Voluntary Insurance for Ensuring Speedy Growth-trend of E-banking Transactions in Thai-economy: Seeking Attention Aimed for Designing Effective Policies

Akim M. Rahman1,2*![]()

1Institute of Business Studies, Sheikh Hasina University of Science and Technology (SHUST), Bhairab, Kishore Gong, Bangladesh

2Research Division, Social and Economic Research Institute (SERI), Bangladesh under The Ohio State University, USA

*Correspondence to: Akim M. Rahman, PhD, Associate Professor and Director, Institute of Business Studies, Sheikh Hasina University of Science and Technology (SHUST), Banshari, Bhairab, Kishoreganj, 2350, Bangladesh; Email: akim_rahman@hotmail.com

DOI: 10.53964/mem.2024005

Abstract

Objective: Digital banking, particularly bank-led digital-banking, is a critical service-product in today’s economy country-wise such as Thailand. But this advancement faces slow growth trends where psychological risk-factors dominate a customer’s or a probable customer’s decision not to use it. Focusing on the issue, a new product voluntary insurance (VI) in e-banking service market can be important marginalizing the dilemma in economy country-wise where Thailand is no exception. Accordingly, calling for policymakers’ attentions in Thailand for effective policy-design including price setting of the VI are the goals of the current study.

Methods: In aim to attract policy-makers attentions, this study uses welfare analysis for assessing the benefits of parties involved in the e-banking service-market in Thai-economy.

Results: Having the VI in the bank-led e-banking service-market can guarantee a cashless society soon by meeting the challenges of perceived risk-factors facing today by the e-banking customers and probable customers. The adaptation of the VI will ensure the business growth of the e-banking services, which will guarantee risk-less digital-banking in Thai-economy. S-curve (the growth trend) in VI operation will capture revenue growth against time. In the process, sometime the e-banking-users will demand it. Accordingly, the growth trend of the VI product will increase slowly but steadily in Thai-economy.

Conclusion: In today’s business-driven world, the VI policy-proposal adaptation is becoming a precondition for ensuring higher growth-trends of e-banking transactions country-wise such as Thailand. Accordingly, this study aims to bring the VI proposal to policymakers’ attentions, particularly to the leadership and Cabinet members in Thailand for their motivations, effort, and ability for political maneuvering to ensuring cashless society soon.

Keywords: digital banking services, perceived-risk factors, Akim-model, cashless society

1 INTRODUCTION

In today’s world, people deliver services in a competitive and rational manner where few factors are sometime unpredictable. Digital banking, particularly bank-led digital-banking, is a critical service product in today’s financial sector. But this development meets severe drawbacks, being its insecurity where psychological risk-factor dominates a customer’s or a probable customer’s decision not to use it. In the financial sector, banks strive to marginalize their costs of operation with the goal of enhancing their revenues. Bank provides services based on terms & conditions of banking services. But customers do not read them, in general. They do not save contract copies of banking services. Also, no customer remembers exactly the number of transactions or amount of each transaction of own account. These factors may become abusive in the e-banking service market.

In today’s e-banking service-market country-wise such as Thailand where a customer faces perceived-risk in multi-faucets including extra fees, account hacking and hidden charges. Overcoming customers’ complaints, service-providers sometime protect themselves with a claim “technical or electricity problem”, and these victims require filing complaints to the respective authority(s). These are not new in the digital-banking service-market country-wise.

The Bank of Thailand (BOT) is the main financial regulator in Thailand. It regulates the financial industry and oversees monetary policies there. The BOT in Thailand is the main authority for authorizing and issuing licenses for banking-business, insurance business, investment advisers, brokers and for system of payment in financial industry[1]. Because of today’s meaningful contributions in multi-faucets of digital revolution impacts financial sector country-wise such as Thailand where banks and other credit institutions are taking total benefits of it. In this digital journey, financial institutions particularly banks are facing greater competition meeting customers’ demands, which have helped the FinTech stepped in providing digital services in businesses country-wise such as Thailand. The FinTech services have constantly been testing with adopting modern-technologies and business-models in Thai-economy. Thus, it is reasonable raising question how much appealing the digital transformation, especially, bank-led digital banking among customers in Thailand where internet penetration rate is 68.1%[2,3].

With this advancement, the policy of the Deposit Insurance System (DIS), introduced in the late of the year 2005, has been ensuring monetary deposit to banking services, which is an important improvement. But this advancement was not a novelty by international standard[4]. Here the DIS does not cover digital transactions. Thus, it is not effective addressing today’s perceived risk-factors including psychological risks of users in e-banking service-market. The goals of the DIS-2005 law were threefold. They were (a) protecting bank depositors’ rights & legal interests; (b) consolidation of public confidence in banking-system; (c) re-interceding savings by the population into banking system; (d) establishing a situation where both state-owned banks and private-sector credit institutions for enhancing competition[4,5] in Thailand financial sector. Despite having the DIS in place, in the case of traditional banking services, a banking service-provider still verifies a few things / information before clearing any check(s) in the banking transaction process.

Similarly, the DIS provision does not ensure secured services of e-banking. Despite enthusiasm for using digital-banking, customers sometime face perceived-risk including psychological-risk, no matter where they live in Thailand. Furthermore, country-wise such as Thailand does not have efficient laws in practice. Thus, it cannot relegate the levels of perceived risks[4]. Here no country is an exception in today’s digitized globe when it comes to digital-banking services.

Focusing on the issue, in literature, Akim Rahman[6] proposed a new product Voluntary Insurance (VI) in e-banking service market country-wise such as Thailand. Here the probable policy-design including price-setting of the VI can guarantee absolute risk-less digital-banking services. Simultaneously, it can open doors for existing ones or for new businesspersons who may want to operate or have insurance company(s) as a new business. So, the well-secured digital finance may lead to dynamic changes in businesses and in human behaviors in Thailand. Accordingly, effective policy design including price of the VI can be important. Also, it might be a vital question and policy-decision in the e-banking progression whether the bank itself or any third-party will provide or supply the VI product services in e-banking service-market of Thai-economy? So, calling for policymakers’ attentions now in Thai-economy for effective policy-design is the goal of the current study.

1.1 Literature Review

Literature shows that the probable-risk or perceived risk is causing substantial negative and direct effects on consumers and probable customers’ decisions adopting digital banking services in their lifestyles[6-9]. Tackling today’s e-banking dilemmas in progression of digital-transaction-numbers in financial-sector country-wise, Akim model’s application[6,9] can be vital and economically favorable to individuals who are engaged. In the referred progression, government efforts for policy-design can ensure a cashless society in Thai-economy soon. This model is as an addendum to behavioral purposeful theories in literature in entrepreneurship and innovation management arenas[10].

As of today, the findings of Web navigation suggest that no individual bank or banking sector in economy country-wise has yet introduced VI protecting its digital-banking services where Thailand is no exception.

In the world of 21st Century Tech-driven, political leaderships country-wise want to have technology utilization effectively for greater interest of its people. On the prospect, just after year 2007, most banks located in Thailand appeared to be ready welcoming e-banking as a potential solution for supporting and bolstering revenues in multi-faucets[11]. Li Bo categorized the Thai-economy as one of the friendly fintech-authorities with no abnormally troublesome requirements for companies that participate in the field of commerce[11]. For ensuring a secured and strong digital-banking services in financial sector of Thailand, interested parties can engage with regulator for designing effective policies and then for its adaptation there.

As reported, there are difficulties and uncertainties on security issues when it comes to digital banking, which may change today’s business models[1,9]. But the recent efforts for upgrading the Thai regulatory framework, the referred difficulties, and uncertainties will change soon[1]. Also, it can expect here that the ongoing efforts will ensure efficient & effective digitalization of Thai-economy.

