Research on the Influence of Shadow Banking Development on the Scale of Social Financing in China

Zirui Yang1*, Chufan Zheng1

1School of Business, Jiangsu Ocean University, Lianyungang, China

*Correspondence to: Zirui Yang, School of Business, Jiangsu Ocean University, Cangwu Road, Lianyungang 222005, China; Email: ytzriver@126.com

DOI: 10.53964/mem.2023001

Abstract

Background: With the continuous improvement and innovation of China’s market-oriented economy, some traditional financial institutions have released new financial products through financial innovation, and the transaction leverage level of most financial institutions and some non-financial institutions is also rising year by year. The latest Quarterly Monitoring Report of China’s Shadow Banks issued by Moody’s, an international rating agency, shows that the assets of China’s broad shadow banks in the first quarter decreased by about 540 billion yuan to 58.7 trillion yuan, continuing the downward trend in recent years. At the same time, China’s economy rebounded rapidly, and the proportion of shadow bank assets in nominal GDP fell to 55.4% from 58.3% at the end of 2020, the lowest level in eight years. The report shows that in the first quarter of 2021, the overall economic leverage ratio measured by the proportion of the adjusted total social financing to the nominal GDP has declined, because the nominal GDP growth in the quarter was 21.2%, far exceeding the growth of 10.1% of the total social financing. Even so, China’s shadow banks are still huge. Also, some non-financial enterprises began to operate shadow banking business, the number of shadow banking enterprises coming into the financial market is growing fast, which is the background and environment of the emergence and development of enterprise shadow banking studied in this paper. In 2020, due to the impact of the epidemic, the Chinese government will actively adjust its macro policies and release liquidity, which will further drive the development of shadow credit business. In the first quarter of 2020, the overall shadow bank assets increased by 100 billion yuan, rebounding compared with 2019. Among them, financial products and asset management products accounted for the main part, with a total increase of 350 billion yuan.

Objective: This paper focuses on using different kinds of products operated by shadow banking enterprises to represent the shadow banking scale of enterprises, and explores its impact on the total amount of social financing, based on which a series of policy recommendations are given.

Methods: Collect the operation data of shadow banking enterprises in the ten years from 2010 to 2019, use ols regression analysis and intermediary effect test to analyze the development of enterprises’ shadow banking scale and China’s social financing scale.

Results: The development of shadow banking will affect the total scale of social financing. There is a non-linear correlation between the development of shadow banking and the total scale of social financing.

Conclusion: The improvement of enterprises’ shadow banking scale will promote the expansion of social financing scale as a whole, and will have a negative effect on the productive investment of various enterprises themselves.

Keywords: financing, social financing scale, shadow banking expansion, the risk of shadow banking, coping policy

1 INTRODUCTION

1.1 Background

At the present stage, China is focusing on the development of the real economy under the socialist model, and the total financing scale and its composition and proportion in the current society are of great significance. Among them, the social financing structure of our country has extremely strict requirements on the funding conditions and credit levels of financing providers and demanders. Moreover, the social financing in our country has a long forming cycle and a complex composition structure. Therefore, regulating the total scale of social financing is of great significance for the current development of the real economy in our country.

At the same time, changes in the scale of social financing are extremely symbolic[1]. In China, the change of social financing scale represents many economic significance. First of all, the expansion of social financing scale indicates that China’s real industry has received more capital support from social financing institutions, such as banks. Many types of financial products, such as the purchase of equity, bonds, investment in real estate and commercial credit, all belong to the assistance to the real industry[2]. Secondly, the expansion of the total amount of social financing indicates that some financial instruments have been fully utilized by the real industry, including bank bills and stock financing, which indicates the expansion of the financing channels of the real industry. In addition, the expansion of social financing scale indicates that non-financial enterprises can obtain more diversified, more convenient and more efficient financing support with the expansion of financing channels for China’s economic development. All these can promote the production and construction of large, small and micro enterprises in China, as well as the expansion of their enterprise scale. What’s more, it also symbolizes the expansion of China’s industrial scale and the improvement of capital liquidity[3,4].

Shadow banks have the characteristics of circumventing the strict supervision of conventional commercial banks and providing credit creation, liquidity and huge credit risk to all sectors of society[5]. There are strict access rules in China’s capital market. At the same time, commercial banks have a monopoly position in the credit market. Therefore, China’s financial market has very serious financial frictions in a sense. The rise of enterprises’ shadow banking scale will lower the threshold and cost of enterprises’ financing from non capital markets and unconventional channels, and enable some enterprises in the Chinese market that could not obtain financial support to obtain financing. On the one hand, it increases the scale of social financing, on the other hand, it also leads to increased financial risks in China, and some original distinctive monetary caliber becomes difficult to measure[6].

