysia, Indonesia, Thailand, and Brunei mentioned that pipelines to leave in-situ must undergo hydrocarbon flushing to ensure cleanliness, subject to approval by local authority. Additionally, the cost of fluids required for cleaning the pipelines must be taken into account, typically estimated by multiplying the pipe diameter by the length of the line[47]. In Malaysia and Vietnam, the leave in-situ pipeline must be buried underground. Malaysia specifies that pipelines must be buried at both ends at a minimum depth of 0.6m measured from the seabed to the top of the pipeline. Similarly in Malaysia, contaminated pipelines intended for be leave in-situ or reused in Thailand require verification of decontamination. PTTEP, partnership with academician, contractors and government bodies have developed a pipeline decontamination technology for decommissioning of pipelines such as decontamination chemicals (MERClean) for pipeline cleaning and Intelligent Sampling Pig (MERIns). Currently, they are working on improving the technology (MERLab)[17]. This technology has been conducted successfully in the Gulf of Thailand in 2023.

In Thailand, the techniques used for leaving in-situ pipelines is reverse installation and cutting the pipelines into large pieces in Thailand[18]. Besides the cost of fluids as mentioned above, the water depth is another significant cost factor for leave in-situ pipelines. This is due to water imposes physical limitations on the duration during which divers can safely operate. The cost statistics shown in Table 2 conclude that the deeper the water depth, the higher the decommissioning cost tends to be[47].

Table 2. Average Pipeline Decommissioning Cost in 2022[47]

Water Depth (M) |

Pipeline ($1,000/Segment) |

Pipeline (4/ft) |

<30 |

321 (119) |

31 |

30-60 |

377 (104) |

47 |

61-122 |

498 (280) |

65 |

Total removal of pipeline is the final option in Malaysia if leaving them in-situ or partial removal is not feasible, subject to PETRONAS and local authorities’ approval. In Vietnam, hanging pipelines must be removed entirely. Similarly in Brunei, pipelines located above ground level must be completely removed. Brunei emphasized that any pipeline removal should not adversely affects the marine environment and fishing activities. Additionally, inspection and soil sampling may be required in Brunei to ensuring that there is no contamination for future process[26,38,42-44].

6.2 Well Plugging and Abandonment

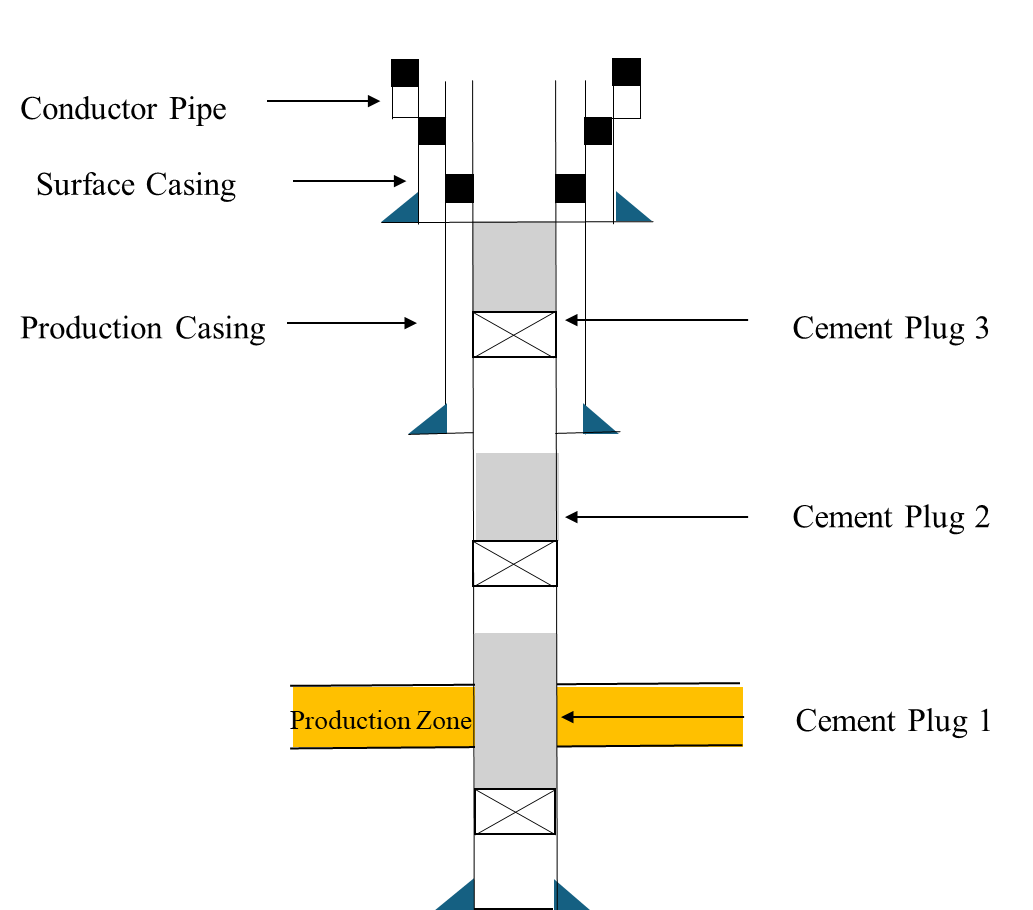

P&A of oil and gas wells is imperative for environmental protection. Abandoned wells pose a risk of fluid leakage, potentially contaminating soil, water, and marine ecosystems. P&A operations seal off the wellbore, preventing such leaks and ensuring compliance with environmental regulations. Before commencing P&A operations, thorough preparation is necessary, including reviewing well records, conducting site assessments, and obtaining permits. Subsequently, the well must be prepared by removing any remaining production equipment.

The casing is then cut at specific depths, depending on the well's condition, followed by the placement of cement plugs within the casing. These plugs prevent potential fluid leakage and safeguard the surrounding environment, particularly marine ecosystems. Once the well is properly plugged and abandoned, the site is restored to its original condition or repurposed. Throughout the process, strict adherence to safety protocols and environmental practices minimizes risks to workers and prevents adverse impacts on the environment. Additionally, ongoing monitoring and maintenance are often required to ensure the integrity of the abandoned well over time. Figure 4 illustrates the design of the P&A process.

|

Figure 4. Illustration of plug and abandonment design[48].

All 5 countries require the complete removal of wellheads, although the cutting depths vary. In Malaysia, the cutting depth ranges from 0 to 2m below the mudline, considering cutting technique and seafloor conditions. In Thailand, wellheads must be cut at a minimum 4.5m below the mudline subject to approval by the Director General[38]. Vietnam requires a minimum cutting depth of 3m below the seabed, with operators utilizing mechanical or hydraulic method for cutting.

Regarding subsea casing , Malaysia requires a minimum cutting depth of 1 meter below the seafloor and for casing to be left in-situ is subjected PETRONAS’s approval and local authorities and written verification that the location has been cleared shall be submit to PETRONAS[49]. Similar with the wellhead cutting in Thailand, the casings also shall be cut minimum at 4.5m in depth below the level of the mud line subjected to approval by the Director General[38]. In Brunei, the casing strings are to be retrieved to about 2m below the seabed. On the contrary, the depth of cutting for both wellhead and casings are not mentioned in Vietnam guidelines, but the operator is not allowed to retrieve any casings installed in the well, except with approval from Petro Vietnam (PVN).