In traditional banking services, customers’ accounts in banks are insured by the Central Bank country-wise through provisions of Deposit Insurance Services. For example, an account-holder’s deposits are insured under provisions of the DIS Law, 2000, in Bangladesh[6,9]. But it does not cover digital-banking transactions[12]. Like any other countries, Thailand banking-service provisions are no exception. Currently, the Thai banking system where bank deposit and bank account are protected by the provision of the DIS in Thailand[13]. But it does not cover today’s digital transactions in banking services. Accordingly, it faces perceived risks including psychological risk, which may even arise from technological interruptions in multi-faucets.

With this dilemma in hand, the reasonable question is: how the Thai political leadership be inspired designing & adopting banking-service policies for ensuring risk-less today’s e-banking services? In other words, can the VI policy proposal in e-banking services be appealing to the policymakers in Thai-economy for ensuing riskless digital transactions in e-banking service?

The current study advances with the background supporting the proposal of adopting the model – the VI Policy for ensuring risk-free e-banking in today’s Thai financial sector. Thus, under the DIS Provision, banks will adopt the VI policy in e-banking services in Thailand financial sector, which can attract probable customers using e-banking-service. At the same time, it can lead higher growth-trends of digital-transactions than that today in e-banking service-market in Thai-economy.

1.2 Why Is Thai-economy?

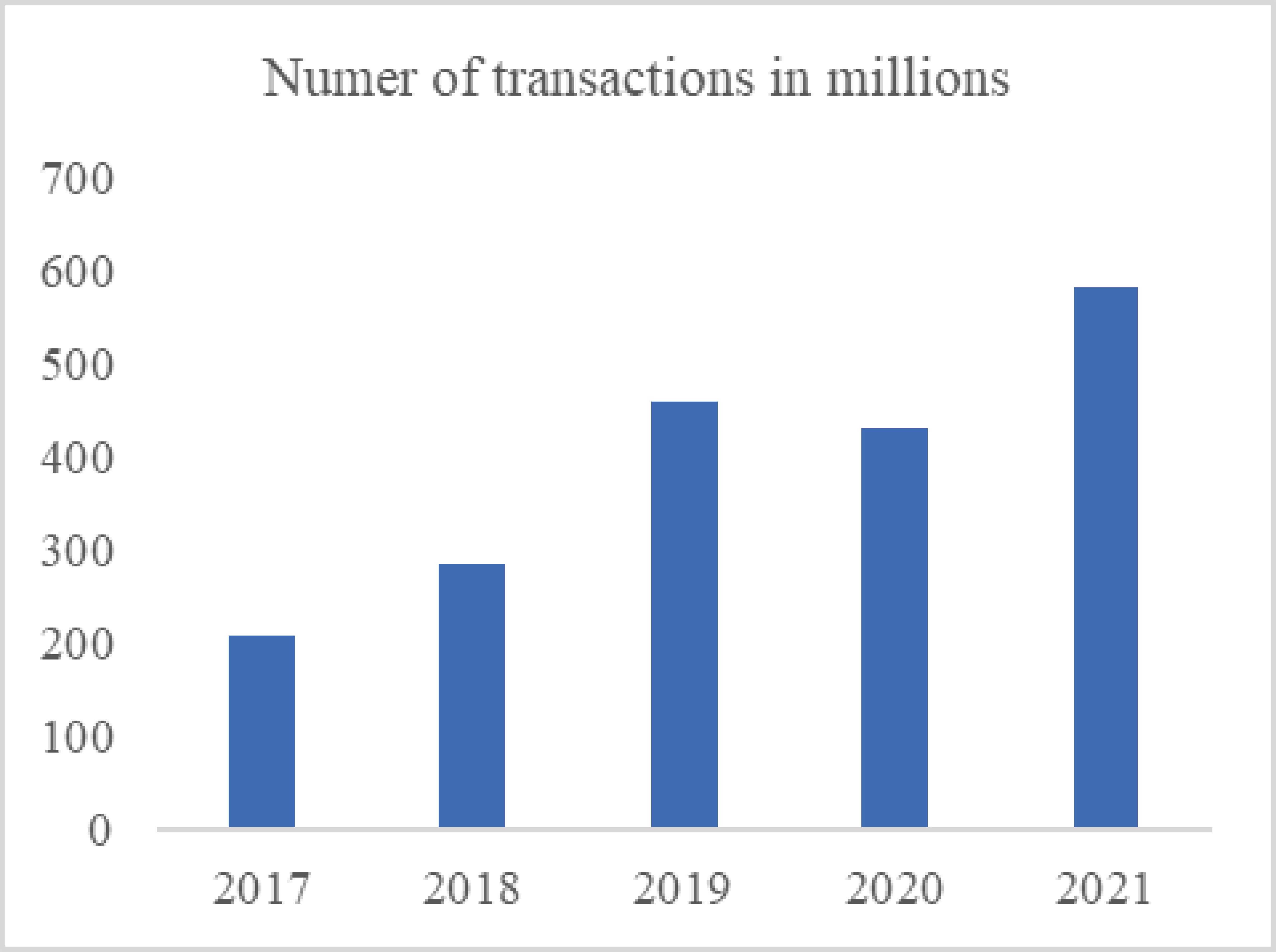

The Bank of Thailand recently announced plans introducing new digital banks in country for boosting competition and promoting financial inclusion[1]. Figure 1 clearly shows that in 2021, the Thai-economy had 580.8 million transactions. It was higher than that of the previous year. Because of drastic consumer lifestyle changes from COVID-19 pandemic, businesses are now under presume adopting digital understanding and practices.

|

Figure 1. Trends of bank-led digital banking in Thai-economy. Data source: statista research dept.

However, as reported this effort has been facing challenges where perceived risk-factors, mostly peoples’ psychological factors, are undermining the growth trends. People in rural areas feel it to be riskier than that in city areas[1,5].

1.3 Study Objectives

The objectives of the study are as follows:

(1) To draw policymakers’ attention for policy-design introducing the VI product in Thai economy for ensuring rapid growth-trends of transactions of e-banking services.

(2) To assess the benefit & effectiveness adopting the proposed VI policy in e-banking service-market of Thailand using welfare analysis.

(3) To hint on setting price or cost for insurance that ensures efficiency under welfare analysis of e-banking sector in Thai-economy.

2 MATERIALS AND METHODS

2.1 Perceived Risks in E-banking Services: What Are Those in general?

The concept of risk is organized around the idea that customer behavior involves risk in the sense that any customer action may produce consequences that they cannot anticipate with anything approaching certainty[14,6]. It is powerful in explaining a customer’s behavior because customers are more often motivated to avoid mistakes than to maximize utility using digital banking[15,6]. Risk is often present in choice situations as customers cannot always be certain that a planned use of digital banking will achieve satisfactory goals[6,9]. In summary, the probable risk factors of using e-banking[9] are as follows:

(1) Security / privacy risk

(2) Financial risk

(3) Performance risk

(4) Psychological risk

(5) Customer dispute

(6) Social risk including incident, which may cause disapproval of guarantor(s)

(7) Time risk

(8) Alternative delivery channel cases code or PIN fraud.

2.2 Methodologies

Here the Consumer Choice & Behavioral Theory[16] is used for establishing the basis of the proposed policy-model i.e., the VI model, in e-banking service-market of financial sector in Thai-economy. The technique of Welfare Analysis in economics is used here for cross-examining the expected effectiveness of the application of VI model. The findings here will serve as a guidance on adopting the VI policies in e-banking service-market of Thai-economy.

