Exploring Innovation Success Factors and Strategies for B2B Platforms in the Manufacturing Sector in Germany

Bernhard Köelmel1,2,3*, Tanja Brugger1, Ansgar Kuehn1, Max Borsch4, Marcel Rath4, Maximilian Maier4, Moritz Peter1, Katharina Kilian-Yasin1, Viola Galler1

1School of Engineering, Pforzheim University, Pforzheim, Germany

2ISM International School of Management, Paris, France

3McCoy College of Business, Texas State University, San Marcos, USA

4Wirtschaftsförderung Nordschwarzwald (Economic Development Agency Northern Black Forest), Pforzheim, Germany

*Correspondence to: Bernhard Kölmel, PhD, Professor, School of Engineering, Pforzheim University, Tiefenbronner Str. 65, 75175 Pforzheim, Germany; Email: bernhard.koelmel@hs-pforzheim.de

DOI: 10.53964/mem.2024012

Abstract

Objective: Business-to-business (B2B) platforms in the manufacturing sector have a profound impact on the digital transformation of small and medium-sized enterprises (SMEs). However, there is still a lack of research on this topic. The primary objective of this study is to explore the existing landscape of B2B platforms and thoroughly assess the benefits and challenges for companies using them, in order begin to fill the identified research gap. This paper presents a comprehensive investigation of B2B platforms in the German manufacturing sector and their profound influence on the digital transformation of SMEs.

Methods: Within the scope of our in-depth analysis of the current state of B2B platforms, a meticulous review of relevant literature is conducted following the approach of Brocke et al. and a comprehensive analysis of both industry-specific and cross-industry best practices on B2B platforms is performed. In addition, the research includes in-depth interviews with platform providers, partners, and academic experts to enhance the depth of understanding. We identify the factors that contribute to their adoption as well as those that hinder their integration, providing the basis for successful innovation. The viability of the concept is assessed through a comprehensive evaluation methodology involving platform operators.

Results: By providing an in-depth assessment of the benefits and challenges faced by companies using B2B platforms, this work contributes to filling existing research gaps. It identifies factors that contribute to their adoption and those that hinder their integration, thus laying the foundation for successful innovation. Finally, it proposes forward-looking guidelines that will enable SMEs to capitalize on the transformative capabilities of these platforms in the future.

Conclusion: The findings of this study show that SMEs can reap numerous benefits from B2B platforms, such as increades efficiency, optimal use of resources, and access to previously untapped markets. However, certain barriers, including the high costs associated with implementation and a prevailing lack of trust among platform users, serve as obstacles to their widespread adoption. The results of this research provide important insights into the current state of B2B platforms and their potential to drive digital transformation. This research advances academic understanding in this area, and provides valuable knowledge for companies seeking to navigate the landscape of B2B platforms and their role in driving digital transformation as a foundation for innovation.

Keywords: platform economy, B2B, innovation success factors, guidelines, transformative capabilities, manufacturing sector

1 INTRODUCTION

The platform economy has emerged as a dominant force in the global business landscape, revolutionizing traditional industries and reshaping the way economic activities are conducted[1]. With the rapid advancement of digital technologies[2], platforms[3] have become instrumental in connecting buyers and sellers, facilitating transactions, and creating value through network effects. The rise of global platforms[4] has led to a paradigm shift in the economy[5], where intangible assets such as data, algorithms, and networks have immense value. Platforms act as intermediaries[6], enabling the exchange of goods, services, and information among diverse participants. They leverage digital infrastructure to foster connections, streamline processes, and unlock new business opportunities. These platforms transcend geographic boundaries, enabling global reach and scale previously unimaginable. As a result, they have become key drivers of economic growth, job creation, and innovation in today’s interconnected world[7].

The economic importance of global platforms[8] is evidenced by the staggering valuations and market capitalizations of platform-based companies. The world’s most valuable companies, such as Apple, Microsoft, Amazon, and Alphabet (Google’s parent company), are all prominent platform providers[9]. These companies have achieved unprecedented growth and market dominance[10] by leveraging their platforms to capture and monetize vast user bases, data, and ecosystem dynamics[9].

However, it is crucial to critically analyze the implications and challenges associated with the rise of global platforms[11]. While platforms offer many benefits, they also raise concerns about market concentration, data privacy, labor rights, and competition[6]. The dominance of a few platform giants can limit market access for smaller players and stifle innovation[1]. In addition, the accumulation and utilization of user data by platforms has raised questions about privacy and the potential for abuse. Policymakers and regulators face the challenge of striking a balance between fostering innovation and ensuring fair competition and consumer protection in the platform economy[12].

The scientific importance of the topic and its relevance for the success of innovation lies in the fundamental change taking place in the business landscape, where existing and traditional business models are gradually being replaced or threatened by digital platforms[3]. This transformation is particularly evident in the business-to-business (B2B) sector, where the emergence of new business models brings forth new potential competitors and significant changes[13]. As a result, established companies, especially small and medium-sized enterprises (SMEs), are compelled to digitally transform and evolve their existing business models to create additional or new competitive advantages[14].

This topic in an important issue for Germany, as failure to address these developments could lead to a potential loss of prosperity. Of particular importance is the manufacturing industry, which accounts for a significant portion of the country’s gross domestic product and serves as a cornerstone of the German economy. However, despite the potential to lead the way in this area, there is currently a lack of sufficiently detailed solutions or success factors for the sustainable establishment of SMEs within the platform economy[15]. This is particularly noteworthy given the absence of a dominant platform provider in the current landscape[16].

The scientific objective is to conduct an in-depth analysis of digital B2B platforms and to elucidate the potentials and success factors that can help SMEs to effectively utilize these platforms[17]. To achieve this, an appropriate scientific approach will be developed, accompanied by appropriate tools and methods to support companies in their transition to the platform economy. This research endeavor aims to address the identified research gap and contribute to the understanding and practical implementation of digital B2B platforms for SMEs to enhance their competitiveness in the evolving business landscape[18].

The hypotheses and research questions of the paper are as follows:

Hypothesis: B2B platforms have a significant impact on traditional industries such as manufacturing and represent new opportunities.

Research question 1: How do B2B platforms influence traditional industries such as manufacturing and what are their potentials?

Research question 2: Which factors and strategies are crucial for a successful platform establishment or entry in the B2B sector of the manufacturing industry?

To accomplish this, this paper presents the identified research gap and the rigorous research approach of this study in Section 2. To this end, this section addresses the intensive literature review that was conducted, the two central research questions that were subsequently formulated, and the further methodological approach based on expert interviews. The results of the literature review are summarized separately in Subsection 2.3. The following subsection deals with the state of the art regarding the platform economy, its definition, forms, types, characteristics and roles. The success factors of digital platforms, the different methods for the development of B2B platforms and the analysis of established B2B platforms according to a best practice analysis are examined here. Subsection 2.5 of this paper then focuses on the empirical research findings based on qualitative interviews, including the chosen approach, the revealing results and the conclusions drawn from them. In Section 4, the resulting guidance framework for SMEs is elaborated, showing them the possible concrete steps towards future approaches and distinguishing between the two options of using an existing platform or building a platform themselves. In that section, the validation of the research results is documented as well. The final section summarizes the results of the study and discusses possible future research options to further close the existing research gap, which can have a significant impact on German and global SMEs.