6.3 Decommissioning of Structures and Facilities

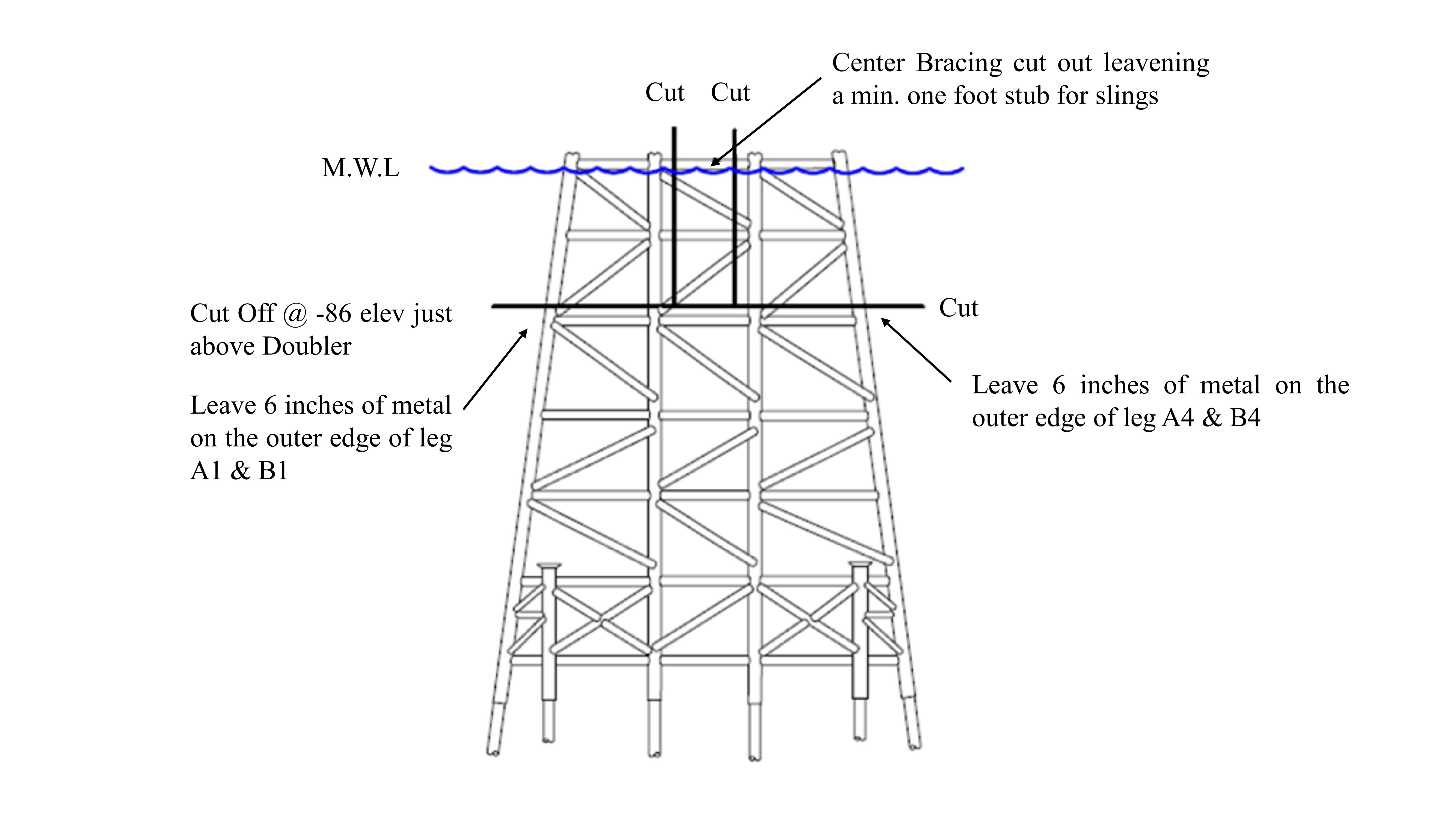

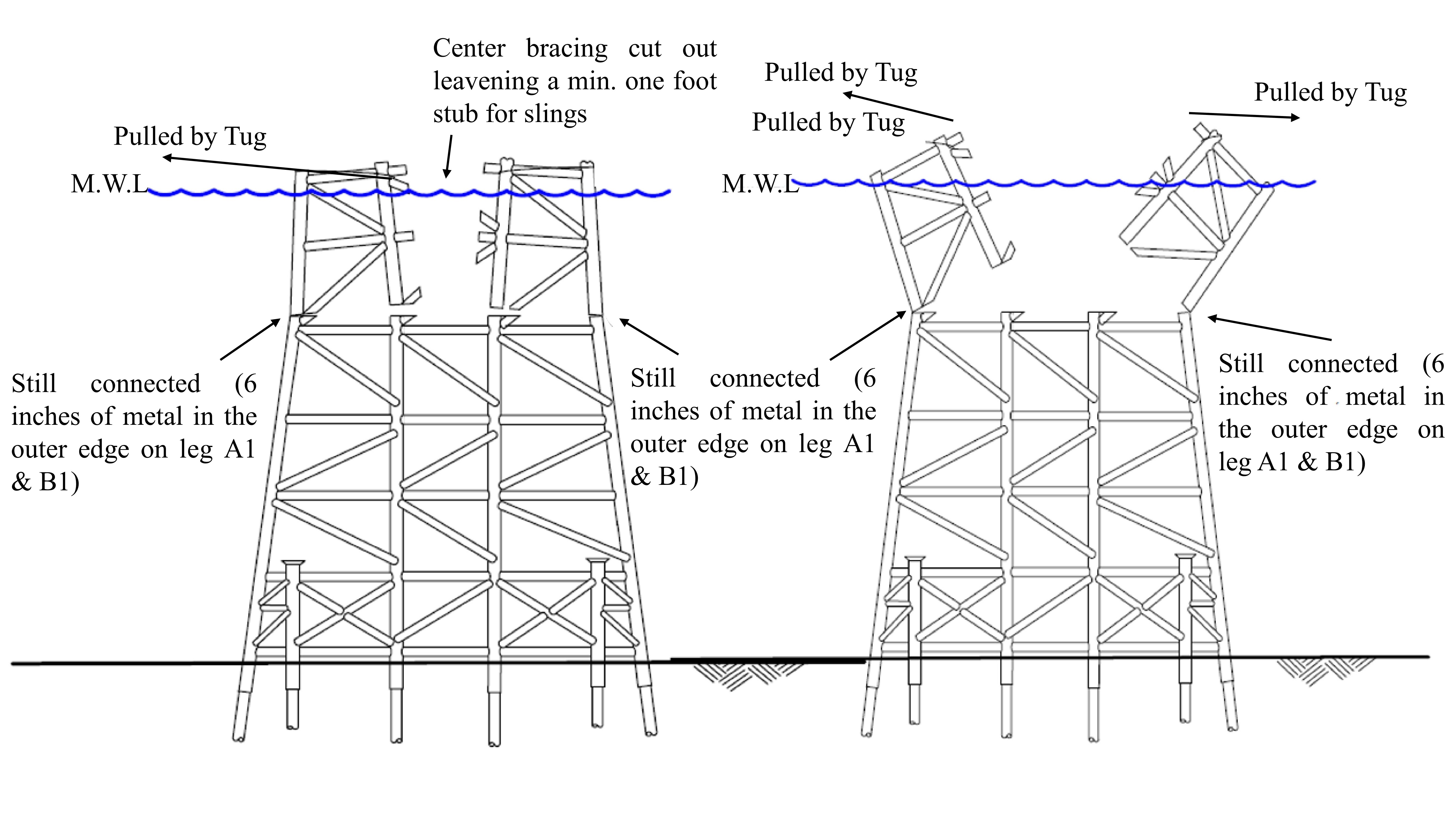

Offshore structures and facilities typically include platforms, topsides, jackets, piles, and other supporting components. Fixed platforms are commonly found in shallow waters, with the jacket serving as the main support structure. The jacket’s leg extends from the seabed to the sea surface, and piles secure it in place. The structures and facilities typically will be partial or complete removal and repurposing the structures for other used. The partial removal process described entails a systematic dismantling of the structure with a focus on minimizing time and resource usage. Initially, the removal begins with take-off the topside section of the structure. Subsequently, attention is directed towards removing the top portion of the jacket, which involves segmenting it into 2 four-pile sections. The depth at which this top section is removed varies according to the regulations of each country. Non-explosive cutting methods are then utilized to sever the jacket legs. Upon the arrival of the tug, it connects its tow line to a sling affixed to one of the jacket sections. With the tug's assistance, the section is pulled over, leading it to descend into the sea. This process is iterated for the remaining section. Such a systematic approach ensures the smooth execution of the partial removal sequence while upholding safety and environmental considerations. Figures 5 and 6 visually represent the steps involved in this process.

|

Figure 5. Partial removal process step 1[50].

|

Figure 6. Partial removal process step 2 and step 3[50].

