The Relationship Between Chief Financial Officer Gender and Investment Efficiency

Omid Farhad Touski1

1Department of Accounting, Khorramabad Branch, Islamic Azad University, Khorramabad, Iran

*Correspondence to: Omid Farhad Touski, PhD, Assistant Professor, Department of Accounting, Khorramabad Branch, Islamic Azad University, Tehran Road, Khorramabad, 6817816645, Iran; E-mail: farhadi_omid58@yahoo.com

DOI: 10.53964/mem.2024019

Abstract

Objective: This study aims to examine the relationship between the gender of the chief financial officer (CFO) and the efficiency of corporate investment, especially over-investment.

Methods: The independent variable is the gender of the CFO and the dependent variable is over-investment. The research method is correlation type and multivariate regression using panel data with a logistic regression model approach. The data of manufacturing companies in the Tehran Stock Exchange has been collected from 2017 to 2021.

Results: The findings of the research show that the presence of a female financial manager is significantly related to the reduction of the company's over-investment level, so gender plays a role in the economic decision-making and investment of companies.

Conclusion: Female chief financial managers are more risk-averse compared to male chief financial managers and consider the interests of shareholders in the company’s economic decisions. Therefore, companies should pay special attention to gender diversity at the level of company managers in making decisions and economic investments.

Keywords: gender of CFO, investment efficiency, over-investment

1 INTRODUCTION

Although women always make up more or less half of the members of society, in the field of decision-making, women’s access to jobs and management positions has not been equal to the small increase in their participation in the labor market, and they still do not have a colorful presence in the field of positions of power in companies. Few women can reach the top management level. Although this situation exists in all developed and developing countries, the intensity of gender inequality is much greater in developing countries. Despite the advantages of the presence of female managers in companies, especially in developing countries[1]. Most past research shows that when making financial decisions, female Chief Financial Officers (CFOs) are less bold, less aggressive, less self-confident, and therefore more cautious and more ethical than male CFOs[2-8]. CFOs have an influential position in companies and their position is after the chief executive officer (CEO) and they are the financial stewards of the company[9]. As can be seen, financial managers have a colorful role in companies. According to this issue, the focus of empirical research is on the issue that female financial managers are influential in the accounting and financial decisions of companies and in companies with female financial managers, compared to companies with male financial managers, decisions will be different regarding financial issues and Accounting. For example, previous research shows that there is a positive relationship between the use of conservatism in financial reporting and the presence of female financial managers in companies[10], lower-cost loans and contracts with more favorable terms, have lower debt levels[11], there is a low probability that they manipulate profits[12,13] and are more cautious in evaluating studies and financing projects[6]. In the research conducted by[14], we did not find evidence that shows that the gender of senior financial managers has a direct effect on discretionary accruals. Although the findings of most of these studies show that female financial managers can help improve company performance, the research in this field is still limited, and the results are also different.

The work area of financial managers is in the financial and accounting departments of a company and they continuously monitor and manage the activities of the financial and accounting department. Compared to other senior managers of the company, they have the most direct influence on all financial and accounting decisions[9,14]. They oversee matters such as internal control, financial reporting, budgeting, and current and capital expenditures of the company[9,15,16]. The role of financial managers is not only to supervise the accounting circle and the financial reporting process, but they are also influential in making strategic decisions for the company[17-20]. There is a view that they play a central role in guiding CEOs and boards of directors in the company’s investment decisions[16,21,22]. Therefore, the present study expands the research literature on CFO gender by examining whether CFO gender affects the firm’s investment choices and outcomes, i.e., firm over-investment.

Theoretically, Meckling and Jensen[23] suggest that information asymmetry may lead to a conflict of interests between managers and shareholders, which leads to deviation from the optimal level of investment, i.e. investment inefficiency. Investment inefficiency is divided into two categories. When the company invests in a project and the net present value of that project is negative, it is called overinvestment. Sometimes the company has enough financial resources and invests in projects whose net present value is positive, which is called underinvestment. The decisions that the company makes about investment can reflect the risk-taking or risk-aversion of the managers[6,24]. Overconfidence in senior managers can lead to overinvestment in the firm, which will have a negative impact on investors[6,25,26]. Some managers tend to exaggerate in estimating the returns of future investment projects and estimate the probability of failure as low as possible, which are characteristics of overconfident managers[27,28]. According to agency theory, the reason for managers’ willingness to overinvest is actually to gain personal benefits. Personal interests that lead to large corporate empires[23,29,30]. Therefore, self-serving managers are more likely to overinvest when they can access abundant domestic financing sources that are obtained from external capital markets[25]. If they are not well monitored by investors and corporate governance mechanisms, self-serving managers may sub-optimally invest corporate capital to pursue personal gains at the expense of the firm’s long-term value[31-34]. However, because managers typically have superior information about the firm’s operating performance and prospects than outsiders, diversified investors have limited ability to monitor and discipline managerial misconduct[24,35,36]. In this research, instead of the gender diversity of CEOs and other senior managers, the focus is on the gender of senior financial managers, because as mentioned in the previous literature, financial managers usually manage and supervise the accounting and financial departments of the company. Therefore, there is a direct relationship between them and the financial decisions of the company because they have the greatest impact on the accounting and financial decisions of the company[9,14].

The purpose of this research is to provide a descriptive and empirical analysis of the importance of the gender of senior financial managers as a measure of corporate governance and corporate over-investment as a measure of investment efficiency. A lot of research has been done on this issue and researchers have used different criteria to examine corporate governance. Undoubtedly, the relationship between the gender of the CFO and corporate over-investment is one of the most important issues to investigate. However, early research was mainly descriptive and focused on developed countries. As a result, the lack of empirical studies examining the relationship between the gender of senior financial managers and corporate over-investment of companies operating in developing countries is felt. In this regard, the research background points to a gap in which the gender of senior financial managers has a different effect on corporate over-investment. To address the existing gap in the accounting and auditing background, this research raises the question of what is the significance of the relationship between the gender of senior financial managers and corporate over-investment as a measure of investment efficiency. Therefore, this research aims to cover the existing gap by examining the relationship between the gender of senior financial managers and corporate over-investment. In accordance with previous research, in this research, to measure the independent variable of the gender of senior financial managers, the two-dimensional index of zero and one was used, and to measure the dependent variable of corporate over-investment, the Richardson model[37] was used.

This research contributes to the growing volume of theoretical foundations of the subject in two ways. First, it extends to research that examines how the personal characteristics of financial managers influence the firm’s investment choices. Previous research on corporate investment focused mainly on firm- and market-level factors and generally treats all executives other than the CEO as a homogeneous group. Financial managers are very important due to their position and responsibilities in the company. They have become the most important senior managers other than CEOs and directly supervise the company’s accounting and financial functions[9]. Therefore, this research focuses on the performance and value of financial managers. By examining the gender of financial managers, this research expands the perspective of what drives a firm’s investment performance. This research is the first research that identifies and measures the effect of the gender of senior financial managers on investment efficiency at the company level. Second, the findings of the research expand the theoretical foundations of gender diversity in the company’s senior management teams. Although women make up almost half of the total workforce in companies, they are still underrepresented in many powerful positions in companies[10]. Research findings show that increasing gender diversity in senior executive teams can help move companies away from risky policies and shareholder profits. Although most empirical research on CEO gender supports the conclusion that female executives outperform their male counterparts and are likely to act in the interests of shareholders, research in this area is still limited and results are mixed. Thus, more research on this issue is necessary. The present study strengthens this cause by showing evidence that the inclusion of female CFOs among senior managers has beneficial effects on investment behavior at the firm level. Thirdly, its scientific achievement can provide useful information to company managers to avoid over-investment by including women as financial managers.