3 RESULTS AND DISCUSSION

3.1 VI: What Is It?

Tackling the factors particularly psychological risk-factor that has been undermining the growth-trends of e-banking transactions in Thai-economy, the adaptation of VI as a product of digital-banking can contribute significantly[6]. In Thai-economy, when the VI is in practice, it will protect each digital transaction for the transaction-user / customer in e-banking service-market of Thailand where insurance provider will take full responsibility securing the transaction. It will serve something like, in today’s word, the FDIC protects the money depositors place in insured banks in the unlikely event of an insured-bank failure country-wise such as Thailand. On regulatory aspects, the VI policy will not be contradictory to or duplicate of the FDIC, but it will ensure secured transactions in today’s digital-banking services in economy country-wise such as Thailand. Accordingly, there should not be any legal or regulatory barriers in aspects of regulatory landscape for the implementation of VI in financial sector country-wise such as Thailand.

Thus, on policy design aspects, under the proposed policy, financial sector in Thai-economy may launch VI as a product in operation where the bank can collect premium securing services. By so doing the bank will serve as an insurance-provider and complete all responsibilities including an assurance when a probable customer is concerned with his / her psychological risk. Alternatively, the bank can collect the insurance premium from the customers on behalf of the insurance provider where the insurance provider will be fully responsible for securing each transaction.

Here for product VI in the e-banking service-market, the customer’s participation will be voluntary. If a customer wants it, insurance will be attached to the customer’s account in e-banking services. Here the insurance plan will be designed to transfer risk away from its premium payers. It will ensure with a sense of certainty, which may inspire using services of e-banking as needed. Premium-receivers here will take extra measures to ensure risk-free e-banking services. For example, transactions can be protected by setting up two identifications such as password and a finger-scan. Defeating the risk of hacker’s access to any bank accounts, banking service providers will have the option to introduce more options as appropriate. In cases such as digital remittances, further efforts can be added as needed. Since customers’ psychological risk-factor undermines today’s growth-trends of digital-transactions in economy such as Thai-economy, adding the VI can be instrumental addressing the dilemma.

3.2 How Can the VI Be Functioning in Thai-economy?

Referring to the factors that undercut today’s bank-led e-banking progression in Thailand, adopting effective policies based on the theme - VI in e-banking services[6,9] can help. After adopting relevant policies, the financial sector in Thai-economy can introduce VI as a product in service-market. And accordingly, the bank itself can collect premium.

In the e-banking market under the VI model, the customer’s participation i.e., buying it or not buying it, is voluntary. It is like buying an I-Phone or an Android phone is a customer’s choice based his / her needs, preferences, and ability in market-economy. Obviously, in this case, demographic factors – such as race, age, income, marital status, and educational achievement etc., consumer behavior, competition and financial ability etc. dominate the decision whether to buy an I-Phone or Android phone.

So, when the policy is in place, underpinning the provision(s), a bank account will attach or connect with insurance, if the accountholder wants it when s/he signs up for using e-banking services. If the accountholder does not want the VI services, the accountholder still has full access to use e-banking services. Once the policy is in place, like any other insurance program in operation, the bank will ensure premium payers with a sense of certainty under a program approved by the Central Bank. Here the bank, the premium receivers, will be responsible for taking extra measures to ensure risk-less e-banking.

3.3 E-banking Service-market with VI as an Option

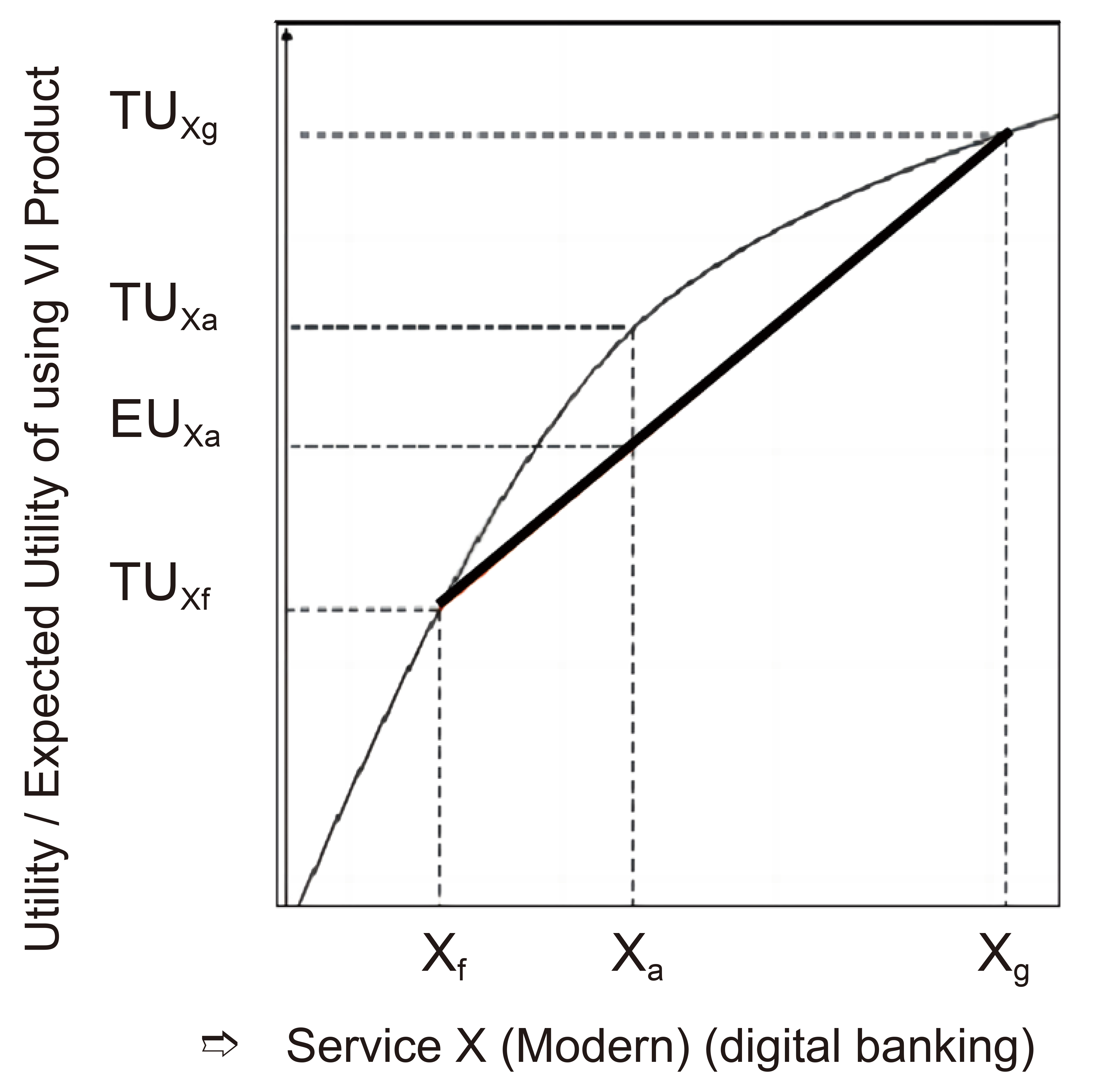

The perceived-risk factor contributes significantly for preparation so that the VI policy can be introduced in e-banking service-market in economy country-wise such as Thailand. It is well recognized that using banking services, customers and probable customers prefer certainty to uncertainty. Figure 2 shows risk preferences of risk-averse banking customers.

In any uncertainty-world, the utility of using e-banking services by a customer will be on the cord – the bold line but not on the TU (X) line in Figure 2. Here (X3) stands for outcome of digital services where a customer may prefer using a certain level of service X. The (X1) stands for dissatisfactory level of digital-service outcome where a customer may not or may use little of digital-service say X level in Figure 2.

|

Figure 2. A case of risk-aversion in digital-banking services in Financial Sector of Thailand.

