Does Trade Openness Influence the Development of Two-way Direct Investment? Evidence from Jiangsu Province, China

Zining Wang1, Bing He1*

1School of Business, Jiangsu Ocean University, Lianyungang, Jiangsu Province, China

*Correspondence to: Bing He, PhD, Special Appointed Associate Professor, School of Business, Jiangsu Ocean University, Cangwu Road, Lianyungang 222005, Jiangsu Province, China; Email: binghe@jou.edu.cn

DOI: 10.53964/mem.2022006

Abstract

Background: As a major foreign trade province in China, Jiangsu is at the forefront of introducing inward foreign direct investment (IFDI) and conducting outward foreign direct investment (OFDI), which share equivalent economic emphasis during the development of China in the recent decades. Many studies have analyzed the factors influencing IFDI or OFDI at a province or country level, while little knowledge is available related to the investigation at the prefectural city level by using a fixed effect model.

Objective: The goal of this study is to examine the impact of trade openness on two-way direct investment in Jiangsu Province, China by using a fixed effect model.

Methods: This study examines the impact of foreign trade openness on IFDI and OFDI by adding control variables such as industrial structure, real GDP per capita, and the number of patents granted using panel data for 13 prefecture-level cities in Jiangsu Province from 2010 to 2020. Moreover, considering the economic gap between northern, central, and southern Jiangsu, a subregion analysis was performed. The panel data for analysis are mainly derived from China City Statistical Yearbook and Jiangsu Statistical Yearbook.

Results: A 1% increase in trade openness will yield a 0.637% increase in IFDI, but no significant correlation with OFDI with observed.

Conclusion: Trade openness is significantly correlated with IFDI, and its relationship with OFDI requires further investigation.

Keywords: trade openness, two-way direct investment, Jiangsu Province

1 INTRODUCTION

Jiangsu Province, an eastern coastal province in China, has actively responded to China’s Reform and Opening-up Policy since the late 1970s. As a major foreign trade province and strong economic province with a population of 84.75 million, ranking 4th of all provinces in 2020, Jiangsu is always at the leading edge of foreign investment area, including inward foreign direct investment (IFDI) and outward foreign direct investment (OFDI). For decades, global economic challenges China has been confronting, such as the demand for high-quality economic development and the upgrade of industry structure, have emphasized the significance of both IFDI and OFDI. The Chinese government has thus attached great importance to the coordinated development of two-way investment and implemented the export-oriented economic strategy of “going out” and “introducing in”. As one of the leading provinces, Jiangsu utilized US $23.52 billion of foreign capital in 2020, ranking the first in the country (data from the Ministry of Commerce, China), and its OFDI was US $6.14 billion, accounting for 7.2% of the total and ranking the fourth in the country (statistical bulletin of China’s foreign direct investment (FDI) in 2020). However, the scale of two-way direct investment in Jiangsu is still far behind their economic development goal. To this end, it is of great significance to examine the factors influencing its two-way investment, so as to help achieve the economic goal in the 14th Five-Year Plan (2021-2025).

Despite a large body of evidence on the development of FDI, most of them focused on the national level of FDI, investigating the diversity between developed countries and developing countries in factors that influence FDI flow[1-3]. Recognizing China as an important economy in developing countries, some studies center on the factors influencing FDI in China, and some examine the interaction effects between IFDI and OFDI[4,5]. However, most of the studies are at either the provincial level (macro) or firm level (micro), and prefectural level data have been little investigated. Jiangsu is a major foreign trade province and a strong economic province in China, with significant gaps between different regions in the province. Hence, investigation of the factors influencing the IFDI and OFDI in Jiangsu Province at the prefectural city level contributes to promoting its high-quality development of economy and the upgrade of industry structure.