The continuation of the article is compiled as follows. The second part examines the theoretical foundations and background of the research and presents the hypothesis of the research. The third part explains the methodology, research design, and data selection methods. Experimental results are reported and discussed in the fourth section. The fifth section provides conclusions and final remarks.

2 LITERATURE REVIEW AND HYPOTHESES DEVELOPMENT

The results of the conducted research show that there is a positive and direct relationship between individual characteristics and their decision-making and judgment, and individual characteristics can shape their decisions. Based on this, the decisions made in companies can show the individual characteristics of managers[38]. Previous research shows that gender can affect corporate decisions because the attitude to risk and ethical standards are different in men and women, and this difference can affect managerial behavior[8]. The findings of most empirical studies show that in important decisions and problems, women are usually less risk-taking than men, and as a result, they act more cautiously in making decisions. Cohen et al.and Riley Jr and Chow[39,40] found that women tend to be less risk-taking than men. According to gender theory, some studies show that women are more cautious than men in identifying and measuring income and assets and require higher verifiability standards for gains than losses[8,10]. Other research shows that women choosing retirement options[2,41-43] and common stock portfolios act more conservatively. Barber and Odean[3] and Fehr-Duda, De Gennaro, and Schubert[44] found that women were less likely to be overconfident in financial decisions. Huang and Kisgen[6] argue that female managers are generally less confident than male managers in important financial decisions of the company. The findings of Ho et al.[8] show that conservatism in financial reporting is more prevalent in companies with female CEOs than in companies with male CEOs. Faccio, Marchica, and Mura[45] state that companies with female CEOs have lower leverage, lower earnings volatility, and higher chances of survival. Gul, Srinidhi, and Ng[46] provide evidence that the stock prices of firms with female directors on the board consistently convey more information. Adams and Ferreira[47] and Chen, Eshleman, and Soileau[48] found that boards with female directors have been shown to provide better supervisory performance. Other research shows that female directors are associated with improved earnings quality[49] and future firm performance[50]. Some research has also shown that men and women have different attitudes to moral principles during evaluation[8,51,52]. Bernardi and Arnold Sr.[53] found that female managers in five of six major accounting firms had higher ethical standards than their male counterparts. Cumming et al.[7] state that female senior managers are less likely to engage in securities fraud. Other research shows that women also follow tax reporting regulations more than men[54-56]. In addition, the findings of B. Francis et al.[57] regarding gender and corporate tax decisions show that male CFOs are more aggressive than female CFOs. Due to the increasing emphasis on the role of financial managers in recent decades, the gender influence of financial managers on the accounting and a financial decision of the company have attracted the attention of researchers. However, the research in this field is still very limited and the research results are not conclusive. Barua et al.[12] found that female financial managers are less likely to manipulate earnings than male financial managers, but Ge et al.[14] found no evidence that the gender of CFOs has a direct effect on the quality of accruals. Huang and Kisgen[6] argue that female financial managers are more cautious in evaluating education and financing projects. B. Francis et al.[58] found that companies with female CFOs usually receive loans at a lower price and contracts with more favorable terms. B. Francis et al.[10] found that female financial managers are more conservative in financial reporting. Gupta et al.[13] state that female financial managers are less likely to be involved in false financial reporting. Schopohl et al.[11] provide evidence that female financial managers are more effective in reducing the level of corporate debt. Evidence that women are more risk-averse, conservative, and cautious than men in identifying income and assets comes from relevant theories in psychology, finance, and accounting. Although most findings show that more cautious and risk-averse CFOs can benefit the accounting and financial decision-making of firms, research is still needed to answer whether CFO gender is a relevant factor in decision-making and firm performance[10].

An investment decision is a decision taken by a company to spend its funds in the form of specific assets to obtain future profits[59]. Over-optimal investment occurs when firms invest in projects with a negative net present value, while suboptimal investment occurs when firms abandon projects with a positive net present value[60]. Corporate investment has long been an important topic in the accounting and finance literature, as investment efficiency is a key driver of growth (at the macroeconomic level) and returns for investors (at the firm level)[36]. By adapting the theory of Tobin[61] with the neoclassical interpretation, many researchers believe that the Q ratio is the only driver of the company’s capital investment policy[36]. According to this theory, companies tend to invest in a new project until the marginal benefits of this investment equal the marginal costs. Managerial overconfidence has an important impact on corporate investment policies[6,25,26]. For example, Malmendier and Tate[25] Malmendier and Tate[62] and Yue Liu and Taffler[63] show that managers’ overconfidence and the sensitivity of corporate investment are there. Sautner and Weber[64] and Ben-David, Graham, and Harvey[65] state that the overconfidence of senior managers in various company decisions, from the word investment, is influential. A manager who overestimates his ability usually expects a higher-than-average payment rate and assumes a low discount rate for a one-period project[27,66,67]. Overconfidence leads managers to believe that they are in control of outcomes and underestimate the likelihood of failure[27,28,68]. The manager and shareholders usually have the same goal of maximizing shareholder wealth, but the interests of both parties may differ. This conflict creates the problem of representation. Therefore, both over-investment and under-investment create agency problems. According to agency theory, the utility functions of investors and managers are different: investors seek the maximum return on a profitable investment with minimum risk; while top managers try to maximize the sphere of power and influence of an organization or individuals[69-71]. Top managers often believe that their rewards, such as compensation, prestige, power, and job satisfaction, can be enhanced by managing and controlling a growing firm[69,72]. This agency conflict between investors and top managers can lead to excessive abuse of managerial discretion and over-investment policies[73,74]. Thus, over-investment may result from top managers wanting to enjoy the personal benefits associated with building large corporate empires[23,29,30]. Narcissistic managers who overestimate their control over outcomes and underestimate the probability of failure, motivated by empire-building ambitions, tend to continue investing even after all projects with positive net present value have been completed[6,75]. The inflow of external financing from the capital market allows overconfident managers to invest more, thereby increasing investment deviations[25]. If these managers are not well monitored by external investors and internal controls, they are likely to over-invest for private gain rather than act in the best interest of investors. These value-destroying projects have an asymmetric impact on managers and investors. When investments have negative results, opportunistic managers may manipulate financial disclosures to hide bad news and increase firm performance to avoid personal losses[34].