Because it represents customer’s dissatisfaction. If there is a level of uncertainty, a customer may not use (X3) units of digital-service X. Thus, the utility that this customer receives will lie somewhere on the chord (the bold line), which means nowhere outside of the bold line. The cord (the bold line) stands for the expected utility (EU) of using service X, which lies in the concavity of the curve. It represents the average probability whether the customer uses digital-service X or not. Consequently, the customer will not ever receive TU (X3) but will receive the EU (X3).

3.4 Welfare Analysis Having VI in Digital-banking Service-market of Thai-economy.

For examining benefits of bank(s) that adopts VI in Thai economy, this section is designed in two folds. They are as follows:

3.4.1 VI Introduction in the E-Banking Market: How Could Consumers Perceive & Respond to?

It is important for customers as well as for banks to get full information about the economic benefits of adopting VI in digital e-banking-services. The reason is that the insurance premium will go out from customer’s pockets. In return, it will ensure secure digital transactions. In this scenario, risk-adverse may not choose insurance in preferences. It is like some people may not choose even traditional banking because of bank-account fees, bank charges etc. So, a theoretical framework for effective cost or price of the VI is developed and justified as follows.

3.4.1.1 Setting up Model and Its Notations: First This Study Considers a Situation in Which Customers of Digital-Banking Are Faced with Choices

(1) signing up for insurance contract or not where the signing up offers high coverage (say contract H) that ensures risk-free digital-banking; (2) Not signing up for insurance offers i.e., no coverage (contract L) but the contract facilitates digital-banking services, the customers are doing now in economy country-wise such as Thailand.

For further simplification, this study assumes that contract L is no insurance, but customers are helped for free access to e-banking. And contract H is full insurance and customers are eased risk-free e-banking services. These are merely normalizations and straightforward to relax where once the VI product is in place. Here bank(s) can manage the insurance matter just like it manages its customer-account supporting fees with the bank.

Another important assumption is that the characteristics of the contracts as given where premium of insurance to be decided endogenously. It is a reasonable characterization of insurance markets with variation across individuals only in pricing of the contracts and not in offered coverage. This analysis is therefore in the spirit of Akerlof[17] rather than Rothschild and Stiglitz[16] who endogenous the level of coverage.

3.4.1.2 Demand for Insurance

This study assumes that each customer of digital banking makes a discrete choice of whether to buy insurance or not. Since we take as given that there are only two available contracts for e-banking services and its associated-coverage-demand is only a function of the relative price “p”. We assume that banks cannot offer different prices to different customers. To the extent that banks can make prices depend on observed characteristics. We assume that if customers choose to buy insurance, they buy it at the lowest price at which it is available. So, it is sufficient to characterize demand for insurance as a function of the lowest premium i.e., price “p”. Mathematically, D=ƒ(p) where D=demand for insurance and p=premium amount or price for insurance services. Since it will be mostly digital services, the price or premium amount will be small no matter what economy we talk about.

3.4.1.3 Supply and Equilibrium

Our further assumption is that there are N≥2 identical risk neutral insurance service-providers or banks in digital-banking cases that set prices in a Nash Equilibrium. There might be both imperfect and perfect competitions in VI-product market. But we choose to focus on the case of perfect competition as it stands for a natural benchmark for welfare analysis of the efficiency cost of selection[18].

We further assume that when multiple banks set the same price, individuals who decide to buy insurance at this price choose a bank randomly. We assume that the only costs of supplying contract H to individuals “i” are insurable total cost is TC. Here average cost (AC) curve is decided by the costs of the sample of individuals choose contract H. Symbolically, AC=TC/i where AC reduces as i increases (“i”=number of customers).

To characterize equilibrium, we make two further assumptions. First, we assume that there exists a price p̄ such that D (p̄>0 and MC (p)<p for every p>p̄. In other words, we assume that it is profitable and efficient to provide insurance to those with the highest willingness to pay for it. Secondly, we assume that if there exists p̱ such that MC (p̱)>p̱ then MC (p)>p for all p<p̱. That is, we assume that MC (p) crosses the demand curve at most once. It is easy to verify that these assumptions guarantee the existence and uniqueness of equilibrium. In particular, the equilibrium is characterized by the lowest break-even price P*=AC (P).

3.4.2 Measuring Welfare to the Parties Involved

This study measures customer / consumer-surplus (CS) in certainty-equivalent weights. This weight of certainty-equivalent over an uncertainty is the amount that would make the e-banking customer to be indifferent between obtaining the amount with uncertain (the uncertain outcome) and obtaining the amount for sure. In this case, a higher certainty outcome ensures or supplies higher utility to the customer[6,10]. Since Welfare measurement is an appropriate technique for measuring economic losses & gains, this study uses the referred technique. In this scenario, the total surplus (TS) of market is the sum of certainty-equivalent weights for consumers and the profits of the premier-receiver (bank or the third-party) that will provide the insurance-services in e-banking service-market. The income effects associated with the changes of prices or costs of the VI we ignore it for now in all over the analysis in this study.

3.4.2.1 Graphical Representation

This graphical demonstration is helpful for better understanding the efficiency-costs or efficiency-prices of diverse types of selection of the insurance for ensuring riskless-e-banking services in Financial Sector of Thailand. With the background, the graphical demonstration of adverse-choice and helpful selection is as follows:

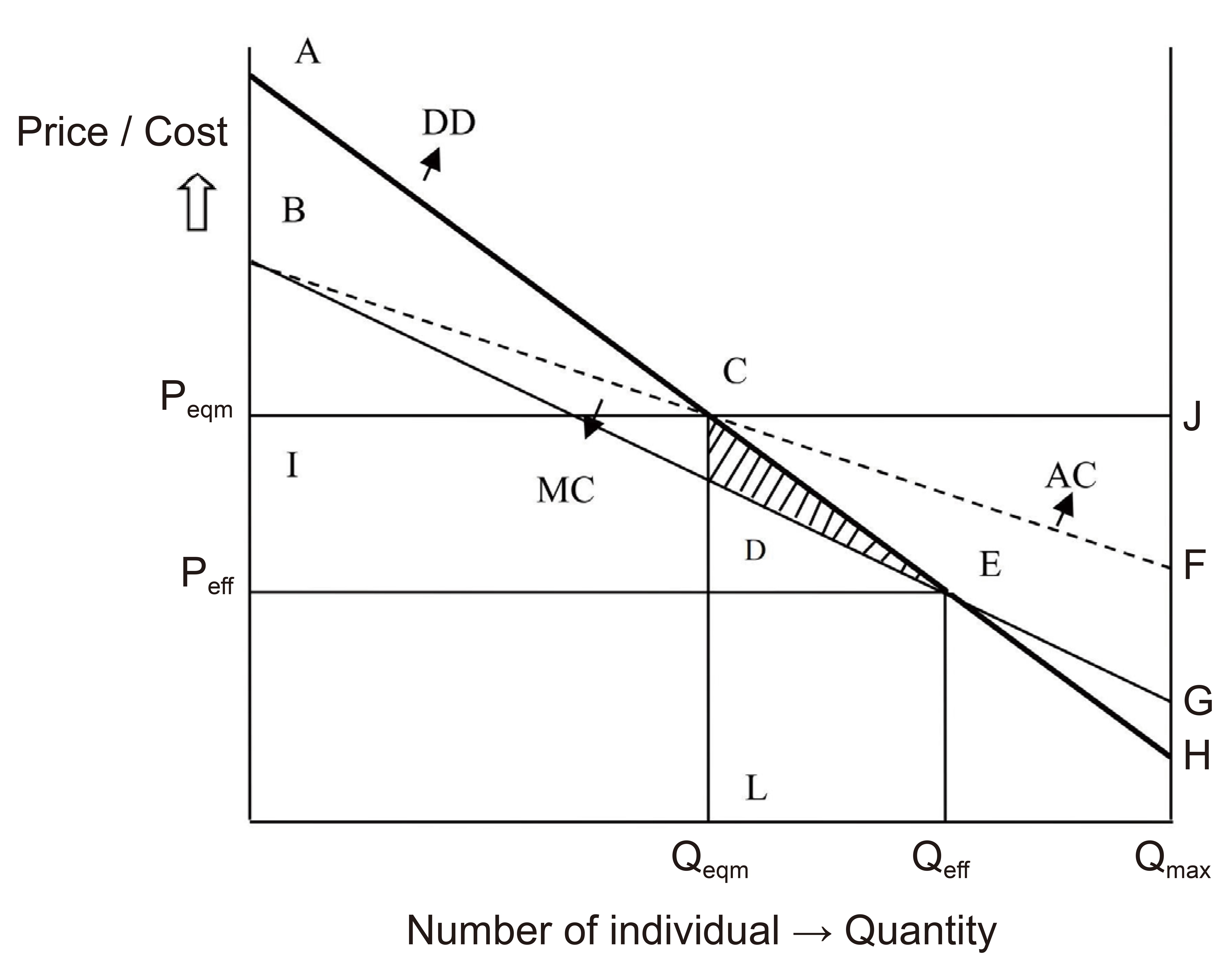

(1) Adverse selection case: Y-axis in Figure 3 stands for cost or price of the contract H and the x-axis stands for number of customers who use e-banking services along with H contract in e-banking service-market where maximum quantity or number of customers is Qmax where Q=no. of customers and max=maximum. Here demand-curve represents the demand for contract-H demand i.e., demand for insurance in the e-banking service-market. Also, the AC curve and the MC curve represent average incremental costs and marginal incremental costs respectively to the service-receiver or insurer in e-banking service-market. In other words, the customers those use contract-H (insurance users in e-banking service-market), from coverage with contract-H compared to contract-L (no insurance but facilitated to e-banking) are better off and enjoy the riskless e-banking services.

|

Figure 3. Efficiency cost of adverse choice with VI presence in Thai-economy.

Here the important part in adverse-selection is that individual who has the highest willingness to pay for insurance is individual who, on average, has the highest expected costs while using the e-banking services, shown in Figure 3 by sketching downward slopping MC curve. Here the MC is increasing in terms of price. But it decreases the number of customers using H-contract. Because of falling prices of the VI, the marginal customers who select contract-H have lower expected costs than that of the infra-marginal customers. It leads to lower average costs. Here the heart of the classified information problem is that the bank cannot charge based on its privately known marginal cost (MC).

Instead, it restricts the charge to a uniform price, which in equilibrium implies average cost pricing. Since AC>MC by economics principles, any adverse selection creates underinsurance, which was first pointed out by Akerlof[17]. In this section, this scenario is shown in Figure 3. The equilibrium shares of customers who buy contract-H is Qeqm (i.e., AC intersects DD at point C). Thus, the efficient number of customers with insurance is Qeff>Qeqm. The reason here is that the MC curve intersects the DD curve.

In Figure 3, CDE (the shaded area) represents losses of welfare due to adverse choices. It stands for customer’s loss from customers who are not insured in equilibrium. The reason is that the uninsured customers’ willingness to pay is less than that of the average cost of insured customers. However, the choices to be insured can be efficient for them. The reason is that their willingness to pay exceeds their actual MC, i.e., willingness of (payment > MC) in this scenario.

With the above elaboration as a foundation, this study advances for evaluating and comparing the welfare of the VI policy under a different scenario. Imagine that the customers in e-banking service-market require to sign-up for the contract-H. Accordingly, this mandatory requirement generates welfare, which is equal to ΔABE–ΔEGH. This computed welfare i.e., the ΔABE–ΔEGH we compare with the welfare at competitive equilibrium, which is equal to ΔABCD i.e., area ABCD. In this case, the welfare at efficient allocation level is ΔABE and the welfare from mandatory requirement. It means here everyone needs to sign up for contract-L (normalized to zero). On direction for future study, it is well recognized that the comparative welfare-ranking of each of these alternatives is an open question. It can be a part of the directions for an empirical study on the topic in the future.

(2)Profitable selection case: In literature on insurance market matters, the theory of selection focused on the adverse, which occurs when one party in a negotiation has relevant information and the other party lacks selection. It results in efficiency-losses from any underinsurance cases[17]. Consistency with Akerlof’s theory, empirical analysis in literature recommends that in any insurance market, for example health-insurance market, the insured patients have comparatively higher average costs than that of uninsured patients[19,20].

However, there exists a beneficial selection option in the life insurance market. Those with higher insurance have lower AC than that of those with less or no insurance at all. In literature, De Meza[20] contributed study-evidence on adverse-selection and useful or functional selection in other kinds of insurance-markets.

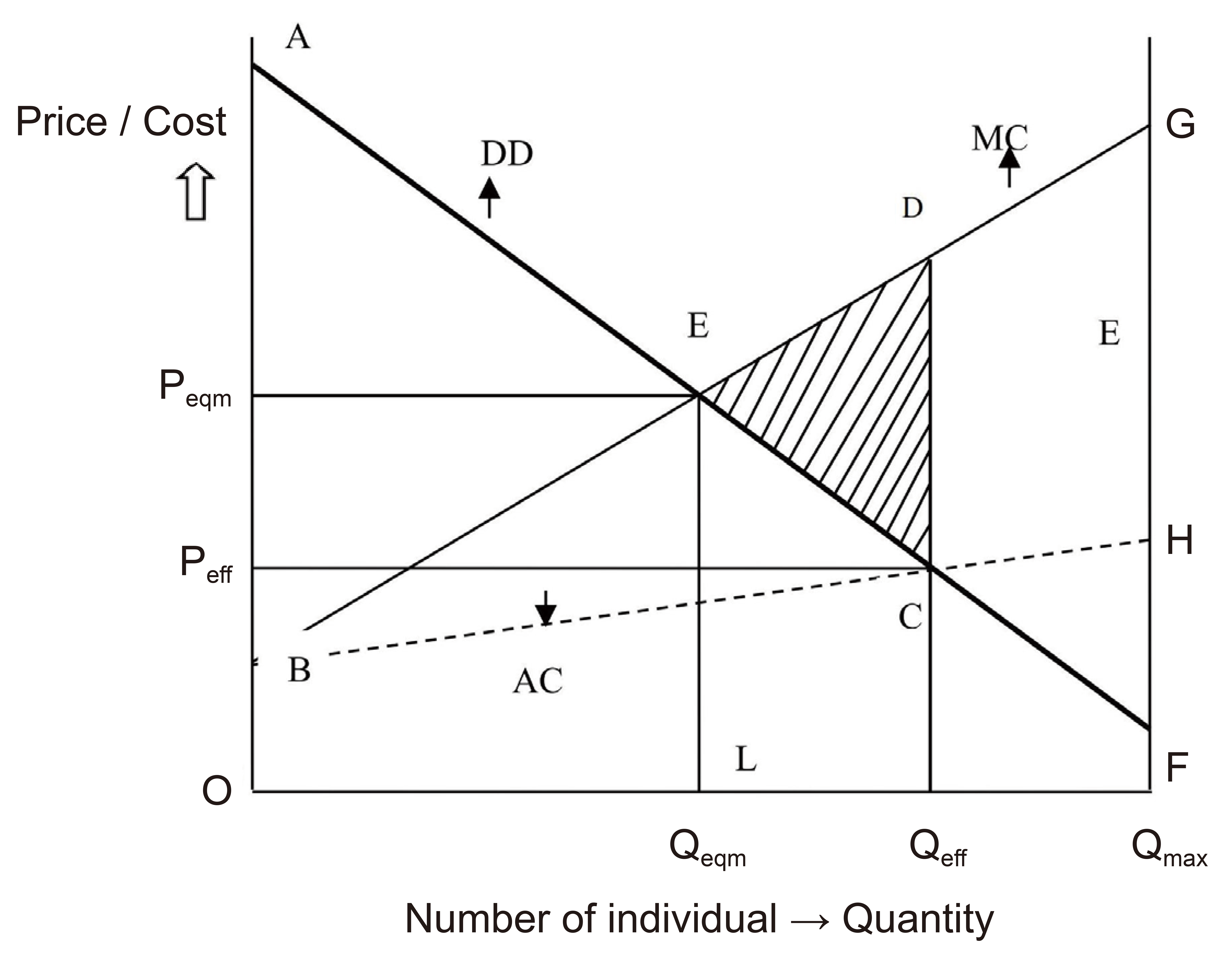

Figure 4 helps to illustrate the properties and consequences of a useful selection in this insurance-market. Compared with adverse choices in the selection process, customers that value the insurance most are those who have the least expected costs. It interprets upward sloping MC curve and the AC curve as shown in Figure 4.

|

Figure 4. Efficiency cost of helpful choice with VI in Thai-economy.