2 METHODS AND MATERIALS

2.1 Research Gap and Rigorous Research Approach

The research areas under investigation include the theoretical foundations of platforms, focusing on the types, roles, and success factors of platforms. Specifically, the study focuses on (transactional) platforms in the B2B sector. Another area of interest is the analysis of established B2B platforms in different industries[19]. By identifying innovation success factors and strategies for platform establishment and participation, the study aims to reveal new opportunities for SMEs. The aim of this scientific approach is to present the current state of research on B2B platforms in the industrial sector. Furthermore, significant success factors for B2B platforms will be identified. By systematically identifying and analyzing the success factors for B2B platforms in the industrial sector, the research aims to use design science methods to generate practical and industry-relevant insights, culminating in a comprehensive guideline for manufacturing companies.

2.2 Initial Literature Analysis on B2B Platforms

In the first step, an intensive literature analysis of more than 100 topic-specific sources was carried out and evaluated according to the methodology of the authors J. vom Brocke, A. Simons, B. Niehaves, K. Riemer, R. Plattfaut and A. Cleven, as described in “Reconstructing the Giant: On the Importance of Rigor in Documenting the Literature Search Process”[20]. Their literature analysis involves a rigorous and systematic approach. The authors emphasize the importance of thoroughly documenting the literature search process. They discuss the importance of clearly defining search terms, databases used, inclusion and exclusion criteria, and the process of screening and selecting relevant literature. In addition, they address methods for synthesizing and analyzing the collected literature to ensure a comprehensive and well-documented review. This approach aims to increase the transparency and reproducibility of the literature analysis, contributing to its overall rigor and reliability.

Following this comprehensive literature analysis based on the Brocke et al. approach, it becomes evident that there are currently no dominant platform providers in the B2B platform space, resulting in a lack of information on the success factors and strategies employed by companies.

As a result, this area represents unexplored territory and a research gap in the present study. The following research questions aim to address this research gap. The first research question examines the impact and potential of B2B platforms on traditional industries such as manufacturing[21]. Therefore, the research question is as follows:

How are B2B platforms influencing traditional industries such as manufacturing, and what potential do they offer?

Given the importance of the manufacturing sector for the German economy[22], these companies are compelled to deal with the platform trend. The second central research question is therefore formulated as follows:

What factors and strategies are crucial for successful platform establishment or entry in the B2B sector of the manufacturing industry?

To determine the current state of research, identify relevant issues, and formulate new research questions, a thorough literature review is conducted, see Table 1.

Table 1. Overview of the rigorous literature search based on German and English synonyms, related terms and generic terms

|

Language |

Block1 |

Frequency |

Block2 |

Frequency |

Block3 |

Frequency |

Synonyms (narrow keywords) |

German |

B2B Plattform |

13,000 |

Maschinen- and Anlagenbau |

19,800 |

Klein- und Mittelständische Unternehmen |

25,700 |

English |

b2b-platforms |

77,600 |

mechanical and plant engineering |

3,200,000 |

Small and medium enterprises |

2,520,000 |

|

Related terms (narrow keywords) |

German |

Digitale Plattform Ökosysteme Plattform |

64,100 33,500 340,000 |

Industrieanlagenbau Maschinenwesen |

2,010 33,800 |

KMU Mittelstand Kleinunternehmen Klein- and Mittelbetriebe |

284,000 103,000 13,300 20,300 |

English |

Digital platforms Ecosystems Platform |

4,460,000 3,970,000 5,450,000 |

Industrial plant engineering Mechanical engineering |

3,690,000 4,820,000 |

SME Medium-sized business Small business Small und medium enterprises |

1,420,000 2,330,000 4,390,000 2,520,000 |

|

Generic terms (further keywords) |

German |

Plattform Plattformökonomie Digitaler Marktplatz |

340,000 2,390 12,100 |

Architektur Bauen Technik Maschinenbau |

816000 816,000 2,160,000 122,000 |

Unternehmen |

2,060,000 |

English |

Platforms Platform economy Digital marketplace |

5,450,000 3,000,000 419,000 |

Architecture Building Technology Mechanical Engineering |

5970000 6,460,000 8,190,000 4,820,000 |

Company Enterprises |

5,340,000 4,470,000 |

|

Database |

Springerlink |

1,127 |

|

62 |

|

1,727 |

|

sciencedirect |

8 |

|

2 |

|

101 |

|

|

Google scholar |

2,620 |

|

2,640 |

|

8,330 |

|

|

Google Scholar |

Plattformen and KMU and Maschinenbau and Strategie |

4,660 |

|||||

Springer Link |

Plattform or Plattformökonomie and Maschinenbau or Mechanical engineering and KMU or SME |

10,365 |

|||||

Sciencedirect |

Platforms and small and medium enterprises and mechanical engineering or mechanical and plant engineering |

3,640 |

|||||

Various databases such as Google Scholar, ScienceDirect, and SpringerLink will be searched and analyzed using the methodology proposed by Broke et al[20]. Considering the novelty of the topic and the challenge to quantitatively capture current developments, a qualitative research approach is preferred. Within the framework of this study, expert interviews will be conducted with experts in the field of the platform economy in order to gain a better understanding of the topic and to gain insights into successful developments.

The expert interviews conducted will be analyzed using scientific methods and the key findings will be summarized. These findings, combined with the results of the literature review, will inform the conceptualization. Thus, this research combines aspects of empirical research and literature review. In a further step, the concept will be validated with industry partners. The aim of this validation is to identify weaknesses and to explore potential areas for optimization in order to confirm the applicability of the concept under practical conditions. Ultimately, the scientific approach aims to provide guidance to SMEs in the manufacturing industry, thus facilitating decision-making processes[23].

2.3 Qualitative Literature Review on B2B Platforms

A qualitative literature review was conducted to determine the current state of research, relevant problems, and to formulate new research questions. Various databases such as Google Scholar, ScienceDirect and SpringerLink were searched and evaluated according to the method of Broke et al[20]. Due to the novelty of the topic and the difficulty to quantify developments, a qualitative research approach was preferred. As part of this study, 14 expert interviews were conducted with platform economy experts to gain a better understanding of the topic and to shed light on successful developments.