The efficiency of corporate investment is a key factor for corporate growth and return on investment for investors[36]. Corporate investment decisions are typically made by the senior executive team[76,77]. Financial managers are a key leader who, in addition to being responsible for the company’s financial and accounting affairs are also involved in the company’s strategic planning and decision-making. Financial managers are also able to interact with board members and the CEO due to acquiring sufficient financial and strategic knowledge[6,18]. Financial managers oversee financial reporting and internal controls, as well as the company’s budgeting and spending (investment and operating expenses)[9,15,16]. They are responsible for collecting data, performing analysis, and making recommendations to the CEO and the board of directors. They are second only to CEOs in terms of hierarchy and, therefore, CFOs work closely with CEOs and the board of directors[9]. They have financial expertise in identifying and evaluating potential investment projects and are in a unique position to implement investment decisions. Therefore, CFOs are expected to play an essential role in the senior management team in guiding CEOs and the company in the company’s investment strategy[16,21,22]. Due to the increasing focus on the role of financial managers, researchers have begun to study the impact of financial managers on corporate investment strategy. Yin Liu et al.[16] found that companies with CFOs on the board have significant improvements in the company’s investment efficiency and operational performance. Ferris and Sainani[21] found that influential CFOs can increase the likelihood of mergers and acquisitions (M&A) and improve shareholder value for firms during M&A. Ginesti et al.[22] state that the personal characteristics of financial managers can affect the research and development (R&D) investments of the company. Hoitash et al.[9] show that firms with a CFO are associated with lower investment and a lower level of external financing (through equity and debt issuance). Yin Liu, Neely, and Karim[78] found that female CFOs were significantly associated with a reduction in the firm’s level of over-investment, thereby protecting investors’ long-term interests. Considering the limited amount of research in this field, more research is needed to understand the potential influence of CFOs on corporate investment.

According to the background of the research and to achieve the goals of the research and answer the research questions, the following hypothesis is formulated:

Hypothesis 1 (H1). There is a significant relationship between female senior financial managers and corporate over-investment.

3 METHODOLOGY

3.1 Data and Sample Selection

This study’s initial sample consists of all firms listed in Tehran stock exchanges from 2017-2021. Following prior studies and to ensure the representativeness and accuracy of the research data, financial firms were excluded from the sample due to their different investment choices and accounting data, and samples with missing data were excluded.

After the exclusions and data matching, the final sample consisted of 685 firm year observations, representing 137 firms on the Tehran Stock Exchange for the period 2017-2021. In this paper, CFO characteristic data were collected manually from the annual reports, and financial and other data were collected from the Tehran Stock Exchange database. All continuous variables are winsorized at the 1st and 99th percentiles to reduce outliers.

3.2 Regression Model

To investigate the relationship between the independent and dependent variables of the research, a multivariate regression model used the panel method. The model used in the multivariate regression method to test the hypothesis is formulated as follows.

|

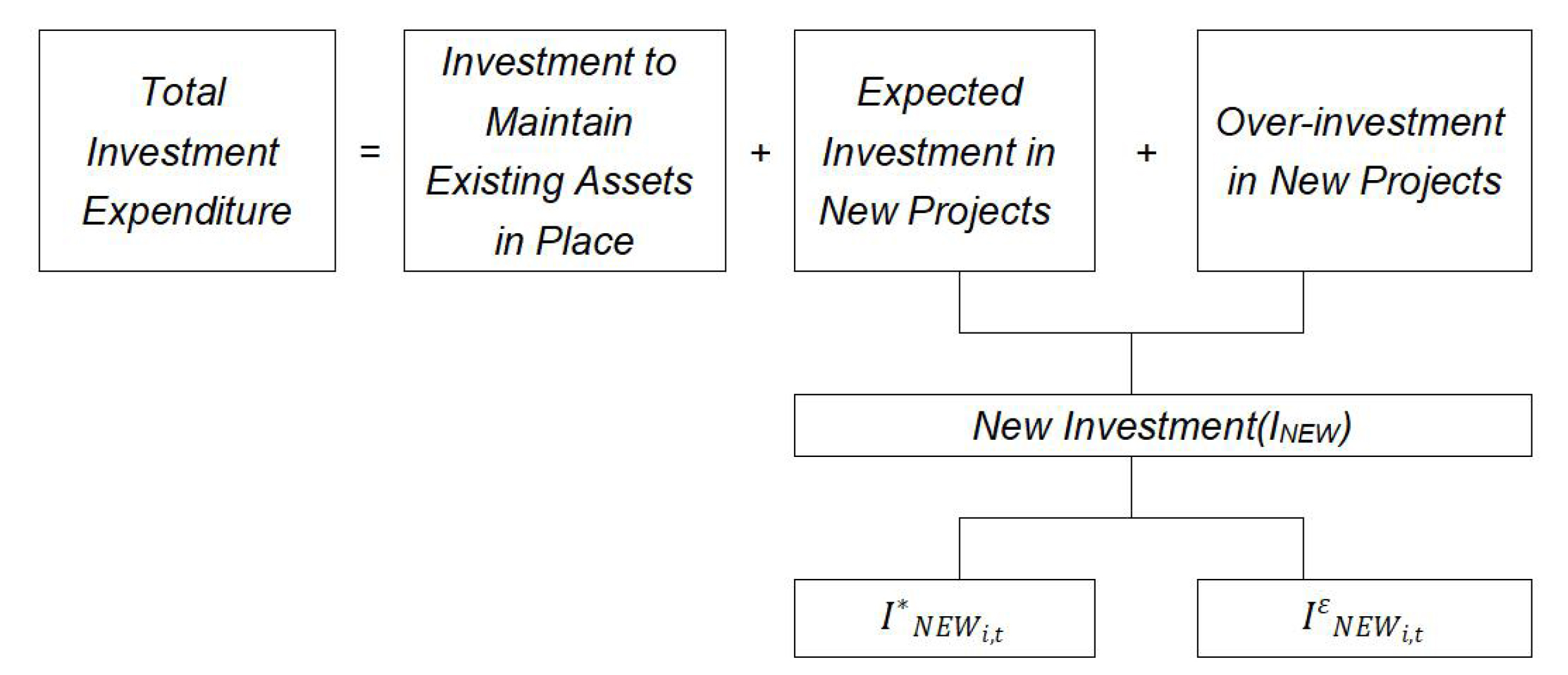

Dependent variable - corporate overinvestment (![]() ): Generally, two models are used to measure investment efficiency. One was presented by Vogt (1994)[79] using the interaction between cash flows and investment opportunities (Tobinʼs Q). The second one was presented by Richardson (2006)[37]. Richardson (2006)[37] decomposes total investment expenditure (ITOTAL) into two components: (1) investment required to maintain assets (IMAINTENANCE) and (2) expected investment in new projects (INEW). Total investment expenses include the sum of capital expenses, research and development expenses, and education expenses minus the proceeds from the sale of property, machinery, and equipment.