Based on institutional theory, Wang et al.[6] looked at the OFDI driving force for Chinese firms in developing countries. Using a firm-level dataset to conduct a firm, industry, and country-level analysis, their study found that the industrial structure of China was a key factor influencing the OFDI, which markedly outweighed the technological factors. However, the impact of industrial structure on IFDI was absent in their research. Kayalvizhi and Thenmozhi[7] examined the impact of technology on IFDI in developing countries by analyzing the data of 22 emerging economies and found that FDI increased with technology absorption. The technology level in their study was measured by the registered patents of local residents. Using Generalized Moments of Methods (GMM approach), Saini and Singhania[8] examined the potential determinants of FDI in 20 countries from 2004-2013 and revealed diverse factors influencing FDI across different countries and economic determinants such as trade openness and efficiency variables as key factors in developing countries. The findings of this study emphasize the significance of trade openness in analyzing the FDI in developing countries, such as China. However, this study has limitations such as unreliable data calculations for the constructed variables and outdated secondary data. Nguyen analyzed the effect of trade openness on FDI flow in Vietnam by using the VAR model and identified a positive effect of trade openness on FDI[2]. Nevertheless, endogenous problems might exist in their research since only time series data were used without necessary control variables.

To accelerate the dynamic development of two-way direct investment in China, the current study examined the impact of trade openness on both IFDI and OFDI. Here, the goal of this research is to investigate the factors that influence the development of IFDI and OFDI in Jiangsu Province, China, by using a fixed effect model. Due to the economic differences in different regions, Jiangsu Province is also divided into Southern Jiangsu (Nanjing, Suzhou, Wuxi, Changzhou, and Zhenjiang), Central Jiangsu (Taizhou, Nantong, and Yangzhou), and Northern Jiangsu (Xuzhou, Lianyungang, Huaian, Yancheng and Suqian), followed by a subsample analysis. The remainder of this paper is as follows: Section 2 introduces the variables, data source, and research methods in this study; Section 3 shows the empirical results and performs a basic discussion; Section 4 concludes the results in this paper and provides suggestions for the improvement of two-way direct investment in Jiangsu, as well for the provinces in China.

2 MATERIALS AND METHODS

2.1 Variables and Data Source

In this study, the dependent variables are IFDI and OFDI, and the key variable is trade openness (degree of foreign trade dependence, hereafter referred to as ftd), which is measured by the volume of import & export trade over GDP as in Kong et al[9,10]. Based on the study of Xu and Zhou[11], we included variables industry structure measured by the GDP in the tertiary industry over GDP in the second industry, rpGDP (real GDP per capita) measured by the rpGDP over GDP deflator, and registered patents by local residents as control variables[11]. Here, IFDI data were derived from China City Statistical Yearbook, OFDI, GDP in second and tertiary industries, GDP per capita, registered patent, and volume of import and export trade data were obtained from Jiangsu Statistical Yearbooks (2011-2021). Notably, the GDP deflator was calculated based on nominal GDP and GDP at a constant price, acquired from Jiangsu Statistical Yearbook. The panel data were yearly data between 2010-2020 for all 13 prefectural cities in Jiangsu Province. Besides, the empirical analysis was based on fixed effect model after the Hausman test and was conducted using the software STATA 16.0.

2.2 Regression Model

Based on the model by Wang et al.[6] and Xu and Zhou[11], we conducted the Hausman test before the analysis to examine the feasibility and reliability of models for data analyses. The result of the Hausman test (P<0.05) encouraged the use of the fixed effect model over the random effect model. The following two equations were then constructed to investigate the impact of foreign trade (including import and export trade) on two-way direct investment in Jiangsu Province, China. To avoid the heteroskedasticity problem, all the variables included in this analysis are in natural logarithms.

|

|

Equations (1) and (2) examine the impact of trade openness on the development of IFDI and OFDI. Subscripts i and t represent city and year. Here, trade openness is the degree of dependence on foreign trade, measured by the volume of import and export trade over GDP in certain years. Control variables include industry structure, rpGDP, and the number of registered patents, which with detail delivered in above part 2.1.