The countries are considering reusing the jackets and topsides as artificial reefs or for other purpose. In Malaysia, jackets can be reused with a minimum clearance of 55m, while topsides must be removed[23,38,51].

Malaysia requires preparation including procedures related to cessation of production and facilities for removal, and provision for adequate temporary facilities and system[42]. Prior to removal in Thailand, all facilities must undergo cleaning and decontamination[26,38]. Factors such as safety to navigation, environmental impact, and risks associated with removal are considered when deciding whether to leave structures in place, especially deeper waters, where adherence to international law is essential[22]. In Indonesian Navy No.B/954/XI/1989, the offshore well can be abandoned at a sea depth of 300m by considering the submarine manoeuvre and sea pollution. The jacket shall be removed by lifting after the piles have been cut. The piles should be cut off below the natural seabed level with the depth level subjected to the seabed conditions[42]. For the structure weighing up to 4,000 tons in shallow water in Indonesia, the option is total removal. The substructure can be taken to the shore, buried, completely dismantled or reused for other purposes as approved by laws[26,52]. In Brunei, the operators should describe the proposed scope of work to dispose the jacket structure if there are any challenges during the disposal activities. Where jackets are to be removed, consideration needs to be given to residual protuberances on the seabed and ensuring sufficient water clearance to meet International Maritime Organisation (IMO) guidelines[39]. The explosive method as cutting tool is prohibited as mentioned in PETRONAS Basic Technical Requirement, Decommissioning of Offshore Facilities, PETRONAS[42] following Fisheries Act 1985 however the explosive can be done subject to PETRONAS and local authorities approval. Additionally, there are new studies examining the efficiency of explosives within a vacuum-sealed pile, which aim to reduce or prevent the propagation of pressure wave to harmless levels in the surrounding marine environment. This innovative approach is benefits to the decommissioning of offshore platform by substantially reducing cutting costs[53].

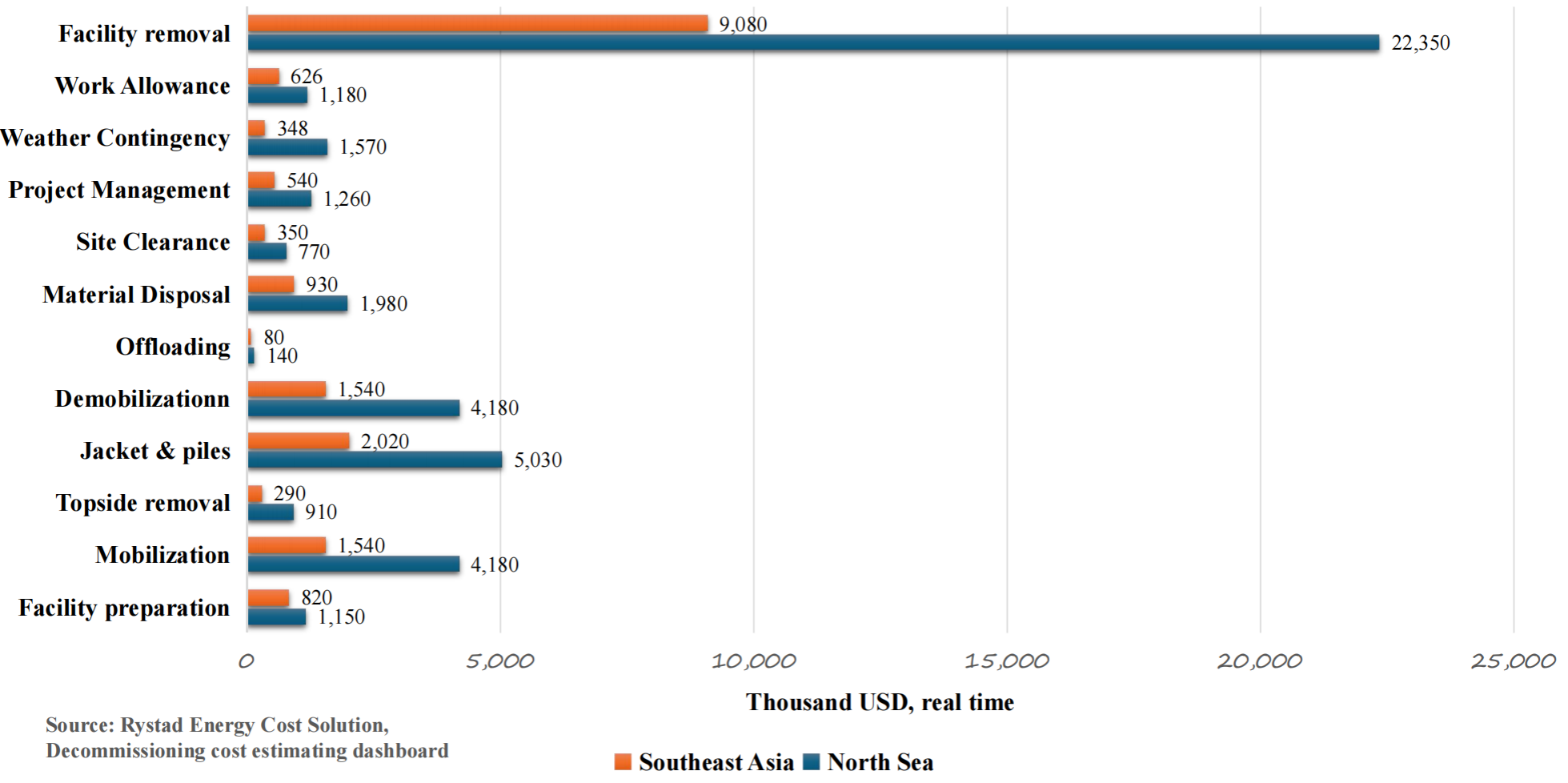

Based on Rystad Energy's recent analysis comparing two similar platforms - one in each region, situated in 60m of water depth with a topside weight of 1,500 tonnes and a jacket weight of 800 tonnes as shown in Figure 7, the projected cost of offshore platform removal, excluding subsea infrastructure, in the Southeast Asia region is less than half the cost in the North Sea. Specifically, the estimated cost is US$22.35 million in the North Sea, compared to US$9.08 million in Southeast Asia[54]. This variance in cost can be attributed to the distinct climate, regulations, and geographical locations of the respective regions.

|

Figure 7. Southeast Asia vs Northwest Europe platform removal cost.

6.4 Seabed Deposit Management

The seabed decommissioning management is not found in any technical guidelines related to decommissioning in all these 5 countries. The seabed deposit guideline under the Thailand Decommissioning Guidelines for Upstream Installations is primarily concerned with the change in sediment quality and the potential toxicological effects on marine life. Under the Brunei Decommissioning and Restoration Guidelines Volume 9 Section 2.7, the area of seabed to be considered will depend on circumstances but is typically taken within a radius of 500m from the location of the platform subject to the proposed decommissioning. For any disposal activities, where applicable, the operators should adequately describe the proposed scope of work for the safe and responsible disposal of seabed debris[39].