): Generally, two models are used to measure investment efficiency. One was presented by Vogt (1994)[79] using the interaction between cash flows and investment opportunities (Tobinʼs Q). The second one was presented by Richardson (2006)[37]. Richardson (2006)[37] decomposes total investment expenditure (ITOTAL) into two components: (1) investment required to maintain assets (IMAINTENANCE) and (2) expected investment in new projects (INEW). Total investment expenses include the sum of capital expenses, research and development expenses, and education expenses minus the proceeds from the sale of property, machinery, and equipment.

|

![]() : Total investment; CAPEXi,t: Capital expenditure; ACQi,t: Acquisition costs; RDi,t: Research and development expenses; SalesPPEi,t: Income from the sale of property, machinery and equipment.

: Total investment; CAPEXi,t: Capital expenditure; ACQi,t: Acquisition costs; RDi,t: Research and development expenses; SalesPPEi,t: Income from the sale of property, machinery and equipment.

The investment required to maintain assets is estimated by depreciation and expiration costs. The investment required in new projects is measured as the difference between the total investment expenditure and the investment required to maintain the asset. The required investment in new projects is then decomposed into expected investment expenditures in new projects with a positive net present value (![]() ) and unexpected (abnormal) investment expenditures (

) and unexpected (abnormal) investment expenditures (![]() ). Therefore, following Richardson (2006), the following regression is used to estimate the firmʼs new investment:

). Therefore, following Richardson (2006), the following regression is used to estimate the firmʼs new investment:

|

The fit value of model (2) measures the expected investment expenditure in new projects with a positive net present value ![]() . The residual (unexplained part) of the model (2) is the overestimation of corporate investment,

. The residual (unexplained part) of the model (2) is the overestimation of corporate investment, ![]() . If the residual of the model is positive, it indicates overinvestment, and if it is negative, it indicates underinvestment. The control variables of the model (2) include growth opportunities (BTM), corporate leverage (Leverage), cash retention at the company level (Cash), natural logarithm of company age (LnFirmAge), company size (Size), stock return (StockReturn) and New investment last year (

. If the residual of the model is positive, it indicates overinvestment, and if it is negative, it indicates underinvestment. The control variables of the model (2) include growth opportunities (BTM), corporate leverage (Leverage), cash retention at the company level (Cash), natural logarithm of company age (LnFirmAge), company size (Size), stock return (StockReturn) and New investment last year (![]() ). Also, industry-fixed effects and year-fixed effects are considered in the model (2) to control industry and year-specific shocks to company investment. To measure over-investment, the values of positive errors are chosen, and the number is one, and negative errors are set equal to zero. Figure 1 shows overinvestment and underinvestment.

). Also, industry-fixed effects and year-fixed effects are considered in the model (2) to control industry and year-specific shocks to company investment. To measure over-investment, the values of positive errors are chosen, and the number is one, and negative errors are set equal to zero. Figure 1 shows overinvestment and underinvestment.

|

Figure 1. Overinvestment and underinvestment (Richardson, 2006).

|

Independent variable - gender of CFO gender: is an indicator variable. If the CFO in year t and for the company i is a woman, the number is one, and otherwise, it is zero.