The literature review presents a comprehensive landscape analysis of platform economies, drawing insights from a critical review of 100 research papers. The analysis identifies three core dimensions that illuminate this dynamic field, see Table 2 below:

Table 2. Overview of relevant citations according to the literature reviewed

Dimension |

Sub-dimension |

Sub-sub-dimenison |

Frequency in literature |

Basics |

Basics Platforms |

Definition |

35 |

Origin |

18 |

||

Prerequisites |

1 |

||

Advantages and disadvantages |

2 |

||

Structure of a platform |

14 |

||

Characteristics of a platform |

13 |

||

EU regulation |

2 |

||

Network effects |

11 |

||

Platforms |

B2B platform |

Definition |

11 |

Industry-related B2B platforms |

10 |

||

Characteristics/features |

3 |

||

B2B platforms outside the industry |

6 |

||

Potentials & challenges |

16 |

||

Success factors |

8 |

||

Established models |

2 |

||

B2C platform |

Definition |

4 |

|

Characteristics/features |

3 |

||

Best Practices |

2 |

||

Platform economy |

Digital marketplace |

4 |

|

Business model & innovation |

8 |

||

Networking |

0 |

||

Industrial sector: Mechanical and machine engineering |

SMES |

8 |

|

Status quo in SMEs |

5 |

||

Guidelines for companies |

Established models |

3 |

|

Success factors and obstacles |

2 |

||

Deployment strategy |

5 |

||

Entry into a platform |

3 |

||

Building a platform |

2 |

||

(1) Foundations of platform economies (35 citations): This dimension explores the basic concepts of platform economies. It examines the widely accepted definition of platforms (35 citations) along with their historical emergence (18 citations). It also examines the conditions for successful platform development (1 citation), along with their inherent advantages and limitations (2 citations). It also examines the structural characteristics of platforms (14 citations) and the evolving regulatory landscape surrounding them, particularly within the European Union (2 citations).

(2) B2B platforms (48 citations): This section focuses on industry-specific B2B platforms, analyzing their defining characteristics (11 citations) and functionalities (3 citations). It delves deeper into platforms that operate beyond a specific industry domain (6 citations). It also examines the potential benefits and challenges associated with B2B platforms (16 citations), as well as the critical success factors (8 citations) and established business models (2 citations) that underpin their effectiveness.

(3) B2C platforms (9 citations): This dimension explores the core characteristics (3 citations) and functionalities (3 citations) of B2C platforms, highlighting best practices for their development and implementation (2 citations).

In addition, the review examines the application of platform economics within the machinery and equipment industry, specifically targeting SMEs (24 citations). It examines the current state of SMEs in this context (5 citations), established platform models suitable for them (3 citations), and the success factors and potential barriers they may encounter (2 citations). In addition, the review examines deployment strategies (5 citations), platform entry considerations for SMEs (3 citations), and platform development processes for companies in this sector (2 citations).

This comprehensive analysis, based on an extensive body of research (100 papers), provides valuable insights into the current state of knowledge on platform economies. The focus on B2B platforms and SMEs in the machinery and equipment industry provides a unique perspective on this evolving field. The findings of this review can inform future research directions and contribute to the development of robust platform business models, particularly within the B2B and SME landscape.

2.4 State of the Art

The definition of digital platforms lacks consensus in the academic literature, leading to different interpretations of their business model. Platforms provide an open infrastructure and establish rules for exchange[24]. They are often associated with two-sided markets that bring together several independent market sides, while one-sided markets involve traditional business models with direct sales to end customers. Examples of two-sided platforms include Airbnb and Uber[10], which connect accommodations with travelers and facilitate ridesharing, respectively. This highlights the role of digital platforms in integrating different customer segments or markets[25]. The distinction between one-sided and two-sided platforms can be described by network effects that affect customer value based on changes in the number of users. Direct network effects depend on the existing user base, while indirect network effects result from changes in the value of goods or services. The success of digital platforms depends on characteristics such as scalability, global reach, reduced transaction costs, network effects, data-driven insights, and high market dynamics[26]. In addition, there are different types of platforms, including transaction platforms, innovation platforms, integrated platforms, and investment platforms, each of which performs specific functions within the platform ecosystem[27]. Key roles within platforms include the platform infrastructure and its participants, as well as external stakeholders that influence the platform’s operations[28]. Understanding the types, characteristics, and roles of digital platforms is critical to understanding their functioning and success[21].

2.4.1 Success Factors of Digital Platforms

Achieving success in the platform business requires careful consideration of the key factors that underpin platform effectiveness[29]. A thriving platform must facilitate critical interactions that become indispensable and highly valued by all participants. This entails leveraging a combination of influential factors, including the pull effect, which involves offering a compelling value proposition to attract and retain users and providers. Moreover, ensuring the seamless execution of simple and easy-to-use interactions is essential to create positive user experiences. Furthermore, effective matching between users and providers is crucial to foster fruitful exchanges and improve the overall platform experience[30].

To ensure equal attractiveness for both providers and customers, the platform should provide them with tailored tools and frameworks that enable smooth communication and promote value creation. Establishing collaborative partnerships and leveraging data insights are critical to fostering mutually beneficial business relationships. By leveraging the platform’s extensive network and data analytics capabilities, companies can uncover unmet customer needs and deliver personalized experiences[31].

In addition, achieving critical mass is critical to the success of the platform, as it triggers positive network effects and attracts more users, thereby solidifying the platform’s position. Implementing appropriate pricing strategies, especially in the early stages, can help stimulate user adoption and overcome the classic chicken-and-egg problem often faced by new platforms. Successful matching, driven by the quality and relevance of the connections made, is critical to enabling meaningful interactions and maximizing user satisfaction[32].

Considering factors such as scalability, openness to additional providers, and (in) dependence from manufacturers also contribute to the success of a digital platform. Scalability ensures that the platform can meet increasing user demand and adapt to changing market dynamics. Embracing openness by allowing new providers and even competitors to join the platform ecosystem promotes innovation, diversity, and a wider range of offerings, thereby enhancing the overall value proposition. Moreover, balancing the platform’s dependence on manufacturers is essential to strike a delicate balance between access to manufacturers’ expertise and proprietary data while mitigating potential risks associated with information asymmetry and competitive disadvantage[33]. In addition, customers’ ethical perceptions of privacy, security, shared value, reliability and service recovery are relevant success factors for digital platforms.

By addressing these multifaceted factors, companies can improve their prospects of thriving in the dynamic platform economy, drive sustainable user engagement, and cultivate a robust ecosystem of active participants[34].

2.4.2 Methods for B2B Platform Development

Manufacturing companies are faced with the central question of what options are available in the platform economy. Simply moving existing business activities to a digital platform does not hold much promise. Developing a strategy to enter the platform economy is also associated with significant challenges for manufacturing companies. The proven disruptive potential of digital platforms allows platform operators to gain significant competitive advantages. Therefore, two fundamental approaches can be defined: building your own platform and joining an existing platform. If the assessment is positive, potential deployment options such as building a platform or joining an existing platform should be considered. Due to market volatility and constantly changing conditions, companies should consider assessing their suitability for digital platforms.

Characteristically, the methodologies for entering the platform economy do not determine the extent to which a platform should be built or pursued, or similar aspects, at the time the methodologies are applied. These methods are generally outcome neutral and provide a first orientation. For practical reasons, not all methods can be discussed in this paper.