In addition, the development of shadow banking of enterprises will squeeze the original asset liability business of commercial banks. In China, there are many non-financial enterprises that are gradually shadow banking. The shadow banking development of these enterprises may lead to the difficulty in limiting the total amount of financing in China. The funds from commercial banks and other formal channels can no longer represent all the financing of the society. At the same time, the competitive effect will force the original commercial banks to raise the loan interest rate, Then, it has a negative impact on those foreign enterprises that are not easy to access the shadow banking system in China, which has raised the financing cost[7].

1.2 Research Hypothesis

At the current stage of economic development in China, because commercial banks have strict loan requirements for enterprises, shadow banks have played a substitute role for commercial banks to some extent. When the shadow banking development scale of non-financial enterprises expands, it will promote the improvement of social financing to a certain extent, so this paper puts forward the first hypothesis.

Hypothesis 1a: The development of enterprise shadow banking will drive the growth of social financing scale.

Hypothesis 1b: The development of enterprise shadow banking will inhibit the growth of social financing scale.

At the same time, due to China’s increasingly strict requirements on the financing review of loan financing enterprises and LX in recent years, many small, medium-sized and micro enterprises and some grass-roots private industries, because their own specifications are not enough to apply for adequate financial support from large commercial banks, so the cost of financing is very high. As the shadow banks are not under the national commercial bank supervision system, they have higher flexibility and lower loan costs, and most shadow banks do not make too many requirements on the interest guarantee ratio and financing matters of borrowing enterprises, which makes many enterprises turn to the shadow banks to obtain financial support, that is, to promote the national financing scale. Therefore, this paper proposes the following two assumptions.

Hypothesis 2: The development of shadow banking of enterprises promotes the growth of social financing scale by reducing the interest guarantee ratio.

Hypothesis 3: The development of enterprise shadow banking promotes the growth of social financing scale by reducing financing requirements.

In addition, the shadow banking development of enterprises will attract many investments, and the source of these funds is likely to be the business investment that many enterprises originally planned to inject into the real industry. Now these enterprises inject funds into the shadow bank to replace their original main business direction, thus driving more enterprises to bring funds into the credit financial market of the shadow bank. Compared with the investment in the real industry, the investment in the financial industry is larger and changes faster. Therefore, we propose the following assumption.

Hypothesis 4: The development of corporate shadow banking promotes the growth of social financing scale by curbing corporate entity investment.

2 MATERIALS AND METHODS

2.1 Main Variables and Data Source

The measurement method of the total scale of social financing is the total scale of loan financing in RMB plus the total scale of loans in other countries’ currencies, plus the total scale of financing of entrusted loans in the whole society, the total scale of financing of trust loans in the whole society, the total scale of financing of undiscounted bank bills in the whole society + the total scale of financing of bonds purchased, held and sold by enterprises in the whole society The total financing scale of non-financial enterprises in China.

The measurement method of enterprises’ shadow banking scale is the product balance of financial products under different operation modes, the basic information of collective trust products, the basic information of bank trust cooperation products, the basic information table of bank financial products and the natural logarithm of the basic information of asset management products.

The data used in this paper are mainly from CNINF, the Administration for Industry and Commerce, SEC EDGAR and Yahoo Finance.

The meaning and calculation method of variables set in this paper are shown in the following Table 1.

Table 1. Meaning and Calculation Method of Variables

Variable Name |

Variable Description |

Variable Measurement Method |

T |

Total scale of social financing |

Sum of total loan financing scale in RMB, total loan scale in other countries’ currencies, total financing scale of entrusted loans in the whole society, total financing scale of trust loans in the whole society, total financing scale of undiscounted bank acceptance bills in the whole society, total financing scale of bonds purchased, held and sold by enterprises in the whole society The total financing scale of non-financial enterprises in China |

SBC |

The shadow banking scale of enterprises |

Natural logarithm of product balance of financial products under different operation modes, basic information of collective trust products, basic information of bank trust cooperation products, basic information table of bank financial products and basic information of asset management products |

F |

Ratio of yield to risk |

Ratio of investment return to return variance |

GM |

Company size |

Take the natural logarithm after adding up the company’s assets |

XJ |

Cash level |

Ratio of net cash flow from operating activities to total assets |

CJ |

Enterprise growth |

Subtract one after dividing the company’s main business income in the current period by the previous period |