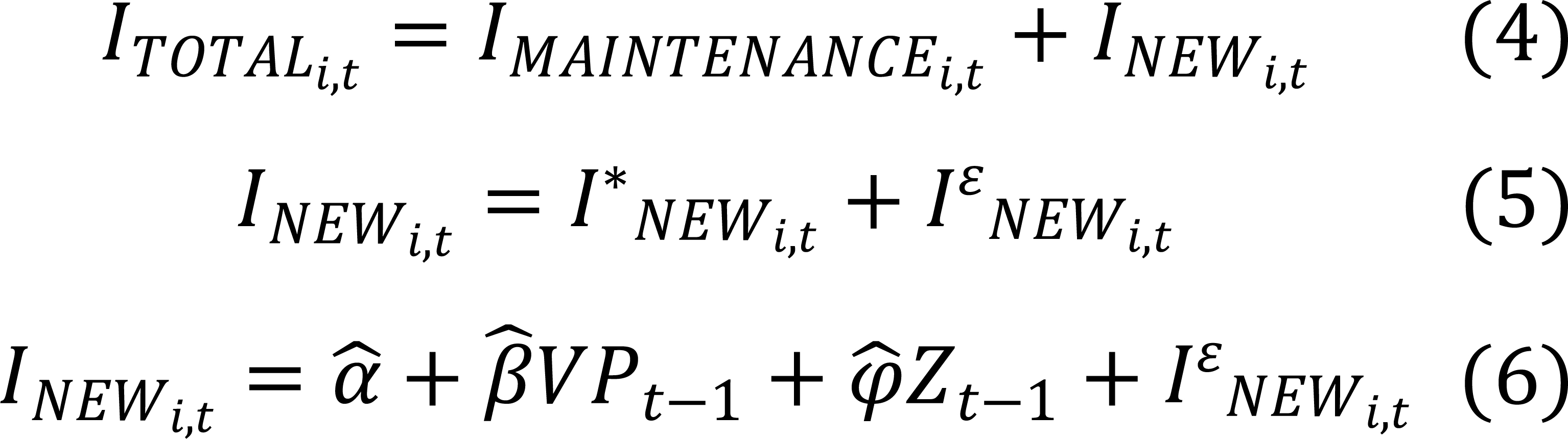

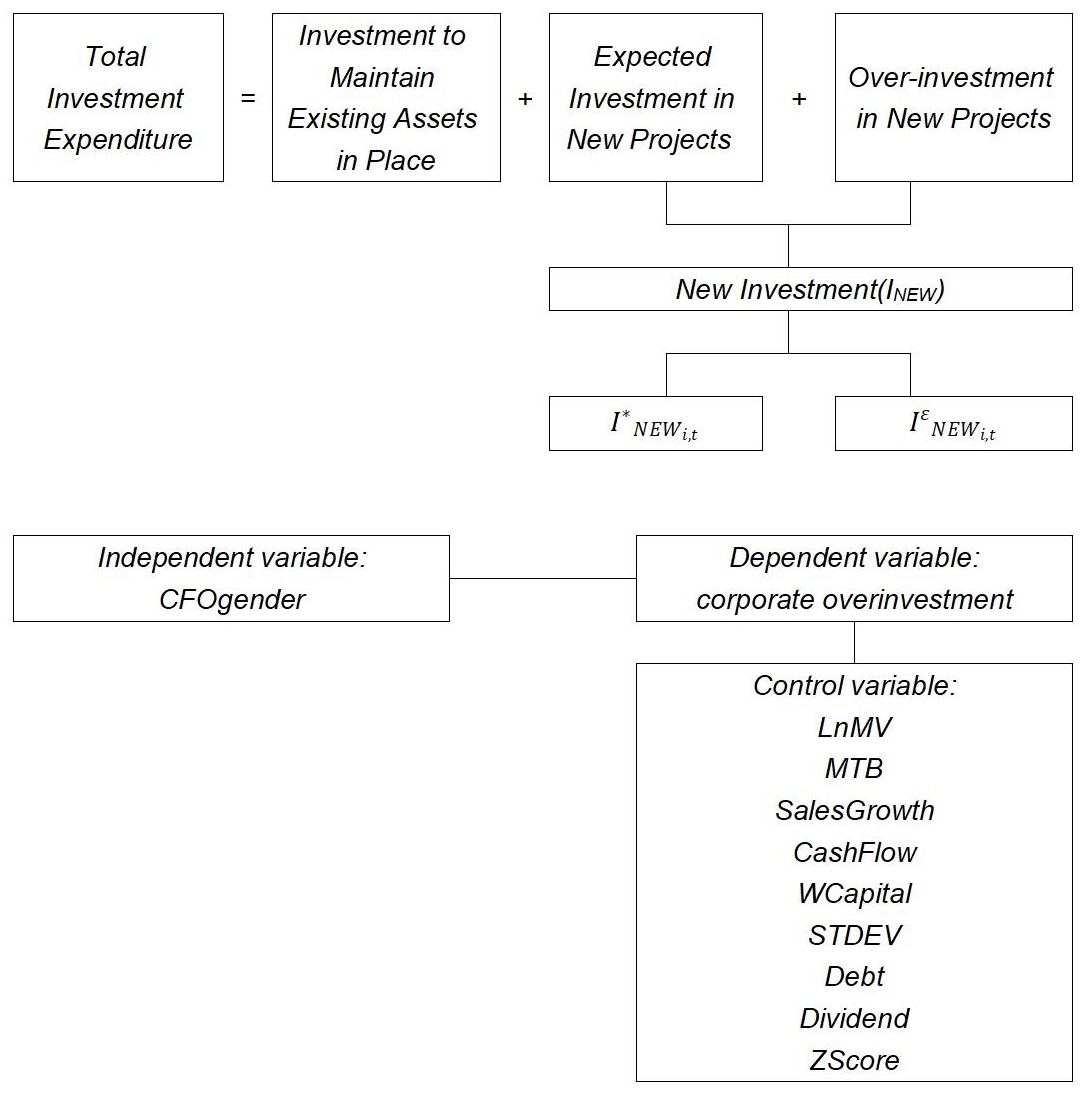

Control variable: based on previous research, a set of company-level variables that influence the over-investment of companies has been used as control variables[37,80-85]. The control variables related to the company’s investment opportunities are: the company’s market value (LnMV), the ratio of market value to the book value (MTB), and sales growth (SalesGrowth), the control variables related to the company’s financial crisis are: operating cash flows (CashFlow), net working capital ratio (WCapital), standard deviation of cash flow (STDEV), offering new debt (Debt), dividends paid (Dividend) and risk of financial bankruptcy (ZScore). Figure 2 shows the relationship between the variables.

|

Figure 2. Conceptual Model of Research.

4 EXPERIMENTAL RESULTS

4.1 Descriptive Statistics

Table 1 shows some concepts of descriptive statistics for the statistical sample of the research. The average over-investment by companies is 0.584, which shows that 58.4% of companies have over-investment. The average value of female CFO is equal to 0.147, which shows that 14.7% of companies have a female senior financial manager. Almost 92.8% of companies have paid dividends and 43.6% of companies have issued debt. The average value of the company’s market value, sales growth, operating cash flow, market value to book value ratio, cash flow fluctuation, net working capital ratio, financial bankruptcy risk, 15.429, 0.419, 0.538, and 6.033 respectively. 0.097, 0.196, and 6.419.

Table 1. Descriptive Statistics

|

Variable |

Mean |

Median |

Max |

Min |

S.D |

1 |

IεNEW |

0.584 |

1.000 |

1.000 |

0.000 |

0.493 |

2 |

CEOgender |

0.147 |

0.000 |

1.000 |

0.000 |

0.355 |

3 |

LnMV |

15.429 |

15.408 |

18.419 |

12.828 |

1.620 |

4 |

SalesGrowth |

0.419 |

0.339 |

1.353 |

-0.212 |

0.423 |

5 |

CashFlow |

0.538 |

0.547 |

0.879 |

0.159 |

0.205 |

6 |

MTB |

6.033 |

3.687 |

22.913 |

1.038 |

5.811 |

7 |

STDEV |

0.097 |

0.070 |

0.301 |

0.006 |

0.084 |

8 |

WCapital |

0.196 |

0.205 |

0.581 |

-0.229 |

0.218 |

9 |

Debt |

0.436 |

0.000 |

1.000 |

0.000 |

0.496 |

10 |

Dividend |

0.928 |

1.000 |

1.000 |

0.000 |

0.258 |

11 |

ZScore |

6.419 |

4.123 |

23.685 |

0.817 |

6.027 |

4.2 Correlation

With the results of the correlation test, we examined the basic relationship between the variables (univariate analysis) and, according to the results of Table 2, we can say that there is a relationship between the variables, and we can investigate these relationships more closely. To calculate the correlation coefficient of research variables, the Pearson correlation coefficient is used. There is a positive correlation of 0.209 between the CFO gender and the over-investment of the company, with a significance of less than 1%, which shows that the over-investment of the company is also higher in companies where the CFO is a woman. The correlation coefficients between all independent variables are small (with a maximum of 0.646), which indicates the absence of a collinearity problem. Also, the variance inflation factor (VIF) of independent and control variables is within the permissible limit (less than 10) and therefore there is no collinearity. All research variables (based on the generalized Dickey-Fuller test) are at the significance level.

Table 2. Pearson Correlation Matrix

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

VIF |

1 |

1.00 |

|

|

|

|

|

|

|

|

|

|

|

2 |

-0.21*** |

1.00 |

|

|

|

|

|

|

|

|

|

1.10 |

3 |

-0.11*** |

-0.27*** |

1.00 |

|

|

|

|

|

|

|

|

1.55 |

4 |

0.11*** |

-0.21*** |

0.42*** |

1.00 |

|

|

|

|

|

|

|

1.32 |

5 |

-0.16*** |

0.12*** |

-0.28*** |

-0.22*** |

1.00 |

|

|

|

|

|

|

3.36 |

6 |

0.15*** |

-0.17*** |

0.38*** |

0.30*** |

0.13*** |

1.00 |

|

|

|

|

|

2.22 |

7 |

0.18*** |

-0.06 |

0.18*** |

0.14*** |

-0.17*** |

0.13*** |

1.00 |

|

|

|

|

1.07 |

8 |

0.12*** |

-0.07* |

0.23*** |

0.20*** |

-0.65*** |

0.03 |

0.18*** |

1.00 |

|

|

|

1.89 |

9 |

0.17*** |

0.05 |

-0.16*** |

-0.17*** |

0.18*** |

-0.13*** |

-0.08** |

-0.11*** |

1.00 |

|

|

1.09 |

10 |

-0.2*** |

0.04 |

0.11*** |

-0.02 |

-0.19*** |

-0.06 |

0.03 |

0.24*** |

-0.02 |

1.00 |

|

1.08 |

11 |

0.18*** |

-0.18*** |

0.48*** |

0.37*** |

-0.65*** |

0.45*** |

0.24*** |

0.55*** |

-0.26*** |

0.09** |

1.00 |

3.70 |

Notes: *, **, and*** denote 10%, 5%, and 1% significance levels, respectively.