Criteria-based development of multi-sided business models by Täuscher et al[35]. Täuscher, Hilbig, and Abdelkafi propose a framework with five dimensions for creating multi-sided business models. These dimensions include value proposition, value communication, value creation, value delivery, and value capture. Value proposition focuses on the overall benefit the operator provides to customers, while value communication emphasizes reaching a critical mass of users. Value creation includes activities, pricing mechanisms, confidence building measures and resource allocation. Value delivery addresses customer segmentation, distribution channels, and implementation timing. Finally, value capture involves identifying revenue streams and selecting primary partners.

Development and evaluation of platform concepts by Wortmann et al[25]. The concept developed by Wortmann et al. for the development and evaluation of platform concepts consists of four phases. It starts with an analysis of the existing ecosystem, mapping the value creation system and identifying the main problems and benefits for the actors involved. In the next phase, ideas for platform services are generated based on the identified platforms and the needs of the actors. These services are then evaluated for attractiveness and potential synergies, leading to the structuring of service bundles. In the final phase, promising platform concepts are developed by combining successful service bundles, and their attractiveness and accessibility is assessed in a workshop. This approach provides a systematic framework for companies to navigate the complexities of digital platforms within their specific ecosystems.

Platform Canvas by Choudary[33]. Choudary presents an approach to building a digital platform using a canvas framework that focuses on developing key interactions within the platform. The result is a comprehensive platform business design. The model consists of four phases, namely the analysis of key interactions, the establishment of necessary conditions, the facilitation of high-quality interactions, and the determination of value for the platform provider and monetization mechanisms. In the analysis phase, the value exchanged between providers and consumers is defined, along with their respective roles and exchange modalities. The second phase involves defining the necessary conditions and access control measures to ensure the selection of producers based on defined quality criteria. The third phase aims at facilitating high quality key interactions and outcomes by building the platform infrastructure. Finally, the fourth phase focuses on defining the added value for the platform provider and the monetization mechanism.

Platform Design Toolkit by Cicero[36]. The Platform Design Toolkit developed by Cicero consists of seven tools that enable the development and design of multi-sided platforms. These tools are organized in the Platform Design Canvas. In the first phase of the toolkit, the platform potential is analyzed by describing the existing ecosystem and identifying opportunities for a value-creating digital platform. This is followed by describing the roles within the ecosystem and analyzing and prioritizing existing and foreseeable interactions. The output of this phase provides initial insights for platform improvement. The second phase focuses on designing a platform strategy by selecting interactions that can be optimized through a platform, especially those with high transaction costs. Access and offerings within the platform are defined, resulting in a digital platform concept presented in the Platform Design Canvas. In the third phase, the formulated hypotheses are evaluated. A functional minimum viable platform is developed to validate the assumptions, followed by a survey to assess the attractiveness of the concept among potential platform users. Based on the validation results, adjustments are made to the concept and the second phase may be restarted. This process ultimately results in a well-founded concept for a promising digital platform. The final phase involves implementing the platform strategy and launching the platform.

Platform Innovation Kit by Walter and Lohse[37]. The Platform Innovation Kit developed by Walter and Lohse consists of a comprehensive manual that enables the development of a complete concept for a digital platform. The toolkit is based on the Platform Business Model Canvas published in 2015 and follows a five-phase process. In the first phase, the current situation is analyzed to identify the opportunities and risks for a digital platform, the key industry players are explored, and potential future players are considered. The second phase focuses on idea generation, where different ideas for platform solutions, value propositions and potential actors are identified. The third phase involves finalizing the value proposition, defining the platform offering, and identifying and modeling additional actors in the ecosystem. The fourth phase focuses on the design of the platform service offering, including access conditions, channels, operating rules, and the necessary IT infrastructure. The final phase addresses the revenue structure, defining the revenue streams derived from the platform, the associated costs of delivering the service, and calculating the business model based on these factors. The Platform Business Model Canvas summarizes the results of this process.

2.4.3 Analysis of Established B2B Platforms: Insights from the Best Practice Analysis

In order to derive recommendations for SMEs, a comprehensive analysis of both industry-specific and cross-industry best practices on B2B platforms was conducted. The focus of the analysis is on transactional platforms, as they hold significant potential for SMEs in the manufacturing sector. Several German examples were identified, including platforms such as PROTIQ, 3YOURMIND, Instawerk, Partfactory, Metals Hub GmbH, Plethora, Laserhub, Xometry, Kreatize, Blexon, Orderfox, Spanflug, Facturee, CADDI, GrabCAD and My proto. In addition, platforms from unrelated industries such as Bevazar, CheMondis, Schüttflix, Coats eComm, MIH Open, AirSupply, and Cargo.one were identified. The analysis highlights key findings, including the importance of increasing network effects, leveraging industry expertise and networks, incentivizing data submission, establishing trust and credibility, optimizing matching algorithms, and offering value-added services. These insights provide a comprehensive overview of the current state of the art in B2B platforms, facilitating the improvement of procurement processes and the realization of the benefits of online manufacturing.

2.5 Approach and Methodology for Qualitative Interviews

In order to gain concrete and up-to-date insights into the platform economy, a qualitative research approach is used, in which 14 expert interviews are conducted to address the research question.

A purposive sampling approach was used to select interviewees for this study, specifically targeting experts with in-depth knowledge of digitization and the platform economy. This involved identifying individuals who met the following criteria.

Domain expertise: Interviewees had demonstrable expertise in either digitization or the platform economy. This could be demonstrated through publications, research projects, work experience, or leadership roles in relevant organizations.

Industry Perspective: We sought a diverse range of perspectives by including representatives from different industry segments. This included prominent figures from industry associations and craft businesses, capturing the experiences of traditional players adapting to the digital landscape.

Academic perspective: Professors from universities of applied sciences were included to incorporate theoretical knowledge and insights into the latest trends in digitization and platform development.

Practical experience: The inclusion of B2B platform operators and partners provided invaluable insights from a practitioner’s perspective. These individuals directly manage and use platform technology, providing a first-hand understanding of its strengths, challenges, and impact on various stakeholders.

Using these criteria, the selection process yielded a rich pool of interviewees with diverse backgrounds and expertise, ensuring a comprehensive understanding of the research topic. To facilitate the interviews, Microsoft Teams was used and a pilot interview, or pre-test, was conducted with an academic, an established digitization expert with extensive expertise. The purpose of the pretest was to identify weaknesses and potential areas for improvement, and it was conducted satisfactorily, allowing the actual survey to begin.

To ensure a progressive survey and to address potential shortcomings, the interview guide was iteratively refined throughout the interview process. Insights gained from earlier interviews influenced the wording and depth of subsequent questions. For example, initial responses highlighting a general “lack of strategy” among SMEs might have prompted the development of follow-up questions targeting specific aspects of platform strategy formulation. This iterative approach aimed to capture a nuanced understanding of the challenges faced by SMEs in the platform economy.

All interviewees provided written consent for the collection and processing of their personal data discussed during the interviews. To facilitate later analysis and to document key findings, the entire interview process was recorded, transcribed, and subsequently analyzed.