Figure 4 helps to illustrate the properties and consequences of a useful selection in this insurance-market. Compared with adverse choices in the selection process, customers that value the insurance most are those who have the least expected costs. It interprets upward sloping MC curve and the AC curve as shown in Figure 4. This inefficiency in the insurance market arises because of few other reasons. They are (a) Consumers here are varied based on their marginal cost; (b) Insurance service providers such as bank is restricted to uniform pricing of insurance of contract H; (c) In this market, the equilibrium price is based on average cost.

Nevertheless, the consequential market-failure in helpful-selection cases is one of over-insurances, not the under-insurances one, i.e., Q-eff<Q-eqm as shown in Figure 4. A group of authors in their study pointed it out in literature[20]. In general, in any insurance service market, service-providers have added incentive to reduce prices. This is because any infra-marginal customers they may get will be in good risks. Here significant amount of welfare-loss is area CDE (the shaded area ΔCDE) in Figure 4. This significant amount of welfare-loss is the consequential result of excess marginal cost of willingness to pay for individuals whose willingness to pay exceeds the average costs of total insured population. This welfare assessment can be evaluated in the case of other scenarios using Figure 4. These specific scenarios in Figure 4 are: (a) authorizing customers under contract-H; (b) authorizing customers under contract-L; (c) the situation of competitive-equilibrium i.e. ΔABE-ΔCDE and efficient-allocation i.e. ΔABE in the insurance-market. This can also be a part of future study direction in this study.

3.4.2.2 Thai-policymakers’ Efforts: How Can the VI Product be Instrumental?

The goal here is to draw policymakers’ attention so that the proposed VI be a part of the digital-banking services of Thai-economy for ensuring rapid growth-trends of e-banking transactions. With this goal in mind, the questions we raise are: how the VI product be instrumental in Thai financial-sector and to the Thai society? Why is it vital in the Thai-economy? Why is it now?

Replying to the questions, it is reasonable saying that risk transferring from a customer to insurance-provider will directly help the bank as well as the customer. It will positively influence the economic growth because of having new a product and demands for it in the economy. It can facilitate attracting new customers who were on the brink using the digital-banking-services in Thail financial-sector because they felt it to be risky psychologically. Besides attracting new customers, with banks’ motivations, customers can be attracted by offering incentives for increasing usage. It can be a win-win for customers as well as for the banking banking-service providers. All these together can ensure higher growth-trends of e-banking transactions eventually in Thai financial sector.

It recognizes in today’s business-driven world, having a legal new product in the market can be the lifeblood running the business. This product can be vital to companies, and to society in years to come. It can ensure new values in society for improving lifestyle. It can be valuable to customers in multi-faucets. It can be helpful to company’s existence in competitive market such as todays’ e-banking service-market of Thai-economy.

It is now well recognized that the VI product can ensure riskless digital-banking country-wise such as Thailand. It can assurance elevated self-services for banking in economy of Thailand sooner than delaying. This can be beneficial to e-banking-users in multi-faucets such as saving money and timesaving in daily lifestyle. With further progression in digital usage in Thailand, the banking sector can become better equipped and ready to provide cost-efficient banking services. This will cut down on banks' operational costs and facilitate meeting the needs of today's customers, in parallel with global changes.

With these prospects for the users, probable-users and for the service-providers in e-banking service-market, the Thail-economy is exception. It is well recognized that for securing revenues in today’s market competition, the banking-sector is engaging more today than before adopting digital-approaches in its operation[1]. However, for a while now, it has been failing to reach out a major part of the probable e-banking customers in Thailand.