4.3 Multivariate Analysis

To test the hypothesis, the estimation results of the model presented in Table 3 have been used with the combined data approach. The logistic regression method is used to estimate the model.

Table 3. Results of Regression Analyses on Corporate Over Investment

|

Dependent variable: IεNEW |

C |

1.60*** (3.76) |

CFOgender |

-1.66*** (-2.64) |

LnMV |

-0.62** (-2.04) |

SalesGrowth |

0.70** (2.00) |

CashFlow |

-2.47*** (-2.61) |

MTB |

1.16*** (2.79) |

STDEV |

2.07** (2.19) |

WCapital |

2.31** (2.48) |

Debt |

1.81** (1.99) |

Dividend |

-2.58*** (-2.84) |

ZScore |

1.50*** (3.47) |

Industry fixed effects |

YES |

Year fixed effects |

YES |

McFadden R-squared |

0.49 |

LR statistic |

853.62*** |

Notes: *, **, and*** denote 10%, 5%, and 1% significance levels, respectively.

The LR statistic (853.620) and its significance (0.00) show that the model is meaningful. McFaddenʼs coefficient of determination states that the independent variables of the model explain about 49% of the changes in the dependent variable. According to the significance levels obtained from the significance test of the regression coefficients of the research, it can be seen that the significance level of the effect of the gender of the CFO on the over-investment of a company (0.00) is smaller than the error of one percent. It can be concluded that there is a significant relationship between the gender of the CFO and the over-investment of a company. Therefore, the hypothesis of the research is accepted at the error level of 1%. The results of control variables show that sales growth, market - to - book value ratio, cash flow fluctuation, net working capital ratio, debt issuance, and financial bankruptcy risk have a positive and significant effect on corporate over-investment. The company’s market value, operating cash flow, and paid dividends have a negative and significant effect on the over-investment of a company.

5 DISCUSSION

The results of this study show that the CFOʼs gender is an important determinant level of investment efficiency for manufacturing companies in emerging economies. The negative effect of the CFOʼs gender on the level of investment efficiency shows that with the increase in the presence of female CFOs in companies, the probability of choosing to over-investment decreases. Therefore, we conclude that firms with female CFOs have a lower chance of choosing to over-investment in emerging economies[58,68,78]. Companies’ investment policies may be affected by agency problems between managers and investors. Self-absorbed managers may invest in projects that jeopardize the long-term interests of investors. The findings of studies that have been conducted with a focus on psychology and finance show that women’s self-confidence in making decisions is less, therefore they act more ethically. Female financial managers act more conservatively in financial decisions, which stems from their risk aversion.

This research contributes to the existing theoretical foundations by documenting the effect of the personal characteristics of senior financial managers on the investment efficiency of the company. The present study is one of the first studies that examines whether the presence of female financial managers can curb the over-investment of the company or not. The potential positive effects of employing female financial managers in the senior management team extend to both companies and investors. Therefore, the current research emphasizes the importance of trying to break the barriers related to the limitation of women to reach the senior management level of the company in the field of accounting and finance. The results of this research not only enrich the theoretical foundations and empirical research but also provide practical policy implications for companies to improve investment efficiency and the importance of monitoring managerial behaviors, corporate governance, and gender diversity of financial managers.

The current research has certain limitations. First, the sample of this research includes only manufacturing companies listed on the Tehran Stock Exchange, so the results of this research cannot be generalized to non-manufacturing companies listed on the Tehran Stock Exchange. Second, there may be other variables influencing the relationship between female financial managers and the company’s overinvestment behavior, which are not considered in this research. Third, a larger sample size could influence the more precise results of the effect of CFO gender diversity and firm overinvestment. Considering the strong interest of the accounting profession, the business community, and standard setters in the relationship between the gender diversity of managers and the quality of financial reporting and investment efficiency, it is believed that the relationship between the gender diversity of managers and corporate investment is still a fruitful research area. The results of the research can suggest new ideas for conducting new research on the gender diversity of managers and the efficiency of corporate investment and the factors affecting it.

6 CONCLUSIONS, IMPLICATIONS AND LIMITATIONS

Financial managers have the greatest impact on the company’s financial decisions compared to other managers, so their role in the management and performance of the company has been emphasized a lot. This research examines the effect of CFO gender on the company’s investment efficiency. The research findings expand the existing theoretical foundations by examining how the gender of CFO affects the investment behavior of companies, especially the amount of over-investment at the company level. Using a sample of companies from 1396 to 1400, research evidence shows that female financial managers have a negative relationship with the company’s over-investment. This finding is by the theoretical perspective of agency theory because these companies prevent the formation of excessive investment due to the presence of gender diversity of senior financial managers and proper corporate governance. These findings suggest that companies with a lack of gender diversity of CFOs are more likely to deviate from their expected investment levels. The results of the research emphasize the importance of gender diversity of CFO Officer of the company as a resource to reduce conflict of interest and thus ensure the efficiency of corporate investment. The research findings are consistent with the risk aversion hypothesis, which reflects the effect of conservatism and risk aversion of female managers on company results. Overall, the results of this research provide evidence that female management is related to investment efficiency, and improvements are observed especially in companies that tend to over-invest.

Acknowledgements

The author was grateful for the valuable suggestions of two reviewers and the editor of the journal.

Conflicts of Interest

The author declared no conflict of interest.

Author Contribution

Farhad Touski O was responsible for the collection, compilation and summary of all data for articles.

Abbreviation List

CEO, Chief executive officer

CFO, Chief financial officer

M&A, Mergers and acquisitions

VIF, Variance inflation factor

References

[1] Nadeem M, De Silva TA, Gan C et al. Boardroom gender diversity and intellectual capital efficiency: evidence from China. Pac Account Rev, 2017; 29: 590-615.[DOI]

[3] Barber BM, Odean T. Boys will be boys: Gender, overconfidence, and common stock investment. Q J Econ, 2001; 116: 261-292.<span dir="ltr"></span>[DOI]

[4] Bernasek A, Shwiff S. Gender, risk, and retirement. J Econ Iss, 2001; 35: 345-356.<span dir="ltr"></span>[DOI]

[5] Agnew J, Balduzzi P, Sunden A. Portfolio choice and trading in a large 401 (k) plan. Am Econ Rev, 2003; 93: 193-215.[DOI]

[6] Huang J, Kisgen DJ. Gender and corporate finance: Are male executives overconfident relative to female executives? J Financ Econ, 2013; 108: 822-839.[DOI]

[7] Cumming D, Leung TY, Rui O. Gender diversity and securities fraud. Acad Manage J, 2015; 58: 1572-1593.[DOI]

[8] Ho SS, Li AY, Tam K et al. CEO gender, ethical leadership, and accounting conservatism. J Bus Ethics, 2015; 127: 351-370.[DOI]

[9] Hoitash R, Hoitash U, Kurt AC. Do accountants make better chief financial officers? J Account Econ, 2016; 61: 414-432.[DOI]