ROE |

Profitability |

Ratio of net profit to shareholders’ equity |

GQ |

Ownership structure |

Percentage of ownership of listed companies held by actual owners |

SL |

Total years of listed companies |

Difference between current year and listing year |

ST |

Total investment amount of enterprises in real industries |

The amount of cash spent by the Company to purchase intangible assets, fixed assets and other long-term assets is taken as the natural logarithm |

RZ |

Financing constraints on behalf of the company |

International General Standards |

LX |

On behalf of the Company’s interest coverage ratio |

EBIT compared with interest |

2.2 Regression Model

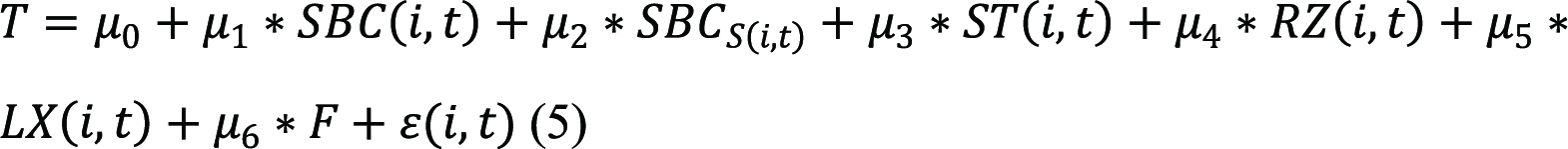

In order to link the relationship between the shadow banking of enterprises and the scale of social financing, this paper decides to build the following model:

|

Test the impact of financial mismatch on the scale of corporate shadow banking through three intermediary variables: financing constraints, return on capital and corporate entity investment. The mediation effect model is as follows:

|

|

|

By testing the size of the coefficient before different independent variables, we can get the significance of the intermediary effect, that is, whether there is intermediary effect.

|

Three intermediary variables are added to the above model to test the impact of corporate interest guarantee ratio, financing constraints and entity investment on social financing scale.

3 RESULTS

3.1 Descriptive Statistics

The results of regression by adding all variables are as follows Table 2.

Table 2. Results of Regression

Dependent Variable: T |

Coefficient |

Std. err. |

P>|t| |

SBC |

0.0398 |

0.028 |

0.0021 |

SBC_S |

0.0012 |

0.315 |

0.0750 |

F |

-0.0495 |

0.008 |

0.0001 |

GM |

-0.0580 |

0.019 |

0.9932 |

XJ |

-0.0539 |

0.006 |

-0.2665 |

CJ |

-0.3526 |

0.074 |

-0.0001 |

ROE |

0.7211 |

0.125 |

0.0016 |

GQ |

-0.0506 |

0.001 |

-0.0062 |

SL |

-0.1007 |

0.020 |

-0.0265 |

As shown in the above table, after the benchmark regression of the impact of the shadow banking development of enterprises on the scale of social financing, it can be seen that when the model is regressed, the pre term coefficients of enterprise shadow banking (SBC) and the square of enterprise shadow banking (SBC_S) are 0.0398 and 0.0012. When this paper uses the 5% significance level to test, it can be seen that the enterprise shadow banking (SBC) and the square of enterprise shadow banking (SBC_S) are significant. In addition, T is not significantly related to the size (0.9932) of the listed company (GM), nor to the cash level (XJ) (-0.2665), but is related to corporate growth (CJ), profitability (ROE), ownership structure (GQ), and the market age (SL) of the listed company. It is in direct proportion to profitability and negatively related to the rest. On the one hand, this shows that there is a significant relationship between the shadow banking of enterprises and the total scale of social financing, that is, the development of shadow banking will affect the total scale of social financing. On the other hand, it also shows that there is a non-linear correlation between the development of shadow banking and the total scale of social financing. Statistics on the development scale of enterprises’ shadow banking show that almost all (>99.99%) enterprises’ shadow banking scale is on the right side of the axis.

Therefore, it is concluded that the increase of the shadow banking scale of enterprises will promote the increase of the total scale of social financing. That is, suppose 1a is true.

3.2 Mechanism Identification: Test the Intermediary Effect

We test the mediation effect. Because the scale of enterprises’ shadow banking may affect the total scale of social financing in China through three mechanisms: the degree of financing constraints, the total amount of enterprises’ physical investment and the interest guarantee ratio of enterprises’ investment, this paper uses the model of intermediary effect to test the intermediary effect of the above three mechanisms. The inspection results are shown in the following Table 3.