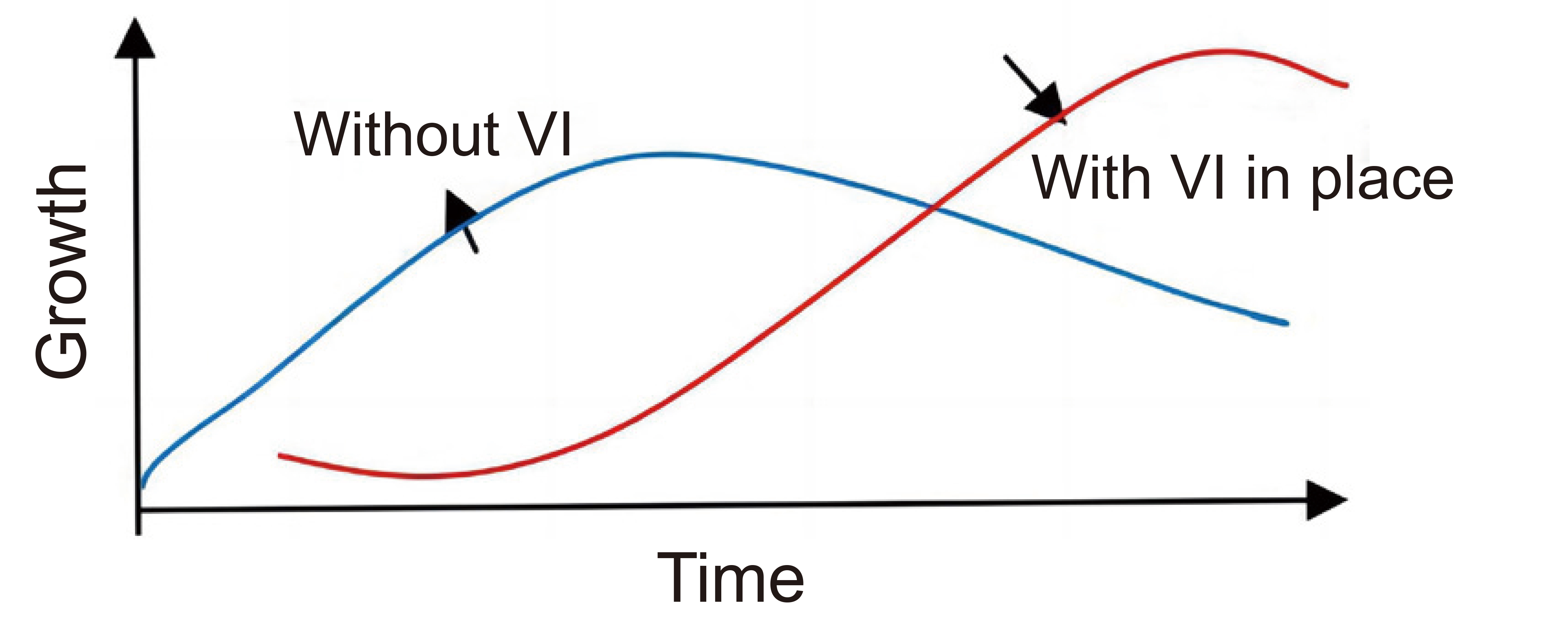

3.4.2.3 Prospects once the VI Policy Is in Practice of E-Banking Services

Once the relevant policymakers and then bank-management in Thailand acknowledge the importance of the proposed VI policy, they may introduce digital banking-provisions or a supplementary provision under Thailand Deposit Insurance System DIS. So that the relevant authority authorizes VI product in e-banking service-market of Thailand. Once policy is in place, it will spread from bankers to customers. This progression (for example, customers are now buying the VI to be on save-side) of the VI product life cycle can be interpreted using “S-curve” as shown in Figure 5. This S-curve of the VI product in Thai-economy will chart the revenue growth-trends against time. In this journey at the early stage, as the new product sets itself up, the revenue-growth trend will be slow. Sometime in the process, based on better understanding, the customers will begin to demand the VI product. In this market, any rebate policy or provision can be further instrumental. As a result, the usages of the VI will increase faster as time passes by. Thess changes to the demand for the VI will allow the growth trend to continue and will make the e-banking services more appealing. The growth trend will slow down near the end-of-life cycle. As time passes, this progression will present a cashless society or people of Thailand. It can place the Thai-economy to be an example to other countries for following Thai’s footsteps.

In this progression, the S-curve will fully replace the traditional banking system, which will continue influencing growth trend upward. Here the VI will have multi-faucets “product life cycle” in Thai-economy.

|

Figure 5. Effects of having VI in e-banking service-market in Thailand.

They are (a) the starting-up phase; (b) the rapidly increasing revenue in e-banking service-market; (c) declining the trends eventually. However, it will not get-off from the bottom. It will contribute significantly by presenting a secure system of bank-led e-banking services. Thus, it is now vital attracting today’s probable customers of e-banking services in Thailand.

Over time, the progression will welcome Thailand to be the first nation in the globe ensuring cashless society. The first curve, i.e., the curve stands for without VI, in Figure 5 represents a growth-trend of the mixture of traditional & e-banking services in Thai-economy. The other curve, i.e., the curve stands for with the VI product, represents the presence of the VI product in service-market. It begins with slow growth trends. But eventually it will overtake and lead growth rate to even at a higher level. In the long-run, this progression in Thai-economy will be an example to other economy country-wise. Based on successful outcome, the other economy country-wise may follow Thailand’s footstep when necessary to efforts for ensuring riskless e-banking services. Eventually the economy country-wise may present a cashless society where the initiative efforts of Thailand’s policymakers will be a part of history.

With these prospects for a service-provider, a customer in the e-banking service-market will recognize it in multi-faucets. However, as of today, the financial sector of Thailand has failed to reach-out major number of customers enhancing e-banking transactions in the Thai-economy[21]. Thus, the situation deserves immediate attention of Thai policymakers for effective policy-design so that the people can enjoy the benefits soon.

3.4.2.4 Efforts for Ensuring Effective Policy-Design Addressing the Dilemmas of Digital Transactions Growth-Trends in Thai-Economy

This section begins with raising a question: Is the Thai leadership ready for guaranteeing risk-free particularly psychological risk-free e-banking services in Thailand?

The answer depends on who is asked to. But it is well recognized that Thailand Government is the unitary government of the Kingdom of Thailand. History suggests that the revolution of the year 1932 ended to absolute monarchy and was replaced with constitutional monarchy in Thailand. Since after the establishment of constitutional monarchy, the country ruled by succession military leaders where the recent one was in May of 2014. In year 2019, Thailand voted for general election. The Thai constitution clearly specifies that the King exercises powers through three branches of the Thai Government even though the sovereignty of state vested in the people of Thailand. These branches are (a) Executive Branch; (b) Legislative Branch; (c) Judiciary Branch.

In this setup, the King has mostly title power and symbol of the Thai nation. Prime Minister is the head of the executive Br of Thailand. So, under Prime Minister’s leadership, the Cabinet oversees formulation & execution of government policies in Thailand.

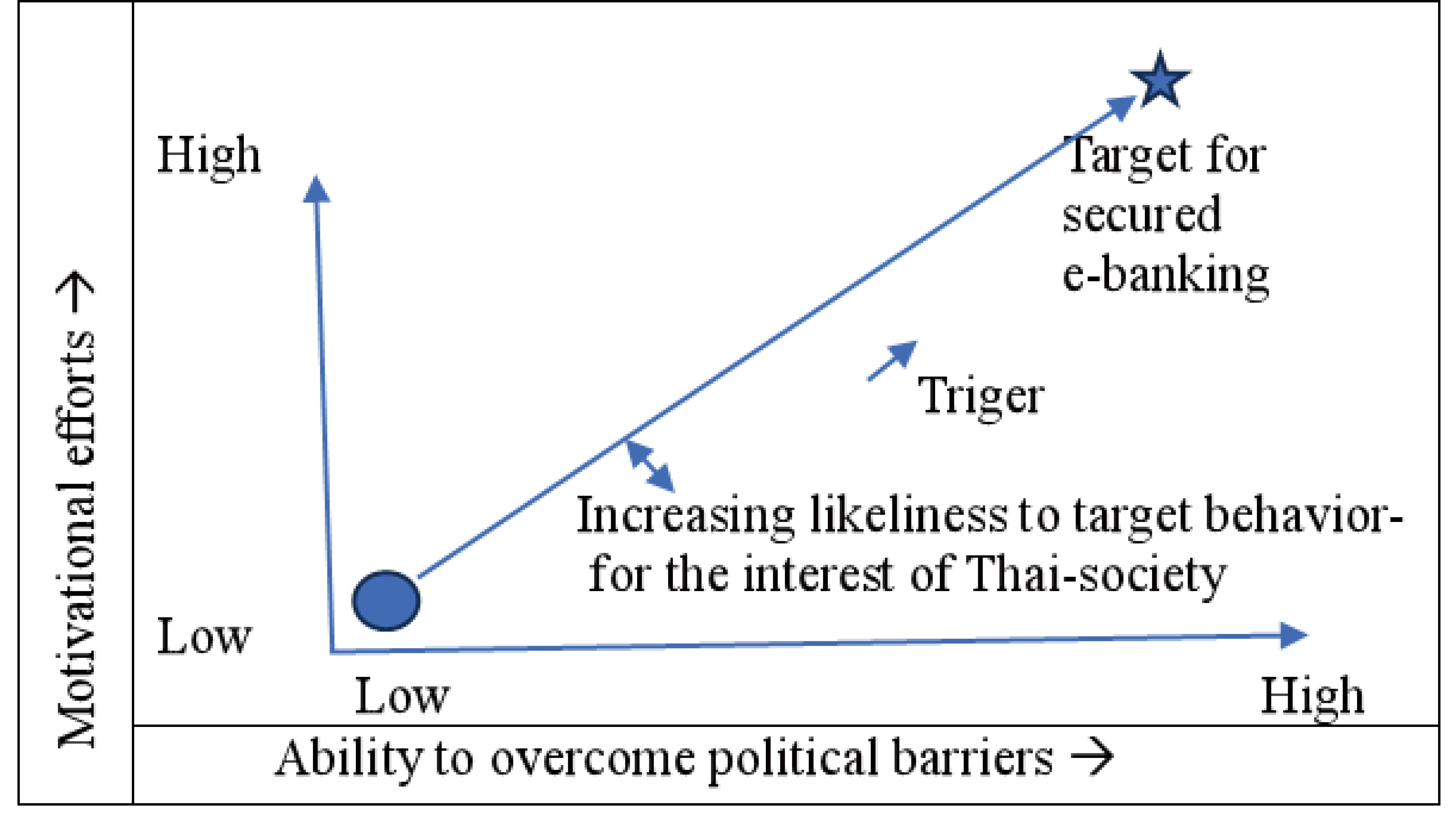

Underpinning Thai Constitutional setup, the current study looks for attention of the Cabinet in Thailand, which raises question: what values of the members of the Cabinet be instrumental for ensuring an effective policy adoption addressing today’s digital-banking dilemmas?