[10] Francis B, Hasan I, Park JC et al. Gender differences in financial reporting decision making: Evidence from accounting conservatism. Contemp Account Res, 2015; 32: 1285-1318.[DOI]

[11] Schopohl L, Urquhart A, Zhang H. Female CFOs, leverage and the moderating role of board diversity and CEO power. J Corp Financ, 2021; 71: 101858.<span dir="ltr"></span>[DOI]

[12] Barua A, Davidson LF, Rama DV, et al. CFO gender and accruals quality. Account Horiz, 2010; 24: 25-39.<span dir="ltr"></span>[DOI]

[13] Gupta VK, Mortal S, Chakrabarty B, et al. CFO gender and financial statement irregularities. Acad Manage J, 2020; 63: 802-831.[DOI]

[14] Ge W, Matsumoto D, Zhang JL. Do CFOs have style? An empirical investigation of the effect of individual CFOs on accounting practices. Contemp Account Res, 2011; 28: 1141-1179.<span dir="ltr"></span>[DOI]

[15] Rose AM, Rose JM, Suh I et al. Why financial executives do bad things: The effects of the slippery slope and tone at the top on misreporting behavior. J Bus Ethics, 2021; 174: 291-309.<span dir="ltr"></span>[DOI]

[16] Liu Y, Gan H, Karim K. The effectiveness of chief financial officer board membership in improving corporate investment efficiency. Rev Quant Financ Acc, 2021; 57: 487-521.<span dir="ltr"></span>[DOI]

[17] Zorn DM. Here a chief, there a chief: The rise of the CFO in the American firm. Am Sociol Rev, 2004; 69: 345-364.[DOI]

[18] Baxter J, Chua WF. Be (com) ing the chief financial officer of an organization: Experimenting with Bourdieu's practice theory. Manage Account Res, 2008; 19: 212-230.<span dir="ltr"></span>[DOI]

[19] Bedard JC, Hoitash R, Hoitash U. Chief financial officers as inside directors. Contemp Account Res, 2014; 31: 787-817.[DOI]

[20] Datta S, Iskandar-Datta M. Upper-echelon executive human capital and compensation: Generalist vs specialist skills. Strategic Manage J, 2014; 35: 1853-1866.<span dir="ltr"></span>[DOI]

[21] Ferris SP, Sainani S. Do CFOs matter? Evidence from the M&A process. J Corp Financ, 2021; 67: 101856.<span dir="ltr"></span>[DOI]

[22] Ginesti G, Spano R, Ferri L et al. The chief financial officer (CFO) profile and R&D investment intensity: evidence from listed European companies. Manage Decis, 2021; 59: 99-114.<span dir="ltr"></span>[DOI]

[23] Meckling WH, Jensen MC. Theory of the firm: Managerial behavior, agency costs, and ownership structure. J Financ Econ, 1976; 3: 305-360.<span dir="ltr"></span>[DOI]

[24] Lara JMG, Osma BG, Penalva F. Accounting conservatism and firm investment efficiency. J Account Econ, 2016; 61: 221-238.[DOI]

[25] Malmendier U, Tate G. CEO overconfidence and corporate investment. J Financ, 2005; 60: 2661-2700.<span dir="ltr"></span>[DOI]

[26] Gervais S, Heaton JB, Odean T. Overconfidence, compensation contracts, and capital budgeting. J Financ, 2011; 66: 1735-1777.<span dir="ltr"></span>[DOI]

[27] Larwood L, Whittaker W. Managerial myopia: Self-serving biases in organizational planning. J Appl Psychol, 1977; 62: 194.<span dir="ltr"></span>[DOI]

[28] Puri M, Robinson DT. Optimism and economic choice. J Financ Econ, 2007; 86: 71-99.<span dir="ltr"></span>[DOI]

[29] Jensen MC. Agency costs of free cash flow, corporate finance, and takeovers. Am Econ Rev, 1986; 76: 323-329.<span dir="ltr"></span>[DOI]

[30] Jensen MC. The modern industrial revolution, exit, and the failure of internal control systems. J Financ, 1993; 48: 831-880.<span dir="ltr"></span>[DOI]

[31] Stulz R. Managerial discretion and optimal financing policies. J Financ Econ, 1990; 26: 3-27.<span dir="ltr"></span>[DOI]

[33] Fluck Z. The dynamics of the management-shareholder conflict. Review of Financ Stud, 1999; 12: 379-404.[DOI]

[34] Bens DA, Goodman TH, Neamtiu M. Does investment-related pressure lead to misreporting? An analysis of reporting following M&A transactions. Acc Rev, 2012; 87: 839-865.<span dir="ltr"></span>[DOI]

[35] Myers SC, Majluf NS. Corporate financing and investment decisions when firms have information that investors do not have. J financ Econ, 1984; 13: 187-221.<span dir="ltr"></span>[DOI]

[36] Biddle GC, Hilary G, Verdi RS. How does financial reporting quality relate to investment efficiency? J Account Econ, 2009; 48: 112-131.[DOI]

[37] Richardson S. Over-investment of free cash flow. Rev Account Stud, 2006; 11: 159-189.<span dir="ltr"></span>[DOI]

[38] Hambrick DC, Mason PA. Upper echelons: The organization as a reflection of its top managers. Acad Manage Rev, 1984; 9: 193-206.<span dir="ltr"></span>[DOI]

[39] Cohn RA, Lewellen WG, Lease RC, et al. Individual investor risk aversion and investment portfolio composition. J Financ, 1975; 30: 605-620.<span dir="ltr"></span>[DOI]

[40] Riley Jr WB, Chow KV. Asset allocation and individual risk aversion. Financ Anal J, 1992; 48: 32-37.[DOI]

[41] Bajtelsmit VL, Bernasek A. Why do women invest differently than men? J Financ Couns Plan, 1996; 7: 1-10.<span dir="ltr"></span>[DOI]

[42] Hinz RP, McCarthy DD, Turner JA. Are women conservative investors? Gender differences in participant-directed pension investments. Wharton Pension Res Counc Working Pap, 1996: 578.