Table 3. Intermediary Effect of the Three Mechanisms

|

T |

RZ |

LX |

ST |

SBC |

0.2871** (1.418) |

-0.1237** (1.401) |

0.2566 (0.289) |

-0.3021** (0.0725) |

SBC_S |

0.5043*** (0.759) |

|

|

|

RZ |

|

|

|

|

ST |

|

|

|

|

LX |

0.0009*** (0.024) |

|

|

0.0120** (0.0062) |

Notes: 1) Document standard error in brackets; 2) *, ** and *** respectively indicate that t values are significant at 10%, 5%, and 1% levels, the same below.

In the above table, the first column, column T, tests the overall impact of the shadow banking development scale of enterprises on China’s social financing scale. It is not difficult to see that under the 5% significance level test, both the shadow banking development scale (SBC) and the square of shadow banking development scale (SBC_S) are significant. The second column RZ, the third column LX, and the fourth column ST jointly test the regression results between these three items and the size of shadow banks. It can be seen from the test results that in the RZ column and ST column, the P value of SBC are -0.0216 and -0.0168, both less than 0.05, which are significant and reject the original hypothesis. In the LX column, the P value of SBC is 0.1325, which exceeds 10% and is considered insignificant. Since the intermediary effect is not significant, the sobel test needs to be conducted. Therefore, for the existence test of LX intermediary effect in the relationship between the shadow banking development of enterprises and the total scale of social financing, the final test results show that z in the sobel test is 0.6325, P>0.1, not significant.

This proves that when the shadow banking scale of enterprises is developed, the shadow banking scale of enterprises will stimulate investment by relaxing the financing constraints of enterprises, and at the same time restrain the physical investment of enterprises, so as to improve the total scale of social financing. Assumptions 3 and 4 hold.

Then, we added RZ, ST and LX to the initial model, that is, to test the influencing factors of the total scale of social financing. The test results are shown in the following Table 4.

Table 4. Influencing Factors of the Total Scale of Social Financing

Variable Name |

Coefficient and Significance |

SBC |

0.0402*** (0.945) |

SBC_S |

0.0001*** (0.391) |

RZ |

-0.0199** (0.121) |

ST |

-0.040*** (0.419) |

LX |

0.0009 (0.346) |

The results are the same as above, that is, the level of financing constraints (RZ) and the scale of entity investment of enterprises (ST) are significant, while the interest coverage ratio (LX) is not significant. That is, Hypothesis 3 and Hypothesis 4 are true.

3.3 Robustness Test of Regression Analysis

The above argument and regression analysis have preliminarily proved various assumptions, but considering the robustness of the analysis results and the strength of the conclusions, the robustness test is carried out next.

Change the measurement method of F. The average measurement method was changed to three-year rolling measurement, and instead of the original measurement indicators, the same regression analysis method was used for analysis, and the same conclusions were obtained, but the regression results did not change.

Change the measurement indicators of enterprise financing constraints and enterprise capital return rate. The cash rate and the liquidation rate are used respectively to try to replace the constraint degree of financing in turn, and then the intermediary effect test of the same steps as the above is conducted. The significance test results are the same as the above, with no change.

Consider the impact of the development of different provinces on shadow banks. In the regression, the total loans of the province and the GDP of the province in the current year are added as variables to replace the development status of the province. The regression analysis of the same steps as above is carried out, and the same conclusions are drawn. The regression results are unchanged.

4 DISCUSSION

After the above analysis of the article, we come to the conclusion that the shadow banking of enterprises is directly related to the financing scale in China. At the same time, the scale of social financing is extremely important in China’s economic development. Therefore, we can neither let go of the shadow banking expansion of enterprises, nor because of the high risk of shadow banking, we need to be careful to deal with the risks and impacts that the shadow banking changes of enterprises will bring to our financial system[8].

In other words, we need to have an objective understanding of the advantages and disadvantages of shadow banks. On the one hand, we need to play a more active role in playing the beneficial part of shadow banks in the economic operation. By regulating their development, we can play a good role in our financial system. Shadow banks play a role that can supplement our traditional credit. They can play a positive role in promoting the development of our financial market and the real economy. Moreover, shadow banks can broaden the financing methods and channels of Chinese enterprises, promote enterprises to optimize their own fund allocation, and help some small and micro enterprises that cannot meet the financing loan conditions of commercial banks to meet their loan and financing needs. On the other hand, because of its own characteristics, shadow banks often have an impact on the smooth operation of the economy and credit risk[9]. First, China’s financial supervision cannot completely bring shadow banks under the supervision system, which often causes a large number of risks that cannot be ignored and threatens the smooth operation of the economy. In addition, shadow banks tend to invest a large amount of money in the credit field[10]. By this way, they can avoid the credit scale restrictions in China’s macro-economic regulation and allow funds to flow into some industries with overcapacity, which will not only lead to the expansion of the credit market without order, but also lead to a large number of asset price foam in individual industries[11].