3 RESULTS

3.1 Results of Qualitative Interviews

The following section presents the results of the expert interviews. It begins with the findings from the introductory question, followed by an exploration of the potential and challenges for SMEs in the platform economy, as well as the key success factors for a B2B platform. In addition, the barriers to entering the platform economy and recommendations for aspiring entrepreneurs are examined.

A total of 14 people were interviewed. These included eight platform operators, two platform partners (contract manufacturers), one professor, and two respondents from the “other” perspective, representing consulting services. The majority of respondents (78%) recognized the importance of digital transformation early on and adapted or expanded their business models accordingly. Eleven of the 14 respondents fall into the second phase of McKinsey’s 3 Horizons model[38], having developed a new business model. Two participants fall into Horizon 1, where initial digitization projects are initiated and automated due to limited resources and a focus on customer satisfaction. However, they plan to move to Horizon 2 in the near future. The McKinsey 3 Horizons model we used is a framework that helps organizations manage their innovation and growth strategies across three time horizons: 1. Horizon 1 focuses on optimizing and defending the core business, with the goal of maintaining and improving the current business model. 2. Horizon 2 explores and validates new business opportunities and growth areas, creating options for future growth and developing the necessary capabilities. 3. Horizon 3 identifies and invests in the seeds of future growth, focusing on disruptive innovations and breakthrough ideas that could create entirely new markets and industries. By balancing investments and resources across the three horizons, organizations can ensure a steady flow of innovation and growth while maintaining their core business and managing short-term pressures.

The following list elaborates on the key findings of the expert interviews and provides additional context.

The majority of respondents (11 out of 14) rated the potential for SMEs in the platform economy as very high.

The majority of respondents (13 out of 14) believe that SMEs should not build their own platform, but rather join an existing platform as a partner/participant.

The challenges identified for SMEs were:

(1) Lack of awareness of the platform economy and new business models.

(2) Lack of strategy for entering the platform economy.

(3) Inertia of German industry to adopt new trends.

(4) Fear of failure.

(5) Lack of skilled workers.

The success factors identified for B2B platforms were:

(1) A strong team with industry expertise, market knowledge, network, know-how, communication skills and patience.

(2) An effective sales strategy with a focus on marketing, branding and search engine optimization (SEO).

(3) A clear strategy that addresses the chicken-and-egg problem, critical mass, market entry, customer needs and value creation.

(4) A well-designed platform architecture with minimum viable product (MVP), system integration, low barriers to entry, matching algorithm, single point of contact, simplicity and transparency.

(5) A focus on scalability and business model development.

3.1.1 Opportunities and Challenges for SMEs in the Platform Economy

The potential for SMEs in the platform economy, particularly in B2B transaction platforms, is perceived to be very high. While three respondents rated it four on a scale of one to five, indicating that platforms are not a one-size-fits-all solution and should be tailored to the objectives of each SME, the majority (eleven respondents) rated the potential as very high, marking the highest value on the scale. However, they emphasized that SMEs have a better chance of developing successfully as platform partners than by launching their own platforms. Limited financial resources, lack of access to systems/tools, and high operational costs are barriers for SMEs considering setting up their own platforms. In addition, concerns about the credibility and trustworthiness of fledgling platforms can deter B2B customers from using them.

Disruptions in global supply chains and fluctuations in demand across industries have led to supply and demand imbalances and eroded trust in established supply chains. As a result, new ecosystems and marketplaces are emerging that offer new opportunities for manufacturers. By joining existing platforms, SMEs can access new markets and serve customers not only regionally, but also nationally and internationally. Platforms also facilitate customer acquisition through existing networks and infrastructure. Maintaining an online profile on a platform increases visibility within the platform and on other search engines such as Google.

One of the challenges identified is the lack of awareness among SMEs about the platform economy and new business models. Many companies lack a clear strategy for entering the platform economy, overcoming the chicken-and-egg problem, achieving critical mass and scaling. This lack of awareness leads to skepticism and negative attitudes towards digital trends, often driven by concerns about job security. SMEs must recognize the need for change, which is often overlooked when traditional business operations are running smoothly.

3.1.2 Success Factors for B2B Platforms

Success factors for platform businesses were grouped into six categories: Team, Trust and Customer Retention, Platform Distribution, Clear Strategy, Platform Architecture, and Business Development.

Team: The team’s expertise, industry knowledge, and existing networks were highly valued. Most platform operators had previous experience in the industry and held leadership positions, which enabled them to build networks. A strong network helps to overcome the chicken-and-egg problem. A transparent communication strategy is critical to success, ensuring that team members understand how the new business model contributes to the company’s success.

Trust and Customer Retention: Building trust between platform operators and users is critical to establishing long-term customer relationships. Companies are more likely to engage with a platform if they trust that the technology behind it is reliable and stable. Trust can be fostered through platform governance mechanisms, such as data security measures and non-disclosure agreements. In addition, access and control mechanisms play a role in building trust, including terms of service, rating mechanisms, and quality ratings for producers and manufacturers.

Platform Distribution: Marketing, branding and SEO were identified as key factors for successful platform distribution. Adequate resources should be allocated to marketing and branding, including activities such as customer mailings, advertising campaigns, trade show appearances, press releases, social media, and word-of-mouth marketing. SEO is essential to increase website visibility in search engines.

Clear Strategy: Overcoming the chicken-and-egg problem and achieving critical mass are critical to platform success. A clear go-to-market strategy that takes into account customer needs is essential to deliver added value through the platform and leverage network effects.

Platform Architecture: Developing a MVP was identified as a key success factor. Create the essential functionalities as a prototype, enter the market, and receive feedback from customers enable continuous platform development. Seamless system integration with external IT systems and minimizing entry barriers for customers or producers are additional considerations. Personal interaction and direct communication channels for customers remain important.

Business Development: Developing the business model and exploring new business areas were seen as key success factors. Identifying and nurturing new trends or markets in a timely manner is essential for business growth and platform scalability. The following Table 3 summarizes the resutls of the interviews.

Table 3. Main Findings from the Expert Interviews

Factors |

Key Points |

Team |

Expertise, industry knowledge, and existing networks of the team are critical Previous industry experience of platform operators makes it easier to overcome the chicken-and-egg problem and establish partnerships |

Trust and Customer Retention |

Building trust between platform operators and users is essential for long-term customer relationships Trust is built through reliable and stable technology, participation of key market players or reference customers, and platform governance mechanisms |

Platform Marketing |

Marketing efforts, branding, and SEO are important to attract and retain customers Reputation of the platform leads to proactive engagement of producers and manufacturers |

Clear Strategy |

Overcoming the chicken-and-egg problem and achieving critical mass requires a clear strategy Understanding customer needs and adding value through the platform are critical to success |

Platform Architecture |

MVP development approach Seamless system integration and low barriers to entry Efficient matching algorithms and personal interaction with customers Simplicity of design and user interface |

Business Development |

Early identification of new trends or markets Continuous business model development for growth and scalability |

3.1.3 Conclusions of Expert Interviews

In summary, the expert interviews conducted to explore the platform economy provided valuable insights into the opportunities, challenges, and success factors for SMEs, as shown in Table 4. The majority of the stakeholders interviewed recognized the importance of digital transformation early on, with many of them already operating in the second phase of McKinsey’s 3 Horizons model[38], where they have developed new and innovative business models. The platform economy is a promising avenue for SMEs, particularly in the B2B sector, offering significant potential for growth and market expansion. However, building an individual platform is a complex and resource-intensive endeavor, and SMEs are better off partnering with existing platforms to benefit from established networks and trust. Trust and customer loyalty are emerging as critical success factors, with transparent platform governance mechanisms and reliable technology fostering long-term relationships between platform operators and users. In addition, effective marketing, branding, and SEO play a critical role in successful platform adoption. Clear strategies for overcoming the chicken-and-egg problem and achieving critical mass are key to realizing network effects and driving platform success. Platform architecture should focus on the development of a MVP, seamless system integration, and low barriers to entry for users. Business development, coupled with early identification of new trends and markets, lays the foundation for sustainable growth and platform scalability.