[43] Watson J, McNaughton M. Gender differences in risk aversion and expected retirement benefits. Financ Anal J, 2007; 63: 52-62.<span dir="ltr"></span>[DOI]

[44] Fehr-Duda H, De Gennaro M, Schubert R. Gender, financial risk, and probability weights. Theor Decis, 2006; 60: 283-313.<span dir="ltr"></span>[DOI]

[45] Faccio M, Marchica M-T, Mura R. CEO gender, corporate risk-taking, and the efficiency of capital allocation. J Corp Financ, 2016; 39: 193-209.<span dir="ltr"></span>[DOI]

[46] Gul FA, Srinidhi B, Ng AC. Does board gender diversity improve the informativeness of stock prices? J Account Econ, 2011; 51: 314-338.[DOI]

[47] Adams RB, Ferreira D. Women in the boardroom and their impact on governance and performance. J Financ Econ, 2009; 94: 291-309.<span dir="ltr"></span>[DOI]

[48] Chen Y, Eshleman JD, Soileau JS. Board gender diversity and internal control weaknesses. Adv Account, 2016; 33: 11-19.<span dir="ltr"></span>[DOI]

[49] Srinidhi B, Gul FA, Tsui J. Female directors, and earnings quality. Contemp Account Res, 2011; 28: 1610-1644.<span dir="ltr"></span>[DOI]

[50] Bennouri M, Chtioui T, Nagati H et al. Female board directorship and firm performance: What really matters? J Bank Financ, 2018; 88: 267-291.<span dir="ltr"></span>[DOI]

[51] Galbraith S, Stephenson HB. Decision rules used by male and female business students in making ethical value judgments: Another look. J Bus Ethics, 1993; 12: 227-233.<span dir="ltr"></span>[DOI]

[52] Ibrahim N, Angelidis J. The relative importance of ethics as a selection criterion for entry-level public accountants: Does gender make a difference? J Bus Ethics, 2009; 85: 49-58.<span dir="ltr"></span>[DOI]

[53] Bernardi RA, Arnold Sr DF. An examination of moral development within public accounting by gender, staff level, and firm. Contemp Account Res, 1997; 14: 653-668.<span dir="ltr"></span>[DOI]

[55] Fallan L. Gender, exposure to tax knowledge, and attitudes towards taxation; an experimental approach. J Bus Ethics, 1999; 18: 173-184.<span dir="ltr"></span>[DOI]

[56] Cullis J, Jones P, Lewis A. Tax framing, instrumentality, and individual differences: Are there two different cultures? J Econ Psychol, 2006; 27: 304-320.<span dir="ltr"></span>[DOI]

[57] Francis BB, Hasan I, Wu Q et al. Are female CFOs less tax-aggressive? Evidence from tax aggressiveness. J Am Tax Assoc, 2014; 36: 171-202.<span dir="ltr"></span>[DOI]

[58] Francis B, Hasan I, Wu Q. The impact of CFO gender on bank loan contracting. J Account Audit Fina, 2013; 28: 53-78.<span dir="ltr"></span>[DOI]

[61] Tobin J. A general equilibrium approach to monetary theory. J Money Credit Bank, 1969; 1: 15-29.<span dir="ltr"></span>[DOI]

[62] Malmendier U, Tate G. Who makes acquisitions? CEO overconfidence and the marketʼs reaction. J Financ Econ, 2008; 89: 20-43.<span dir="ltr"></span>[DOI]

[64] Sautner Z, Weber M. How do managers behave in stock option plans? Clinical evidence from exercise and survey data. J Financ Res, 2009; 32: 123-155.<span dir="ltr"></span>[DOI]

[65] Ben-David I, Graham JR, Harvey CR. Managerial miscalibration. Q J econ, 2013; 128: 1547-1584.<span dir="ltr"></span>[DOI]

[66] Svenson O. Are we all less risky and more skillful than our fellow drivers? Acta Psychol, 1981; 47: 143-148.<span dir="ltr"></span>[DOI]

[67] Lundeberg MA, Fox PW, Punćcohaŕ J. Highly confident but wrong: Gender differences and similarities in confidence judgments. J Educ Psychol, 1994; 86: 114.<span dir="ltr"></span>[DOI]

[68] Jiang T, Wang Z, Goto S et al. CEO and CFO risk-taking incentives and earnings guidance. Appl Econ Lett, 2020; 27: 1256-1259.<span dir="ltr"></span>[DOI]

[69] Murphy KJ. Corporate performance and managerial remuneration: An empirical analysis. J Account Econ, 1985; 7: 11-42.<span dir="ltr"></span>[DOI]

[70] Murphy KJ. Incentives, learning, and compensation: A theoretical and empirical investigation of managerial labor contracts. Rand J Econ, 1986; 17: 59-76.<span dir="ltr"></span>[DOI]

[71] Lin YC. Do voluntary clawback adoptions curb overinvestment? Corp Gov-Oxford, 2017; 25: 255-270.<span dir="ltr"></span>[DOI]

[72] Doukas J. Overinvestment, Tobinʼs q, and gains from foreign acquisitions. J Bank Financ, 1995; 19: 1285-1303.<span dir="ltr"></span>[DOI]

[73] Hoskisson RE, Turk TA. Corporate restructuring: Governance and control limits of the internal capital market. Acad Manage Rev, 1990; 15: 459-477.<span dir="ltr"></span>[DOI]

[74] Kuo YP, Hung JH. Family control and investment‐cash flow sensitivity: Moderating effects of excess control rights and board independence. Corp Gov-Oxford, 2012; 20: 253-266.<span dir="ltr"></span>[DOI]

[75] Aggarwal RK, Samwick AA. Empire-builders and shirkers: Investment, firm performance, and managerial incentives. J Corp Financ, 2006; 12: 489-515.<span dir="ltr"></span>[DOI]

[76] Kor YY. Direct and interaction effects of the top management team and board compositions on R&D investment strategy. Strategic Manage J, 2006; 27: 1081-1099.<span dir="ltr"></span>[DOI]

[77] Bhaumik S, Driffield N, Gaur A et al. Corporate governance and MNE strategies in emerging economies. J World Bus, 2019; 54: 234-243.<span dir="ltr"></span>[DOI]

[78] Liu Y, Neely P, Karim K. The impact of CFO gender on corporate overinvestment. Adv Account, 2022; 57: 100599.<span dir="ltr"></span>[DOI]

[79] Vogt SC. The role of internal financial sources in firm financing and investment decisions. Rev Financ Econ, 1994; 4: 1-24.<span dir="ltr"></span>[DOI]

[80] Fazzari S, Hubbard RG, Petersen BC. Financing constraints and corporate investment. Brookings Pap Eco Ac, 1987; 1: 141-195.[DOI]

[81] Fama EF, French KR. Size and book to market factors in earnings and returns. J financ, 1995; 50: 131-155.<span dir="ltr"></span>[DOI]

[82] D’Mello R, Miranda M. Long-term debt and overinvestment agency problem. J Bank Financ, 2010; 34: 324-335.<span dir="ltr"></span>[DOI]

[83] Chowdhury MR, Xie F, Hasan MM. Powerful CEOs and investment efficiency. Glob Financ J, 2023; 58: 100886.<span dir="ltr"></span>[DOI]

[84] Gaio C, Gonçalves TC, Cardoso J. Investment efficiency and earnings quality: European evidence. J Risk Financ Manag, 2023; 16: 100886.<span dir="ltr"></span>[DOI]

[85] Bilyay-Erdogan S, Danisman GO, Demir E. ESG performance and investment efficiency: The impact of information asymmetry. J Int Financ Mark I, 2024; 91: 101919.<span dir="ltr"></span>[DOI]

Copyright © 2024 The Author. This open-access article is licensed under a Creative Commons Attribution 4.0 International License (https://creativecommons.org/licenses/by/4.0), which permits unrestricted use, sharing, adaptation, distribution, and reproduction in any medium, provided the original work is properly cited.

Copyright ©

Copyright ©