5 CONCLUSION

Therefore, we cannot avoid shadow banks, nor can we strictly restrict the development of shadow banks through certain policies and other measures to curb their development level; At the same time, we also need to maintain a cautious attitude towards shadow banks to avoid their unrestrained expansion and flooding[12]. To this end, regulators need to improve the business capabilities of shadow banks and ensure the transparency of procedures in business operations, shorten the long capital chain of shadow banks from various aspects, reduce the potential risks it contains, promote the healthy development of shadow banks, and bring more positive effects to China’s economic operation[13-15].

Acknowledgements

Thanks for the support from Education Department of Jiangsu Province and Jiangsu Ocean University. This work was supported by 2022 College Students’ Innovation and Entrepreneurship Training Program of Jiangsu Ocean University (Project No.153)

Conflicts of Interest

The authors had no conflict of interest.

Author Contribution

Yang Z designed this study, conducted the analysis and wrote the first draft of this paper. Wang Z collected the data, provided suggestions in the analysis and as well revised and improve the content. All the authors approved the final version of this study.

Abbreviation List

CJ, Corporate growth

GM, Listed company

GQ, Ownership structure

LX, Interest coverage ratio

ROE, Profitability

RZ, Financing constraints

SBC, Shadow banking development scale

SBC_S, Square of enterprise shadow banking

SL, Market age

ST, Scale of entity investment of enterprises

XJ, Cash level

References

[1] Nabilou H. Can the Plight of the European Banking Structural Reforms be a Blessing in Disguise? Eur Bus Org Law Rev, 2021; 22: 241-281.[DOI]

[2] Wu Y, Shang Y, Bu L. Research on the "Double Pillar" Policy Coordination under the New Normal [in Chinese]. Int Financ, 2021; 2: 49-54.

[3] Fu Huangshiying. The Impact of Shadow Banks on SME Financing and Regulatory Issues [in Chinese]. Invest Coop, 2021; 2: 58-59.

[4] China. China Bank Insurance News. Contribute financial power to build a new development pattern [in Chinese]. Accessed 2022. Available at:[Web]

[5] Barth JR, Li T, Shi W et al. China's shadow banking sector: beneficial or harmful to economic growth? J Finan Econ Policy, 2015; 7: 421-445.[DOI]

[6] Li R. Research on Government Regulation Difficulties and Countermeasures of China’s Shadow Banks [in Chinese]. Invest Coop, 2021; 1: 56-57.

[7] Wang Y. The relationship between the regional flow of shadow banks and financial development -based on the data analysis of China’s entrusted loans [in Chinese]. J Harbin University, 2021; 42: 42-45.

[8] Duong THM, Nguyen TAN, Nguyen VD. Social capital and the shadow economy: a Bayesian analysis of the BRICS. AJEB, 2021; 5 : 272-283.[DOI]

[9] Lysandrou P, Shabani M, D’Avino C. The explosive growth of the US ABCP market between 2004 and 2007: an integrated empirical analysis. Q Rev Econ Finance, 2022; 85: 31-46.[DOI]

[10] Pan Y. U.S. Policy Options and Potential Impacts on China General Stocks [in Chinese]. South Financ, 2020; 11: 46-53.

[11] Xu Y. On balance sheet credit activities of major commercial banks and their hidden risks [in Chinese]. Res Quant Econo Techn Econ, 2020; 37: 119-138.

[12] Khan S, Rehman MZ. Macroeconomic fundamentals, institutional quality and shadow economy in OIC and non-OIC countries. J Econo Stu, 2022; 49: 1566-1584.[DOI]

[13] Pan H, Fan H. Research on the Stability of the Banking System With Shadow Banking Under Macroeconomic Fluctuation. Front Phys, 2020; 8: 338.[DOI]

[14] Khan S, Abdul Hamid B, Rehman MZ. Determinants of shadow economy in OIC and non-OIC countries: the role of financial development. Int J Emerg Mark, 2021 [Epub ahead of print].[DOI]

[15] Shah SMR, Lu Y, Fu Q et al. Interaction between wealth management products and bank deposits: evidence from China’s shadow banking. Int J Bank Marketing, 2021; 40: 154-171.[DOI]

Copyright © 2023 The Author(s). This open-access article is licensed under a Creative Commons Attribution 4.0 International License (https://creativecommons.org/licenses/by/4.0), which permits unrestricted use, sharing, adaptation, distribution, and reproduction in any medium, provided the original work is properly cited.

Copyright ©

Copyright ©