Table 4. Summary of the Expert Interviews

Topic |

Findings |

Potential for SMEs in the platform economy |

High, but SMEs should not build their own platform but rather join an existing platform as a partner/participant |

Challenges for SMEs |

Lack of awareness, lack of strategy, inertia of German industry, fear of failure, lack of skilled workers |

Success factors of B2B platforms |

Team: Industry expertise, market knowledge, network, know-how, communication, patience |

Conclusion |

The platform economy offers great potential for SMEs, but building your own platform is not recommended. SMEs should focus on digital transformation and innovation and use platforms as partners/participants |

While challenges such as the lack of awareness of the platform economy and reluctance to embrace digital trends persist, SMEs must embrace the transformative potential of platforms to remain competitive in the rapidly evolving business landscape. Overall, joining existing platforms presents a compelling opportunity for SMEs to leverage digital ecosystems, expand their market reach, and innovate within established networks, enabling them to thrive in the dynamic realm of the platform economy.

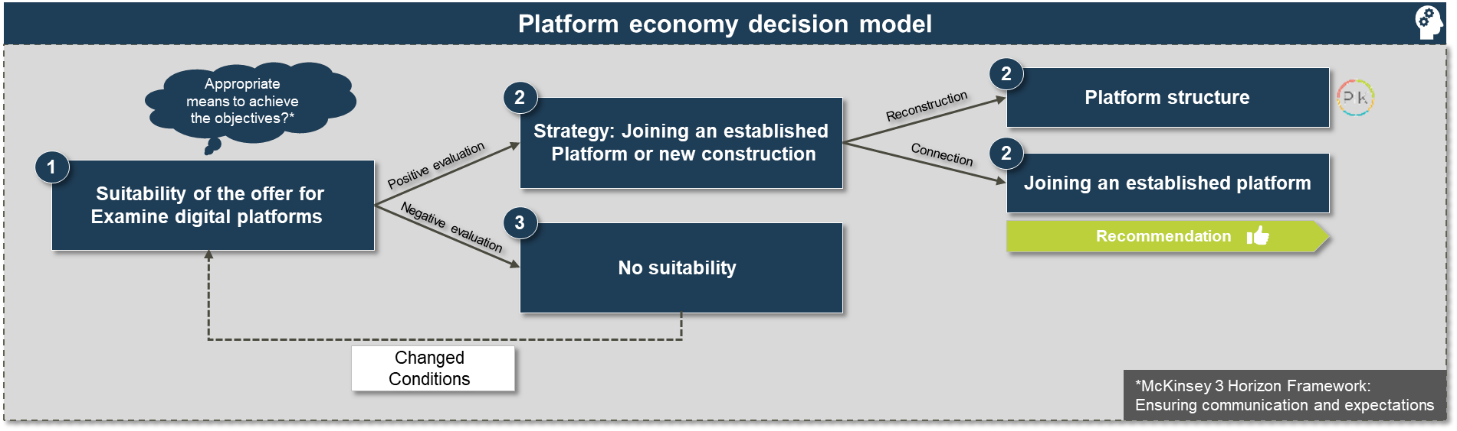

4 DISCUSSION: POTENTIAL STEPS TOWARDS FUTURE APPROACHES

The platform economy has become a significant force in the business landscape, creating new opportunities and challenges for companies, especially in the B2B sector[11]. Extensive literature research and qualitative interviews have provided valuable insights into how companies can effectively participate in the platform economy. Based on these findings, a guidance framework could be summarized that provides solutions for identifying platform strategies in the B2B domain. This framework, shown in Figure 1, suggests two main approaches for companies: joining an existing platform or creating their own platform. In addition, recommendations for aspiring platform entrepreneurs from the perspective of platform operators and actionable strategies for SMEs have been compiled[12].

|

Figure 1. Opportunities for entering the platform economy.

4.1 Entry of SMEs into the Platform Economy: A Decision Model

To guide SMEs in their platform engagement, a decision model has been developed that focuses on assessing the suitability of their existing offerings for digital platforms. There are three options: continue with the platform strategy, make necessary adjustments, or reconsider the venture altogether. Asking questions about positioning within the ecosystem can be a helpful orientation for companies[40]:

Does your company have relevant software development expertise and know-how?

Is your company a small or medium sized business?

Is your company a large enterprise or an international corporation?

Does your company have qualified professionals in various fields?

Does your company have an existing network?

Option A: Joining an existing Platform

For companies considering joining an existing B2B platform, a phased guidance process has been formulated[31]. It includes:

(1) Embracing Digital Transformation: Proactively responding to digital changes and trends is critical for SMEs to remain competitive and adapt to unforeseen events. An agile and flexible mindset is recommended to effectively navigate evolving market conditions.

(2) Information and Awareness: SMEs are encouraged to seek information about digital platforms, opportunities, and risks through various channels such as government programs, business associations, consulting firms, and direct communication with platform providers.

(3) Communication: Transparent communication at all levels of the organization is essential to ensure a common understanding of the platform venture and to gain employee buy-in. A targeted communication strategy can buid motivation and support for the transformation.

(4) Research: Conducting thorough research is critical for SMEs to identify the ideal platform that aligns with their goals. Analyzing existing platforms in the market and creating a membership map is recommended.

(5) Contacting Platforms: Selecting appropriate platforms and contacting them to explore potential collaborations is the next step. Online demonstrations can facilitate the decision-making process.

(6) Decision-making: After evaluating the potential for collaboration, setting up an online demonstration with the platform and gathering feedback helps to make an informed decision.

(7) Contract and Restart: After a positive decision, SMEs can register on the platform and complete the formalities. This marks their official entry into the platform and allows them to start benefiting from its advantages.

Option B: Establishing a Platform

Creating a new platform is advisable if there is a recognized market gap or if existing platforms do not meet specific needs[36]. Several key conditions must be considered before embarking on this venture:

Understanding the potential of digital trends and transformation. Acquiring basic knowledge of the platform economy and possibly already having partnerships on an existing platform. Building a network, as this helps overcome the chicken-and-egg problem and achieve a critical mass. Access to the necessary expertise, including IT and sales specialists, to support platform development.