It requires the leadership and Cabinet Members institutional motivation and ability to overcome the political barriers for the greater interest of the Thai-society there. As psychologists mentioned, the leadership and the members of the Cabinet must find motivation within themselves[22] for ensuring a secured e-banking services where their motivations and their ability can be vital for adopting the proposed VI policy in Thai-economy.

Figure 6 clearly ratifies that for reaching to the target of secured e-banking services, the leadership and the members of the Cabinet require higher motivations and higher ability to overcome political barriers, if there is any, in case of adopting the VI policy in Thai-economy. The two, motivation and the ability to overcome the political barriers, must work in parallel for effective outcomes in the process.

|

Figure 6. Motivation, effort, and ability for political maneuver in policy adoption process.

4 CONCLUSION

4.1 Limitations and Directions for Future Research

Since the conclusion is based on theoretical economic analysis using the Consumer Choice and Behavior Theory and Welfare Analysis, the opinions of Thai people can be helpful conducting any empirical studies on how they feel about adopting the VI product in Thai-economy. It can further be helpful to set up the prices of the VI product once it is in practice. Future study on whether the bank itself or any third-party will supply the VI product services in e-banking service-market in Thai-economy can be helpful?

4.2 Conclusion

Adopting the policy for ensuring VI product in bank-led e-banking services in Thai-economy may facilitate the Thai-society to be the first having a cashless economy in the world. By meeting the challenges of customer’s and probable customer’s perceived risk-factors in Thai-economy, the cashless society will appear in practice.

This new and increasing value of the VI product will keep banks growing. Overall, it can ease a booming economy in Thailand. Historical growth-trends of Thailand economy show that legal any new product addition will improve society beyond just instant meeting the needs of its consumers. It can ensure risk-less bank-led e-banking services in Thai financial-sector. The Welfare Analysis here shows that competitive pricing of the insurance can ensure the VI to be attractive to the users and probable users. It also ensures efficiency cost in case of buyers (Contract-H) of the insurance. When the bank decides to be an insurance-provider in e-banking service-market, in adverse-selection cases, the welfare cost of inefficient pricing is small. However, the helpful-selection cases result in the opposite. Once the VI is in practice, it will spread from bankers to customers and its growth trend (S-curve) will capture the growth of revenue against time. At the beginning, since the product itself will be settling, the growth will be slow but eventually e-banking-users will begin to demand it. Thus, growth trend of the VI usages will increase promptly. It will ensure a higher number of e-banking transactions than that is today in Thai-economy.

Therefore, question is: Can Thai policymakers play vital role for ensuring the better-ness of today’s Thai-society in case of securing riskless services of the e-digital-banking there?

The answer to the question posed is “yes” where the motivations, ability and needed efforts of policymakers and bank-management in Thailand can contribute significantly which can ensuring the Thai to be cashless society soon.

4.3 Brief Summary

Acknowledgements

Author acknowledges the inspiration of Dr. Sabera Yasmin, Prof of Pol. Sci., on choosing the Thai-economy for the application of Akim’s Model i.e., the VI product in digital-banking services there.

Conflicts of Interest

The author declared no conflict of interest.

Author Contribution

Rahman AM is the sole author of this paper where the designed analysis, data collection, analysis tools, completion of the analysis etc. are author’s creations for completion of the paper.

Abbreviation List

AC, Average cost

DIS, Deposit insurance system.

EU, Expected utility.

MC, Marginal cost

TC, Total cost

References

[1] BOT. Repositioning Thailand’s Financial Sector for a Sustainable Digital-economy. Bank of Thailand (BOT) Consultation Paper on Financial Landscape. Accessed February 2022. Available at:[Web]

[2] Kiera H. Mobile banking in Thailand. Accessed March 26 2024. Available at:[Web]

[3] Statista Research Department. Share of digital payments users in Thailand in 2023, by age. Accessed April 29 2024. Available at:[Web]

[4] Hall I. Bank of Thailand consults on ‘sustainable digital economy’. Accessed 14 February 2022. Available at:[Web]

[5] Retail Banker International. Thailand to invite digital banking applications soon. Accessed 13 January 2023. Available at:[Web]

[6] Rahman A. Voluntary Insurance for Ensuring Risk-free On-the-Go Banking Services in Market Competition: A Proposal for Bangladesh. J Asian Financ Econ Bus, 2018; 5: 1.[DOI]

[7] Kuisma T, Laukkanen T, Hiltunen M. Mapping reasons for resistance to internet banking use: A means-end approach. Int J Inf Manage, 2007; 27: 75-85.[DOI]

[8] Lee MC. Factors influencing the adoption of internet banking: An integration of TAM. and TPB with perceived risk and perceived benefit. Electron Commer R A, 2009; 8: 130-141.[DOI]

[9] Rahman A. bKash vs. Bank-led Option: Factors influencing customer’s preferences – does it warrant voluntary-insurance-policy for rapid-growth digital-banking in Bangladesh-economy? J Bank Finance Econ, 2020; 1: 51-69.[DOI]

[10] Rahman A. Microeconomics Basics, New Way Learning Microeconomics in the 21st Century era, Print Your Books Academic Publishing Company: Dhaka, Bangladesh, 2019.

[11] Li Bo. The cross-border digital payment systems: Case of Singapore, Thailand, Malaysia, and beyond, opening remarks by DMD Bo Li in peer-learning series on digital technologies and digital money in Asia and the Pacific, Accessed 8 November 2022. Available at:[Web]

[12] Carlos J, Lyman T, McGuire C et al. Deposit Insurance and Digital Financial Inclusion. Accessed October 2016. Available at:[Web]

[13] Camara L. Does deposit insurance increase banking system stability? An empirical investigation. Accessed 2006. Available at:[Web]

[14] Bauer RA, Cox DF. Rational vs emotional communications: a new approach. In: Cox DF (Ed.). Risk Taking & Information Handling in Consumer Behavior. Graduate School of Business Administration, Harvard University: Boston, USA, 1967; 469-486.

[15] Mitchel. Consumer perceived risk: conceptualizations and models. Eur J Marketing, 1999; 33: 163-195.[DOI]

[16] Rothschild M. Stiglitz J. Equilibrium in Competitive Insurance Markets: An Essay on the Economics of Imperfect Information. Q J Econ, 1976; 90: 630-649.[DOI]

[17] Akerlof G. The Market for “Lemons”: The quality uncertainty and market mechanism. Q J Econ, 1970; 84: 488-500.[DOI]

[18] Mankiw NG. Principles of Microeconomics, 8th ed. Harvad University: Boston, USA, 2008.

[19] Cutler D. The preference of heterogeneity and insurance markets: Explaining a puzzle of insurance. Am Econ Rev Pap Proc, 2001; 98: 157-162.[DOI]

[20] De Meza D; Webb DC. Advantageous selection in insurance markets. Rand J Econ, 2001; 32: 249-262.[DOI]

[21] Tuyapala P, Nuangjamong C. Factors affecting customer trust and loyalty in the online shopping: A case study of popular platform in Thailand. Int J Bus Market Manag, 2022; 7: 18-40.

[22] Ryan R, Edward D. Self-Determination Theory: Basic Psychological Needs in Motivation, Development, and Wellness, 1st ed. Guildford Press: New York, USA, 1985.

Copyright © 2024 The Author(s). This open-access article is licensed under a Creative Commons Attribution 4.0 International License (https://creativecommons.org/licenses/by/4.0), which permits unrestricted use, sharing, adaptation, distribution, and reproduction in any medium, provided the original work is properly cited.

Copyright ©

Copyright ©