6.5 Reused Standards

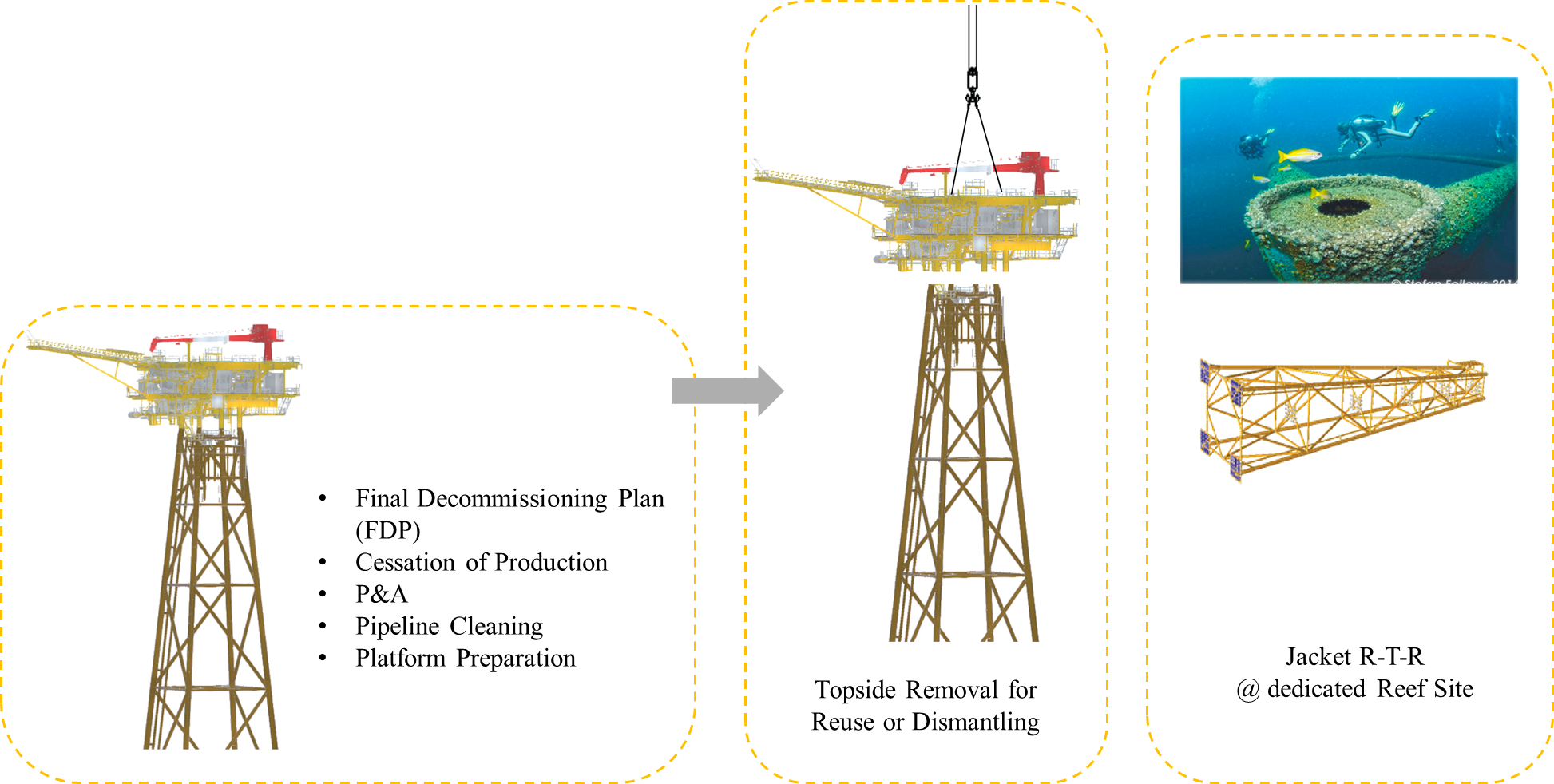

All 5 countries are exploring the idea of reusing the decommissioned structure as an artificial reef or for the other uses, which is more environmentally friendly compared to other options. Furthermore, artificial reefs provide a cost-effective alternative to the expensive process of decommissioning benefiting marine life and saving companies significant capital. According to information from an Asia-focused research website, the removal cost of an average 6,000-ton oil platform in Asia Pacific region is estimated to be around USD 35 million. However, by implementing the rig to reefs approach, this expenditure could be reduced by half, leading to average savings of nearly USD 22 million per platform[55]. Figure 8 illustrates the process of removing the topside and repurposing the jacket for rig-to-reef initiatives.

|

Figure 8. Illustration of topside removal and jacket repurposing for artificial reef[17].

The countries are contemplating the implementation of the decommissioning option for repurposing offshore structures as artificial reefs, as it has received the highest evaluation among other reuse options in a comparative assessment. Opting for the reuse of structures is also favoured due to reduced waste generation, minimal environmental impact, and fewer technical complications[16].

In Malaysia, there are few artificial reef programs was successful implemented such as BARAM-8 in 2005 and the Dana, D30 and Kapal in 2017[12]. Furthermore, Malaysia had one successful record in the reuse of a decommissioned structure as an ecotourism resort, located in the East Coast of Sabah. The refurbished oil platform was converted into a hotel, Sea Venture Dive Resort. The latest decommissioning project in Malaysia was Ophir Field Abandonment activity which is the first repurpose offshore platform to be reused for other field development project[56].

The utilization of artificial reefs has demonstrated its effectiveness in restoring marine ecosystems in Thailand. The initial deployment of artificial reefs took place near Koh Pha-Ngan, Surat Thani, where seven retired platform jackets were repurposed into artificial reefs. This initiative was made possible through the contribution of Chevron Thailand Exploration and Production Company Limited[57]. Additionally, as of December 2021, there have been 7 decommissioned topsides repurposed in Thailand[18].

Malaysia, Indonesia, and Thailand have stressed the importance of conducting evaluations to ensure the structures are suitable for reuse[22,26,38,39,58]. In Malaysia, a comprehensive condition assessment must adhere to the Structural Integrity Management of fixed offshore structures (API RP 2SIM) guidelines to ascertain the current condition of the platform. This assessment is imperative for determining the fitness for purpose before considering reuse. The proposed locations for Non-destructive Testing (NDT) must undergo review and approval by the owner. The minimum NDT inspection for existing fixed offshore structures for reuse should adhere to international standards such as Planning, Designing, and Constructing Fixed Offshore Platforms - Working Stress Design (API RP 2A) PETRONAS[58]. Prior to the decision to reuse, integrity assessment typically involves non-destructive examination (NDE). Following the NDE assessment, a technical evaluation is essential to ensure the structures and facilities are suitable for future use[38].

6.6 Waste Management

Waste produced during decommissioning can be hazardous or non-hazardous. Typically, pre-decommissioning activities generate non-hazardous waste, which can often be reused, recycled, or recovered. However, during the decontamination, dismantling, demolishing, and removal of structures, both hazardous and non-hazardous waste may be generated. The types of waste produced at each stage are listed in Table 3.

Table 3. The Type of Waste[59]

Decommissioning Stage |

Waste Type |

Pre-decommissioning |

Electrical Equipment (Main substation panel, Generator set, Fire alarms, Transformer, etc.). Chemical from chemical store, laboratory, and process area. Oil from storage tank, warehouse, and crude oil tank. |

Decontamination of Equipment & Facility |

Scheduled Waste: generated from platform inventory (hydrocarbon liquids and gases), lubricating oil recovered from rotating equipment, fluids, and sludge from the vessel, etc) Mercury from process equipment and vessels Pyrophoric material from metal scale of vessel, filter in sour service and iron sponge in sweeting unit Radioactive Materials (Naturally Occurring Radioactive Materials (NORM), Radioactive Source, Scale and Sludge) |

Dismantling, Demolishing and Removal of Equipment, Facility and Structure |

Polychlorinated biphenyls from maintenance and process area. Radioactive Materials from maintenance and process area. Packaging Waste (Cleaned used drums, Containers (plastic, metal, or glass), Bags, Carton, Boxes, Pallets, Styrofoam, Cardboard) Wooden Waste (Plywood, Chip wood and Wooden pallet) Plastic Waste (PVC plumbing pipe, PVC siding, Styrofoam insulation, Plastic sheet, Fibreglass insulation) Electrical Waste (Electrical cable, Insulation material, Transformers, Instrumentation and electrical system, Fire protection system) Domestic/Kitchen Waste (Food waste/kitchen waste, Paper waste, Used stationaries, Plastic waste - drinking bottles, packaging material, Wood waste, Glass waste, Metal waste) Clinical Waste (Human or animal tissue, blood or other body fluids, excretions, Drugs or other pharmaceutical products, Swabs or dressings, or syringes, needles, Sharp instruments of any substance, arising from medical, dental, nursing, veterinary or pathological laboratory practice) Sanitary waste (Toilets, Sewage treatment plant) |