The platform creation process involves seven main steps, including organizational transformation, team restructuring, and customer analysis. A focus on customer centricity, agile methodologies, and the lean startup cycle is recommended during platform development.

4.2 Business Development: Enhancing and Scaling the Platform

Once the platform is operational, continued business development is critical to its success and growth. Long-term strategic partnerships, expansion into new markets, and the introduction of additional services can lead to further success. Maintaining a customer-centric approach and keeping abreast of emerging trends and customer needs are critical aspects of successful platform development[34].

In summary, participation in the platform economy offers numerous opportunities for companies in the B2B sector. Whether joining an established platform or establishing their own, SMEs can reap the benefits of the platform economy. By following the guidance framework and adapting to the ever-evolving digital landscape, companies can position themselves competitively and reap the benefits of the platform economy[37].

4.3 Validation of the Research

In this subsection, the viability of the concept is assessed through a comprehensive evaluation methodology involving three platform operators who hold key positions as Operations Manager, CEO and Sales Manager. The main focus of this evaluation is the solution concept for SMEs wishing to enter the platform economy, as introduced in subsection 4.1. The primary objective is to ensure the practical applicability of the concept and the recommendations derived from it. To achieve this, eight statements were presented to the participants for evaluation, and their responses were recorded using a traffic light system.

4.3.1 Evaluation Methodology of the Concept

The evaluation process consisted of presenting eight statements to the participants for their feedback. Each statement could be rated with three response options: a red signal indicating disagreement, a yellow signal indicating partial agreement, and a green signal indicating full agreement. The responses were then analyzed to determine the overall consensus on the concept.

4.3.2 Results of the Evaluation and Discussion

In general, the participants showed substantial agreement with the statements presented during the evaluation, except for the fifth statement, which received mixed responses with some partial agreement. The analysis showed that the proposed solution concept was well received and supported by the participants, demonstrating its potential effectiveness for SMEs wishing to enter the platform economy.

A specific statement related to employee training generated some interesting discussion. Three participants expressed partial agreement with this statement. The criticism expressed was that not all employees necessarily need formal workshops or training sessions. Given the different educational backgrounds of employees on existing platforms, it was argued that it would be more effective to provide them with sufficient freedom and space for self-development and organization.

Overall, the evaluation confirmed the viability of the concept, with the majority of participants supporting its adoption. The results also highlighted areas for improvement, particularly in relation to employee training strategies. These insights contribute significantly to the validation and refinement of the proposed solution concept.

4.3.3 Limitations of Research

The work is limited in its geographic scope, focusing only on the manufacturing sector in Germany. While insights were gained, the findings may not be generalizable to other countries or industries. Expanding the analysis to other regions and sectors could enrich the understanding of B2B platforms.

In addition, the work primarily examined activities and offerings that are already prevalent in the current B2B platform landscape. By focusing on established platforms, the research was limited in exploring more innovative or emerging business models that may hold promise. Diversifying the analysis to include newer entrants and more pioneering platforms may have provided valuable perspectives on future trends and opportunities.

The narrow geographic scope, focused on Germany, and the emphasis on maintream rather than pioneering B2B platform models are notable limitations of the research. Broadening the lens in terms of locations and business models examined could strengthen the findings and better highlight areas of future growth for B2B platforms going forward. Acknowleding these limitations provides context for the findings and illuminates avenues for further investigation.

5 CONCLUSION AND FUTURE PERSPECTIVES

In this section, we summarize the key findings of this research and critically examine the implications of the study. In addition, we explore potential avenues for future research to further promote the relevance of digital platforms for SMEs.

5.1 Summary of Results

The primary objective of this research was to explore the potential and challenges of digital platforms for SMEs. Based on the findings, valuable recommendations were derived to help SMEs successfully enter the platform economy. The opportunities for SMEs to play a significant role in the B2B platform economy are diverse and promising. Given the dynamic nature and rapid growth of digital technologies and business models, it is crucial for companies to capitalize on these opportunities to remain competitive[11].

The research journey began by defining the problem and outlining the research objectives in the first section. The subsequent sections and subsections laid the foundation for the study by exploring theoretical concepts, definitions, types, and success factors relevant to B2B platforms. Empirical insights from existing B2B platforms were gathered through industry and cross-industry best-practice analyses and expert interviews. Based on this comprehensive understanding of digital platforms, a systematic solution approach was developed to guide SMEs in formulating effective platform strategies. The approach was further validated through evaluation by prominent industry representatives, confirming its practical relevance and potential benefits for SMEs.

5.2 Future Research Perspectives

Current research has made significant progress in advancing our understanding of the platform economy. Nevertheless, there are promising avenues for future research that can further advance the field. One area of interest lies in examining the specific impacts of the platform economy on different industries. Analyzing how different sectors are affected and understanding the nuances of platform adoption and use in different industry contexts can provide valuable insights.

Another fruitful line of research is to explore the scalability and long-term sustainability of platform-based business models. Identifying the factors that contribute to the successful growth and longevity of these models can provide valuable guidance to businesses and policymakers in making informed decisions about platform development and investment. In addition, there is an opportunity for future studies to examine the interplay between platform governance, user behavior, and network effects. Further specific research is also needed on the ethical aspects of the platform economy, and how integrating ethical principles into platform development and operation could help overcome challenges in the areas of governance, trustworthiness, transparency and credibility. Understanding how these factors interact and influence each other can shed light on critical success factors within the platform ecosystem. The insights gained from such research can inform platform design and management strategies, leading to improved user experience and platform performance. This research paper has provided insights into the platform economy and offers valuable recommendations for SMEs seeking to adopt digital platforms. By addressing the challenges and capitalizing on the potential benefits, SMEs can strategically position themselves in the dynamic digital landscape. Engaging in further research in this area has the potential to advance our understanding and practical application of digital platforms in different economic contexts. By venturing into these additional areas of research, scholars can contribute to a more comprehensive understanding of the platform economy and its far-reaching implications for various sectors of the global economy. This expansion of knowledge will not only benefit academia, but also provide valuable insights for policymakers, businesses, and stakeholders as they navigate the evolving landscape of digital platforms and their impact on the broader economic landscape.

Acknowledgements

We thank former student Filiz Ayaz for her valuable preliminary work and support on this paper.

Conflicts of Interest

The authors declared no conflict of interest.

Author Contribution

Kölmel B conceived the main idea of the paper, contributed to the conceptualization and methodology, and drafted the paper. Borsch M, Rath R and Maier M conducted the extensive literature review and expert interviews and analyzed the data. Brugger T, Moritz P, Kilian-Yasin K, and Galler V were the primary authors of this article. All authors jointly finalized the working draft of the article, revised it, and approved the final draft for submission to the journal.

Abbreviation List

B2B, Business-to-business

MVP, Minimum viable product

SEO, Search engine optimization

SMEs, Small and medium-sized enterprises

References

[1] Kenney M, Zysman J. The Rise of the Platform Economy. Issues Sci Technol, 2016; 32: 61.