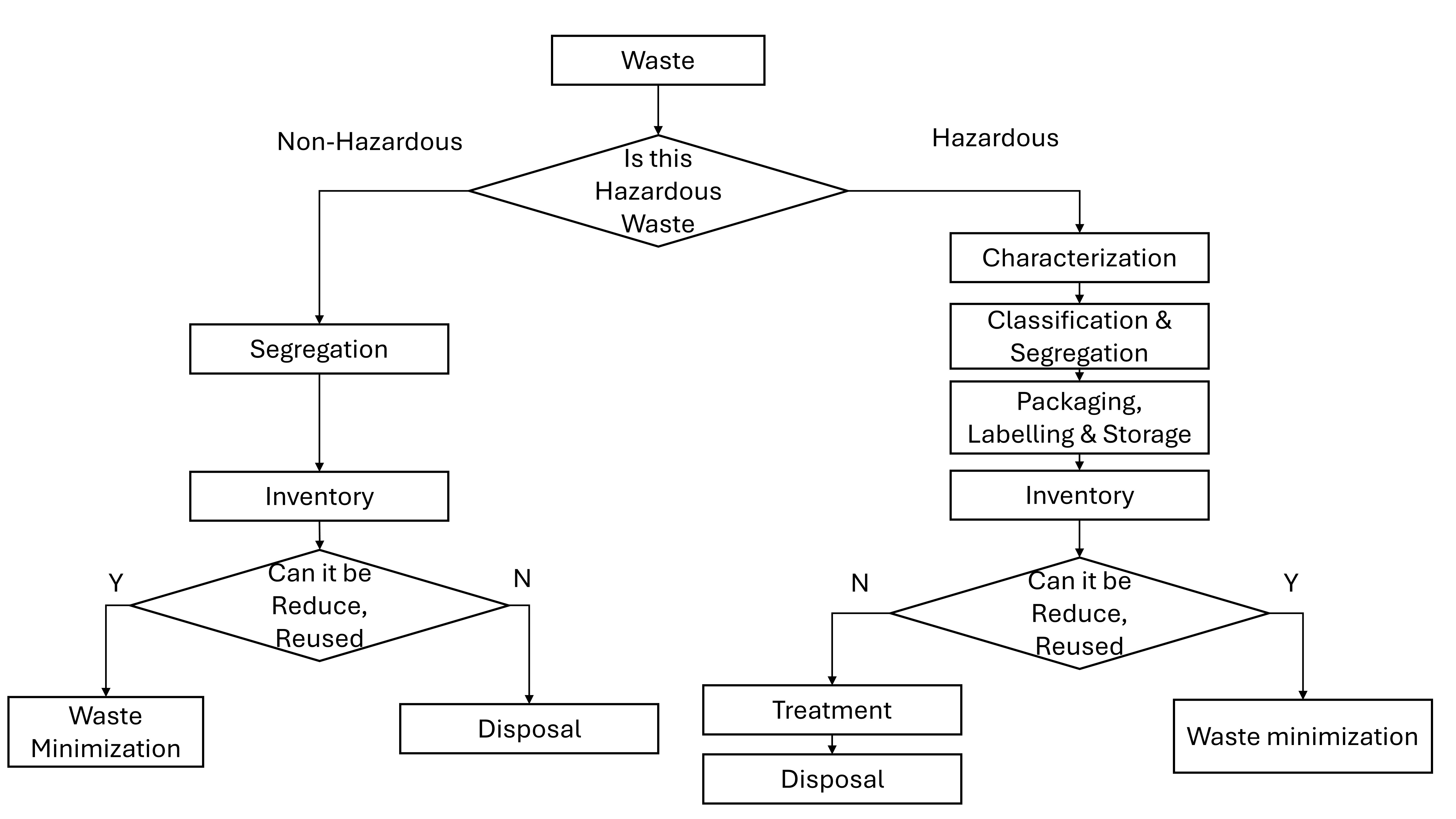

The waste management of the countries typically follows the waste hierarchy, which includes the principle of waste removal, reduction, reuse, recycling, recovery, and disposal. The processes of waste handling, minimization, and disposal decisions are illustrated in Figure 9.

|

Figure 9. Management of waste, minimization, and disposal decision[59].

Waste management options for hazardous waste mentioned in Malaysia’s PETRONAS Basic Technical Requirement (PBTR) are either recycling, treatment, or disposal at the approved site. The Scheduled Waste Regulations 2005 governs waste characterization, handling, collection, storing, transferring, transporting, treatment, and disposal. Facilities containing NORM or Low Specific Activity (LSA) material must be cleaned until they meet the acceptable NORM or LSA limit. If the NORM level is unable to be reduced even after cleaning, the equipment or facilities shall be cut, removed, transported to approved disposal yards subject to PETRONAS and local Authorities’ approval[60]. Malaysia have Muhibbah Engineering (M) Bhd, a company that provides decommissioning yard with the mission to be the preferred yard for offshore structures decommissioning, recycling, and disposal in Malaysia. The yard was designed to do the decommissioning activities for oil and gas assets besides do the remediation activities related to oil and gas assets. Muhibbah’s decommissioning yard was set up in 2018 and by 2019, Muhibbah was the only company in Southeast Asia to achieve ISO 30000:2009 certification for the recycling activities for ships, oil and gas platforms, jackets, and other related structures[61].

Indonesia has implemented several regulations concerning waste management, including regulation No.101 of 2014 for hazardous waste disposal, and Ministerial Regulation No.12 of 2020 for hazardous waste containment. Additionally, the Code of Work (Working regulation (PTK)) Oil and Gas Task Force (SKK Migas) No.005 (2018) oversees health, safety and environmental protection in upstream oil and gas activities[62]. Furthermore, PT Prasandha Pamunah Limbah Industri (PPLi), established since 1994, offers collection, recycling, treatment, and disposal service for both hazardous and non-hazardous waste in Indonesia. PPLi operates the sole hazardous waste landfill in the country, providing comprehensive waste treatment services including waste transportation, energy conversion, liquid waste treatment, and landfill service[63].

Waste management in Thailand is overseen by PTT Exploration and Production Public Company Limited, PTTEP, which operates in accordance with the regulations and laws of the countries where it conducts its activities, adhering to the waste management hierarchy. There is detailed information on storing hazardous substances. Hazardous waste must be stored in closed containers labelled in accordance with Annex 3 of the Ministry of Minerals and Fuels Notice before being transported for disposal to the licensed facility[18].

Vietnam has Circular 36/2015/T T-BTNMT, which outlines regulations for the management of Hazardous Waste[63]. Waste collection and survey shall be included in the decommissioning plan, collected, and treated as prescribed by laws in Vietnam[26]. After each collection, the operators shall take a survey of waste, to determine and garner waste generated during the collection or production process that remains on the seabed.

Meanwhile in Brunei, according to EPMO and COMAH, if any presence of radioactive materials during decommissioning activities, Radiation Order shall be complied with. The waste treatment facilities shall follow the legislative obligations under Brunei Law[39]. In addition, Environmental Protection and Management Act No.32 of 2009, Chapter 7 Clause 60 of Indonesia states that it is illegal to dump waste or any other substances into the environment. In Clause 61, the Minister of Environment, the Governor, or Mayor is the authorized party for the dumping permit approval.

7 SAFETY MANAGEMENT IN SOUTHEAST ASIA COUNTRIES

Safety management is a critical aspect of the oil and gas sector, given the inherent risks involved in its operation. According to data from the U.S Bureau of Labor, accidents involving workers in the industry are increase. With the growing number of risks, effective safety management becomes imperative. It is essential for all oil and gas companies to implement robust safety management systems to enhance workplace safety and minimize the occurrence of accidents. The safety management is required in Malaysia according to PETRONAS standards and other internationally acceptable standards. Similar goes for Thailand, Vietnam, and Brunei[28,38,39,44]. Indonesia does not clearly define safety management in the Code of Work (PTK) Oil and Gas Task Force SKK Migas[22]. The risk assessment shall be conducted in Malaysia, Thailand, and Vietnam to identify all the risks before, during and after decommissioning activities to ensure mitigation controls are identified to eliminate and minimize harm to people, environment, and assets[27,38,40]. In addition for Thailand, it is stated that the risk activities must be properly managed and reduced to the as-low-as-reasonably-practicable[38]. In Vietnam, all the safety-related documents shall be included in Decommissioning Plan following the Vietnam’s Law and submit to PVN and MOIT to ensure decommissioning activities carry out safely[64,65]. In addition, during the dismantling of the wellhead platform, Vietnam guidelines specify the explosive materials shall not be used for cutting for safety reason[28]. Interestingly, Malaysia PBTR specify for jackets substructures, piles, and other appurtenances: non-explosive method shall be used as cutting tools, but not mentioned for the wellhead.

8 POST DECOMMISSIONING IN SOUTHEAST ASIA COUNTRIES

Post-decommissioning marks the concluding phase of decommissioning operation. It entails three primary requirements: site clearance, submission of a close-out report, and environmental monitoring. The oil and gas company must clear all obstruction from the seabed within the specified radius before submitting the close-out report. This report should comprehensively outline the decommissioning program. Environmental monitoring is essential to verify that the environmental condition surrounding the oil and gas production platform remains favourable.

Malaysia requires to submit 4 reports upon completion of the decommissioning activities, which are Survey Verification Report, Post Environmental Report, Disposal Report and as-built drawings or documents. The post environmental survey report shall be submitted within 1 month from the date of accomplishment of decommissioning[40,42] and for Indonesia, the close out report have to submit to the Directorate General within 14 days[24]. The structures that have been decommissioned will be reported in the form of Shipping Notice and Indonesian Seaman News and also published in the Sea Map of Indonesia, which is released by the authorized bureau[66]. The Close Out Report contains 2 stages: decommissioning and post-decommissioning. The submission of the first stage report follows the accomplishment of decommissioning activities. Meanwhile, the second stage report to be submitted once the post-decommissioning monitoring is completed[38]. Within 9 months of the decommissioning in Vietnam, it is required to submit an Environmental Monitoring Report to the MOIT. The report shall include assessments of the effects of the decommissioning, residual effects of entire decommissioning and natural resilience of the environment. Post decommissioning monitoring results shall be included in the report on completed petroleum installation decommissioning[26]. Malaysia and Brunei implemented a Monitoring Program for post decommissioning. The monitoring program depend on the current conditions, however it will change with time, if necessary. An inspection report is also required and must be presented to the Authority with proposals for any maintenance needed. Malaysia, Thailand, and Brunei emphasize the importance of maintaining a clean and safe environment. Removal of debris and site clearance are requiring and it must be ensured that there are no obstacles that can affect people, marine environment and surrounding ecosystem[23,38,39]. In addition, in Thailand the verification are also required by using side scan sonar for ROV[18].

9 COMMON DECOMMISSIONING PRACTICES BETWEEN FIVE SOUTHEAST ASIA COUNTRIES

In the oil and gas industry, decommissioning plays an important role in ensuring the safe and efficient conclusion of operation. Southeast Asia countries navigate a complex landscape of regulatory requirements and operational protocols when it comes to decommissioning offshore structures and facilities. Understanding the common practices and shared challenges among these nations is crucial for stakeholders in the industry. Before starting decommissioning, Malaysia follows to PETRONAS standards, needing an environmental impact assessment, a management plan, data, and a decommissioning options assessment for approval. Indonesia requires a WP&B submission 3 to 5 years before decommissioning. Thailand uses a BPEO as a tool to pick decommissioning options, considering impact, health, safety, feasibility, and cost. Vietnam requires an environmental report in its plan, while Brunei needs a submission covering cessation to decommissioning end, including monitoring. Early planning for decommissioning is crucial. It assesses options, costs, time, and environmental factors, involving stakeholders through consultations.

After planning and approval stages, the technical execution of decommissioning can start, including pipelines and structures, well plugging and abandonment, structures, and facilities removal. Regarding decommissioning options for pipelines and structures, all countries consider leaving them in-situ, partial removal, or total removal, except for Indonesia which not mentioned in any document. Malaysia, Thailand, Vietnam, and Brunei allow partial or total removal as well as reuse as artificial reef of structures and facilities. However, Indonesia lacks specific technical guidelines in this regard. A comparative study on the cost analysis for decommissioning options revealed that the leave in-situ removal option incurred a cost of $18,560,200, while the complete removal option totalled $106,364,400, and the partial removal option amounted to $64,610,800. Among these options, the leave in-situ removal option emerged as the least costly. Consequently, opting for leaving in-situ demonstrated the most favourable outcome[67]. Table 4 provides a breakdown of the decommissioning option costs.

Table 4. Comparative Cost Analysis of Decommissioning Options[67]

Cost ($) |

Leave in Place |

Total Removal |

Partial Removal |

Engineering and Planning |

699,200 |

1,398,400 |

1,398,400 |

Permitting and Regulatory Compliance |

|

380,000 |

760,000 |

Platform Preparation |

600,000 |

1,200,000 |

1,200,000 |

Plugging and Abandonment |

12,121,200 |

12,121,200 |

12,121,200 |

Conductor Severing and Recovery |

3,029,400 |

3,029,400 |

3,049,400 |

Mobilization/Demobilization |

500,000 |

12,000,000 |

12,000,000 |

Platform and Structural Removal |

|

48,675,000 |

23,482,000 |

Pipeline and Power Cable Decommissioning |

550,000 |

550,000 |

550,000 |

Materials Disposal |

|

23,450,000 |

10,050,000 |

Site Clearance and verification |

1,060,400 |

1,060,400 |

|

Shell Mounds |

|

2,500,000 |

|

Navigation Aids |

|

|

|

Total Cost |

18,560,200 |

106,364,400 |

64,610,800 |

Seabed deposit management is not discussed in guidelines for Malaysia, Indonesia, Vietnam, and Brunei. In Thailand, the guidelines focus on change in sediment quality and potential toxic substance affecting marine life. In terms of reusing offshore structures, Malaysia, Indonesia, and Thailand highlight the need for assessments to ensure structures are in good condition. Waste management approaches in these countries are similar, following the waste hierarchy principles. All countries develop an almost similar waste management plan to determine the best disposal options for decommissioning. The waste must be handled according to the laws and regulations of each country. All countries require a safety management system. In addition, Malaysia, Thailand, and Vietnam have an additional requirement to conduct the risk assessment. All countries are required to submit close out report except for Brunei which is not mentioned in any document.

The comparison in decommissioning requirements for Southeast Asia are summarised in Table 5 and the summary on technical execution of decommissioning in Southeast Asia are shown in Figure 10.

Table 5. Comparison in Decommissioning Requirements for Southeast Asia

|

|

Malaysia |

Indonesia |

Thailand |

Vietnam |

Brunei |

|

Financial |

Cessation Fund (Since 1998) - contribute to by operators |

Post Operation Fund - contribute to by operators |

Financial Security by individual or combination |

Financial Guarantee Fund - set up by Operator |

Cost estimation by Duty Holders |

Pre-decommissioning |

Decommissioning Plan |

Yes |

3-5 years prior to execution schedule |

2-5years prior (dependent on remaining reserves) |

Yes |

Yes |

Comparative Assessment |

Yes - DOA |

NA |

Yes - BPEO |

NA |

Yes |

|

Environmental Appraisal |

Yes |

NA |

Yes |

Yes |

NA |

|

HSE Risk Assessment |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Technical Execution |

Well Plugging & Abandonmen |

Yes |

Yes |

Yes |

Yes |

Yes |

Structure & Facilities |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Pipelines & Associated Structures |

Yes |

NA |

Yes |

Yes |

Yes |

|

Seabed deposit management - Site specific evaluation |

NA |

NA |

Yes |

NA |

NA |

|

Seabed deposit management - Debris survey & clearance |

Yes |

NA |

NA |

NA |

Yes |

|

Safety - risk assesment |

Yes |

NA |

Yes |

Yes |

NA |

|

Safety - prohibit the explosive use |

Yes - Jacket & substructure and piles |

NA |

NA |

Yes - cutting wellhead |

NA |

|

|

Reused Standard - Artificial reef |

Yes |

Yes |

Yes |

Yes |

Yes |

Reused Standard - Structure evaluation |

Yes |

Yes |

Yes |

NA |

NA |

|

Waste Handling |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Post decommissioning |

Close out report |

Yes - 1 month |

Yes - 14 days |

Yes - 12 months |

Yes - 9 months |

NA |

Monitoring program |

Yes |

|

Yes |

|

Yes |

|

Figure 10. Summary on technical execution of decommissioning in Southeast Asia.