[2] Bindra J. The tech whisperer: On digital transformation and the technologies that enable it. Penguin Random House India Private Limited: Gurgaon, India, 2019.

[3] Belleflamme P, Peitz M. The Economics of Platforms. Cambridge University Press: Cambridge, UK, 2021.

[4] Guillen F. PLATFORM PARADOX: how digital businesses succeed in an ever-changing global marketplace. Univ Of Pennsylvania Press: Philadelphia, USA, 2021.

[5] Czakó E. Have Competitiveness Research Projects Brought a System Paradigm Shift? Soc Econ, 2003; 25: 337-349.[DOI]

[6] Trabucchi D, Buganza T. Platform Thinking. Business Expert Press: New York, USA, 2023.

[7] Coe NM, Yeung HWC. Global production networks: theorizing economic development in an interconnected world. Oxford University Press: Oxford, USA, 2015.

[8] CB Insights Research. How quickly did Google, Amazon, Facebook, and other early internet companies grow revenue? A: Crazy fast. 03 March 2023. Accessed 04 November 2023. Available at:[Web]

[9] Fortune 500. Accessed 21 July 2023. Available at:[Web]

[10] Neufeld D. Ranked: The Top 100 brands by Value in 2023. Visual Capitalist. Accessed 24 July 2023. Available at:[Web]

[11] Hines A, Bishop P. Thinking about the future: guidelines for strategic foresight. Hinesight: Houston, TX, USA, 2015.

[12] Evens T, Donders K. Platform power and policy in transforming television markets. Palgrave Macmillan: Cham, Switzerland, 2018.

[13] Osterwalder A, Pigneur Y. Business Model Generation: A Handbook for Visionaries, Game changers, and Challengers. Wiley: Hoboken, New Jersey, USA, 2010.

[14] Kugler S, Anrich F. Digitale Transformation im Mittelstand mit System: Wie KMU durch eine innovative Kultur den digitalen Wandel schaffen. Springer Gabler: Wiesbaden, Germany, 2018.

[15] Bernhard AB, Wagner J. Exports and Success in German Manufacturing. Weltwirtschaftliches Archiv, 1997; 133: 134-157.[DOI]

[16] Schmidt H. Europa verliert. Die Zeit, 15 May 2020. Accessed 23 November 2023. Available at:[Web]

[17] Garbugli É. Lean B2B: Build Products Businesses Want. CreateSpace Independent Publishing Platform: South Carolina, USA, 2014.

[18] Viles E, Ormazábal M, Lleó A. Closing the gap between practice and research in industrial engineering. Springer: Heidelberg, Germany, 2017.

[19] Link J, Tiedtke D. Erfolgreiche Praxisbeispiele im Online Marketing. Springer: Heidelberg, Germany, 2021.

[20] Brocke J, Simons A, Niehaves B et al. Reconstructing the Giant: On the Importance of Rigour in Documenting the Literature Search Process. 17th European Conference on Information Systems (ECIS 2009), Verona, Italy, 22 June 2009.

[21] Drewel M, Gausemeier J, Vaßholz M et al. Einstieg in die Plattformökonomie. Symposium für Vorausschau und Technologieplanung: Berlin, Germany, 2019.

[22] Arnold B. Strategische Lieferantenintegration: Ein Modell zur Entscheidungsunterstützung für die Automobilindustrie und den Maschinenbau. Springer: Heidelberg, Germany, 2013.

[23] Matt DT, Modrák V, Zsifkovits H. Industry 4.0 for SMEs: Challenges, Opportunities and Requirements. Palgrave Macmillan: London, UK, 2021.

[24] Jaekel M. Disruption durch digitale Plattform-Ökosysteme. Springer Vieweg Wiesbaden: Wiesbaden, Germany, 2020.

[25] Moser D, Wecht C, Gassmann O. Digitale Plattformen als Geschäftsmodell. ERP Manage, 2019; 15: 45-48.[DOI]

[26] Szerb L, Komlosi ES, Acs ZJ et al. The Digital Platform Economy Index 2020. Springer: Cham, Switzerland, 2022.

[27] Tiwana PA. Platform ecosystems: aligning architecture, governance, and strategy. Morgan Kaufmann: Burlington, USA, 2013.

[28] Schreieck M, Hein A, Wiesche M et at. The challenge of governing digital platform ecosystems. Springer: Heidelberg, Germany, 2017.

[29] Ritter N. High five: Diese fünf Faktoren zeichnen gute digitale Plattformen aus. Digitale Exzellenz. Accessed 22 July 2023. Available at:[Web]

[30] Bungard P, Schmidpeter R. Future of Work and Sustainable Business Models: How Sustainable Entrepreneurship Can Create Added Value. In: Emerging Economic Models for Sustainable Businesses. Springer Nature Singapore: Singapore, 2022; 145-153.

[31] Parker GG, Van Alstyne MW, Choudary SP. Die Plattform-Revolution: Von Airbnb, Uber, PayPal und Co. lernen: Wie neue Plattform-Geschäftsmodelle die Wirtschaft verändern. MITP-Verlags GmbH & Co. KG: French, 2017.

[32] Rohn D, Bican PM, Brem A et al. Digital platform-based business models-An exploration of critical success factors. J Eng Technol Manage, 2021; 60: 101625.[DOI]

[33] Choudary SP. Platform Scale: How an Emerging Business Model Helps Startups Build large Empires With Minimum Investment. Accessed on 23 October 2023. Available at:[Web]

[34] Cusumano MA, Gawer A. Platform Leadership How Intel, Microsoft, and Cisco drive industry innovation. Harvard Business School Press: Boston, Mass, 2002.

[35] Täuscher K, Hilbig R, Abdelkafi N. Geschäftsmodellelemente mehrseitiger Plattformen. Springer Gabler: Wiesbaden, Germany, 2017.

[36] Cicero S. Platform Design Toolkit. Medium. Accessed 21 November 2023. Available at:[Web]

[37] Walter M, Lohse M. Platform Innovation Kit 3.0: User Guide. Platform & Blockchain Innovation Lab, Dresden, Germany, 2018.

[38] McKinsey. Enduring Ideas: The three horizons of growth. McKinsey & Company, 2009. Accessed 17 September 2023. Available at:[Web]

[39] Nadeem W, Juntunen M, Hajli N et al. The role of ethical perceptions in consumers’ participation and value co-creation on sharing economy platforms. J Bus Ethics, 2021; 169: 421-441.[DOI]

[40] Engelhardt S, Petzolt S (Eds). Das Geschäftsmodell-Toolbook für digitale Ökosysteme. Campus Verlag GmbH: Frankfurt, Germany, 2019.

Copyright © 2024 The Author(s). This open-access article is licensed under a Creative Commons Attribution 4.0 International License (https://creativecommons.org/licenses/by/4.0), which permits unrestricted use, sharing, adaptation, distribution, and reproduction in any medium, provided the original work is properly cited.

Copyright ©

Copyright ©