10 CONCLUSION

The paper review study the decommissioning landscape in Malaysia, Thailand, Indonesia, Vietnam, and Brunei, conducting a comparative analysis of decommissioning practices and guidelines. The paper gathered, compiled, reviewed, and compared existing information on decommissioning legislation, guidelines, and practices. Malaysia refers to technical documents from PETRONAS, primarily the PPGUA, last amended in 2013. Thailand has a decommissioning legal framework established through amendments to the Petroleum Act 1971. Vietnam revised the 1994 Law on Petroleum in 2015 to align the legislation with UNCLOS. In Brunei, the Decommissioning and Restoration Guidelines for Onshore and Offshore Facilities were implemented in 2009.

The study focuses on specific components for comparing decommissioning regulation including the legal framework, financial framework, pre-decommissioning, technical execution (covering pipelines and associated structures, well plugging and abandonment, structures, and facilities), seabed deposit management, reuse standards, waste management, safety management, and post-decommissioning. We observed that decommissioning practices are similar across the countries. Thailand stands out slightly due to more detailed regulations and greater decommissioning experience.

There are notable gaps in the decommissioning regulation of these 5 countries, as they lack regional regulations specific to decommissioning and depend only on guidelines and technical standards. In contrast to the Gulf of Mexico, Southeast Asia countries have limited knowledge and experience in offshore decommissioning. The absence of clear regulation and limited of experience result in unclear decommissioning plan. Furthermore, there is insufficient research in the impacts of decommissioning activities on marine life.

The anticipated rise in the number of offshore structures nearing the end of their operational life until 2040 signifies a substantial forthcoming market within the decommissioning sector. Consequently, Southeast Asian countries must proactively prepare to address this impending wave, ensuring that decommissioning activities are meticulously planned. Sustained collaboration among stakeholders and industry participants is crucial to enhancing the effectiveness of decommissioning efforts. The perspectives and input of these stakeholders are invaluable during the early stages of planning and development.

Acknowledgements

The authors would like to acknowledge the support of project SEELOS 1920\1\111, which is supported by Engineering X, an international collaboration funded by the Royal Academy of Engineering and the Lloyd’s Register Foundation under the Safer End of Engineered Life [Grant number: 015MC0-023].

Conflicts of Interest

The authors declare no conflict of interest.

Author Contribution

NA Zawawi was responsible for conceptualization, FE Hashim, W Punurai, LT Huyen, S Amelia and S Suherman were responsible for methodology, MS Liew, LE Shawn, and OB Yaakob were responsible for validation, NA Kamarudin responsible in writing - original draft preparation, NA Zawawi, FE Hashim, OB Yaakob, A Kr. Dev, J Wang, and KU Danyaro were responsible for review and editing. All authors have read and agreed to the published version of the manuscript.

Abbreviation List

ASCOPE, ASEAN council on petroleum

ASR, Abandonment and site restoration

BPEO, Best practicable environmental option

COMAH, Control of major accident hazards

D&R, Decommissioning and restoration

DOA, Decommissioning options assessment

DOE, Department of environment

EEZ, Exclusive economic zone

EoFL, End of field life

EPMO, Environmental protection and management order

EQA, Environmental quality act

IMO, International Maritime Organisation

LSA, Low specific activity

MOIT, Ministry of Industry and Trade

NDE, Non-destructive examination

NDT, Non-destructive testing

NORM, Naturally occurring radioactive material

P&A Plugging and abandonment

PBTR, PETRONAS Basic Technical Requirements

PMO, Peninsular Malaysia Operation

POD, Plan of development

PPGUA, PETRONAS procedures & guidelines for upstream activities

PSC, Production sharing contactor

PCBs, Polychlorinated biphenyls

PTK, Working regulation

PVN, PetroVietnam

PPLi, Prasandha Pamunah Limbah industri

UNCLOS, United Nations Convention Law of the Sea

WP&B, Work plan & budget

References

[1] ASEAN Council on Petroleum (ASCOPE). ASCOPE Decommissioning Guidelines (ADG) for Oil and Gas Facilities. 2012.

[2] Nåmdal S. Decommissioning of Offshore Installations. Climate and Pollution Agency, Oslo, 2011. Available at:[Web]

[3] Zainai AI. SPEKL Technical Forum @ SOGSE Decommissioning of Oil & Gas Facilities - Challenges, Opportunity & Way Forward. SPE Kuala Lumpur 2022. Accessed 13 September 2021. Available at:[Web]

[4] Wood M. Offshore decommissioning in Asia Pacific could cost US$100 billion. Accessed 15 June 2022. Available at:[Web]

[5] Gabriel P, Eduardo C. The Coming Decommissioning Wave in Southeast Asia: What to Expect and the Relevance of Experiences in the North Sea and U.S Gulf of Mexico. Accessed 15 June 2022. Available at:[Web]

[6] Parente V, Ferreira D, dos Santos EM et al. Offshore decommissioning issues: Deductibility and transferability. Energ Policy, 2006; 34: 1992-2001.[DOI]

[7] Na KL, Lee HE, Liew MS et al. An expert knowledge based decommissioning alternative selection system for fixed oil and gas assets in the South China Sea. Ocean Eng, 2017; 130: 645-658.[DOI]

[8] Sommer B, Fowler AM, Macreadie PI et al. Decommissioning of offshore oil and gas structures–Environmental opportunities and challenges. Sci Total Environ, 2019; 658: 973-981.[DOI]

[9] Royal Academy of Engineering (RAE) WP1A SEELOS Project, WP1A Report: Review of the Current Offshore Decommissioning Plans, Practices, Incidents, Limitations and Guidelines for Baseline Data Collection. 2023.

[10] Offshore Decommissioning Market Report. Available at:[Web]

[11] Ahmad SS. SPEKL Technical Forum Decommissioning of Oil & Gas Facilities - Challenges, Opportunity and Way Forward, 2022. Available at:[Web]

[12] Zawawi NAWA, Liew MS, Na KL. Decommissioning of offshore platform: A sustainable framework. In 2012 IEEE Colloquium on Humanities, Science and Engineering (CHUSER). Kota Kinabalu, Malaysia, 03-04 December 2012.[DOI]

[13] Zawawi NA. Decommissioning in Malaysia, Thailand, Vietnam, Indonesia and Brunei: Comparison of Decommissioning Guidelines 2020. Available at:[Web]

[14] Amelia S, Rarasati AD, Santos AJ. Universuum of Institutional Development for Post Production Offshore Platform Decommissioning in Indonesia. Int J Bus Stud, 2020; 4: 1-7.[DOI]

[15] Bambang ES. Implementaion of Abandonment and Site Restoration (ASR) in Upstream Oil and Gas Business Activities in Indonesia. In 3rd International Seminar on “Challenges and Opportunities in Offshore Decommissioning in South East Asia and Beyond”. Thailand, Bangkok, 2022.

[16] Nugraha RBA, Basuki R, Oh JS et al. Rigs-To-Reef (R2R): A new initiative on re-utilization of abandoned offshore oil and gas platforms in Indonesia for marine and fisheries sectors. Earth Env Sci, 2019; 241: 012014.[DOI]

[17] Rittichai S. The Challenges of Offshore Facilities Decommissioning and Environmental Management. In 3rd International Seminar on "Challenges and Opportunities in Offshore Decommissioning in South East Asia and Beyond". PTT Exploration and Production. 2022.

[18] Kamkaew K. Knowledge-Sharing Best Practices for Dealing with Hazardous Wastes from Offshore Thailand to Final Disposal (Part 1). Seminar on “Waste Management Challenges and Strategies for Decommissioned Offshore Structure in ASEAN” May 2022.

[19] Bui Mt, Nguyen Hm. Determinants affecting profitability of firms: A study of oil and gas industry in Vietnam. J Asian Financ Econ, 2021; 8: 599-608.[DOI]

[20] Le HT, Liao JX, Spray CJ. Decommissioning planning of offshore oil and gas fields in Vietnam: what can be learnt from mine closure planning in Scotland?. Int J Energ Econ Policy, 2021; 11: 162-174.[DOI]

[21] Vara V. Ca Tam Oil Field-Oil and gas news, data and in-depth articles on offshore projects, exploration and decommissioning and the trends driving technology and innovation. Available at:[Web]

[22] SKK Migas. Code of Work of Oil & Gas Task Force (PTK SKK Migas) No.40 of 2018 about Abandonment and Site Restoration (ASR). Jakarta, Indonesia, 2018.

[23] PPGUA. PETRONAS Procedures and Guidelines for Upstream Activities Decommissioning Guidelines. 2006.

[24] Laister S, Jagerroos S. Different routes-same destination: planning processes for decommissioning in South East Asia. SPE Symposium: Decommissioning and Abandonment. Kuala Lumpur, Malaysia, December 2018.[DOI]

[25] Beckstead D. Lessons from Thailand on the Importance of Devising and Implementing Detailed Decommissioning Regimes. Oil, Gas & Energy Law, 2018; 16.[DOI]

[26] The Prime Minister of Government. Decision No.49/2017/QD-TTg Prime Minister on removal of installations, equipment and facilities serving petroleum activities. 2017. Available at:[Web]

[27] The Prime Minister of Government. Decision No.41/1999/QD-TTg of the Prime Minister promulgating the regulation on safety control in petroleum activities. 1999. Available at:[Web].

[28] The Prime Minister of Government. Decision No.04/2015/QD-TTg, petroleum operational safety management. 2015. Available at:[Web]

[29] The Prime Minister of Government. Decision No.37/2005/QD-BCN, on promulgation of the regulation on maintenance and abandonment of oil and gas wells. 2005. Available at:[Web]

[30] The Prime Minister of Government, Integrated document No.10/VBHN-BCT, on promulgating the regulation on preservation and abandonment of petroleum grilling wells. 2014. Available at:[Web]

[31] Petroleum Mining Act, Laws of Brunei Chapter 44 Petroleum Mining Act Revised Edition. 2002. Available at:[Web]

[32] Petroleum (Pipe-lines) Act, Laws of Brunei Chapter 45 Petroleum (Pipe-Lines) Revised Edition 1984. Available at:[Web]

[33] Territorial Waters of Brunei Act, Laws of Brunei Chapter 138 Territorial Waters of Brunei Act 9 Revised Edition 2002. Available at:[Web]

[34] Land Code (Strata) Act, Laws of Brunei Chapter 189 Land Code (Strata) S 29/99 Revised Edition 2000. Available at:[Web]

[35] Hazardous Waste (Control of Export Import and Transit) Order, 2013. Available at [Web]

[36] Fam ML, Konovessis D, Ong LS et al. A review of offshore decommissioning regulations in five countries–Strengths and weaknesses. Ocean Eng, 2018; 160: 244-263.[DOI]

[37] Minister of Energy and Mineral Resources, Regulation No.15 Post Operation Activities of Oil and Gas. 2018.

[38] Petroleum Institute of Thailand. Draft Thailand Decommissioning Guidelines for Upstream Installations. 2009.

[39] Ministry of Energy and Industry. Brunei Darussalam Decommissioning and Restoration Guidelines for Onshore and Offshore Facilities. 2018.

[40] PETRONAS, PETRONAS Technical Standard HSE Management for Decommissioning of Facilities PTS 18.70.06. 2019.

[41] The Control of Major Accident Hazards Regulations (COMAH). 2015. Available at:[Web]

[42] PETRONAS. PETRONAS Basic Technical Requirement Decommissioning of Offshore Facilities. 2018.

[43] Guidelines for Decommissioning, Abandonment and Restoration of the Oil and Gas Industry Assets in Brunei Darussalam. 2009.

[44] Ministry Of Energy Brunei Darussalam. 14 March 2022; Available at:[Web]

[45] Christian de los Reyes Ullevik. Are we entering a decade of offshore decommissioning? Accessed 2024 February 15. Available at:[Web]

[46] Raja Yeop RA. Upstream Decommissioning Framework in Malaysia: From the Regulator's Lens. in 3rd International Seminar Challenges and Opportunities in Offshore Decommissioning in South-East Asia. Bangkok, Thailand, 2022.

[47] Kaiser MJ. New statistical data can help pinpoint pipeline decommissioning costs. 2023. Available at:[Web]

[48] Asyri M, Mulia K. Study of microfine cement use on squeeze cementing operations in plug and abandonment work.E3S Web of Conferences. EDP Sciences, 2018; 67: 03001.[DOI]

[49] PETRONAS, PETRONAS Basic Technical Requirement Plug and Abandonment of Wells. 2018.

[50] SNYDER T. State of The Art of Removing Large Platforms Located in Deep Water. Available at [Web]

[51] Jagerroos S, Kayleigh H. Emerging Decommissioning Trends in South East Asia:-Local Interpretation and Implementation of Recently Updated Legislative Framework and Guidelines. SPE Symposium: Decommissioning and Abandonment. 2019: D022S014R002.[DOI]

[52] Desrina R, Anwar C, Susantoro TM. Environmental Impacts Of The Oil And Gas Platform Decommissioning. Sci Contrib Oil Gas, 2013; 36: 97-103.[DOI]

[53] Zawawi NAWA, Danyaro KU, Liew MS et al. Environmental Sustainability and Efficiency of Offshore Platform Decommissioning: A Review. Sustainability-Basel, 2023; 15: 12757.[DOI]

[54] Sottilotta S. North Sea Decommissioning Costs Estimated as Double Those in SE Asia -Rystad Energy compared the decommissioning costs based on two similar steel platforms, one in each region, using its cost-estimating tool. Accessed 16 February 2024. Available at:[Web]

[55] Network O. Asia Pacific Decommissioning and Abandonment Outlook released 2023 Accessed 15 February 2024. Available at:[Web]

[56] Mohd Kamil MB. First Re Purpose Platform through Decommissioning Activity. Offshore Technology Conference Asia. Kuala Lumpur, Malaysia, November 2020.[DOI]

[57] Chevron Global, Artificial Reefs Converted from Retired Platform Jackets proven to help restore Thai marine ecosystems. 2022: 2001-2024 Chevron Corporation. Available at:[Web]

[58] PETRONAS. PETRONAS Technical Standard of Offshore Refurbished Structures PTS11.03.07. 2017.

[59] PETRONAS. PETRONAS Technical Standard of Waste Management PTS 18.72.01. 2018.

[60] PETRONAS. PETRONAS Basic Technical Requirement PETRONAS Decommissioning Remediation Facilities Guideline. 2019.

[61] Muhibbah Engineering (M) Bhd. Visit by "Safe and Sustainable Decommissioning of Offshore Structure Taking into Consideration the Peculiarities of the ASEAN & South Asia Regions" (SEELOS) Project Delegation to Muhibbah Engineering (M) Bhd. 2023.

[62] Law of The Republic of Indonesia No.32 Concerning Protection and Management of Environment. 2009.

[63] Le HT. Waste Management Facilities in ASEAN and South Asia region 2020. Available at:[Web]

[64] Lam Son Joint Operating Company. Kế hoạch thu dọn mỏ Y (Decommissioning Plan for Y Field), Lam Son Joint Operating Company. 2017.

[65] PVEP POC, PetroVietnam Domestic Exploration Production Operating Company Limited. X Field Abandonment Plan. 2015.

[66] Ministry of Connectivity. Regulation No.129 of 2016, Clause 73(3) and 75(3). 2016.

[67] Ogbeide PO, Omoregbee I. Cost Analysis of Decommissioning Process of Offshore Structure: A Comparative Study for Removal Options. J Energ Technol Env, 2023; 5:2.[DOI]

Copyright © 2024 The Author(s). This open-access article is licensed under a Creative Commons Attribution 4.0 International License (https://creativecommons.org/licenses/by/4.0), which permits unrestricted use, sharing, adaptation, distribution, and reproduction in any medium, provided the original work is properly cited.

Copyright ©

Copyright ©