3 RESULTS AND DISCUSSION

3.1 Descriptive Statistics

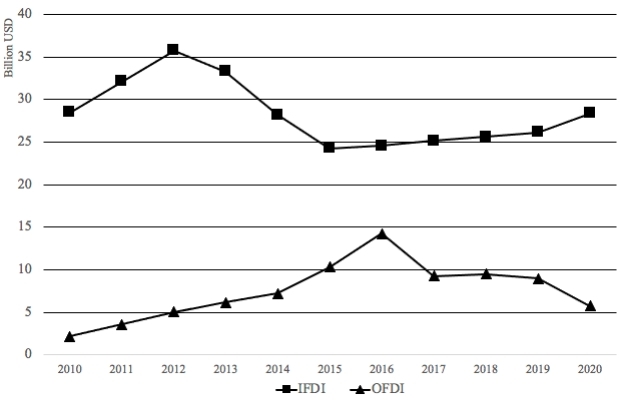

As mentioned before, this study uses panel data for the 13 prefectural cities of Jiangsu Province in China from the year 2010 to 2020, and the data source for each variable is described in part 2.1. Figure 1 shows the development trend of IFDI and OFDI in Jiangsu Province between 2010 and 2020. IFDI in Jiangsu sharply reduced after 2012, increased after 2014, and reached 28.4 billion USD in 2020. OFDI in Jiangsu rapidly increased before 2015 and reached 14.2 billion USD in 2016. But OFDI started to reduce after the year 2016 and down to 5.74 billion USD in 2020, which is around 20% of the IFDI scale in 2020. The decrement in IFDI is ascribed to the fierce competition from other developing countries (for example India, Vietnam, and Thailand) and the policy changes in FDI by the Chinese government and Jiangsu local government. In recent decades, the Chinese government emphasized more on the quality other quantity of IFDI to facilitate high-quality development. To acquire high-quality IFDI, Jiangsu Province established a strict criterion in selecting FDI inflow despite the good services it provided in the last decade. The decrement in OFDI is attributed to the dynamic international economic situation and the outbreak of COVID-19.

|

Figure 1. IFDI&OFDI of Jiangsu Province (2010-2020). Data source: The provincial level data are from Jiangsu Statistical Yearbook.

Table 1 reports the descriptive statistics for all variables used in the current study, including IFDI, OFDI, trade openness, rpGDP, industry structure, and the number of registered patents.

Table 1. Descriptive Statistics of All Variables Included

Variables |

Obs. |

Mean |

Std. Dev. |

Min |

Max |

IFDI |

143 |

23.116 |

0.753 |

20.902 |

24.777 |

OFDI |

143 |

21.157 |

1.643 |

16.971 |

23.826 |

ftd |

143 |

-1.445 |

0.784 |

-2.659 |

0.683 |

rpGDP |

143 |

11.115 |

0.425 |

10.023 |

11.865 |

143 |

-0.038 |

0.191 |

-0.386 |

0.577 |

|

pt |

143 |

9.429 |

1.004 |

6.091 |

11.841 |

Notes: All the variables included are in natural logarithm. Istru, industry structure; pt, registered patents; ftd, trade openness.

3.2 Basic Regression

Table 2 presents the regression of OLS analysis and two-way fixed effect (year and city fixed effect) analysis. The fixed effect analysis is based on Equations (1) and (2). The OLS analysis results in columns (1) and (3) demonstrate the trade openness is significantly related to the development of IFDI and OFDI. Columns (2) and (4) present the results of fixed effect analysis, 1% increment in trade openness increases IFDI by 0.637% and significant at 1% level, which is consistent with the results in the study of Zhang et al[12]. However, changes in trade openness are not significantly correlated with OFDI. As for the control variables, results in column (2) reveal that IFDI is not significantly related to the alterations in all the control variables, and results in column (4) show that OFDI is significantly correlated with the changes in rpGDP. A 1% increase in rpGDP results in an increase in OFDI by 2.463%. This suggests that the improvement of economic strength in Jiangsu Province may enhance the OFDI activities for exploiting a larger market, which has been observed in recent decades, especially in the infrastructure industries and energy industries.

Table 2. Basic Regression Result

|

IFDI |

OFDI |

||

|

(1) OLS |

(2) Fixed Effect |

(3) OLS |

(4) Fixed Effect |

ftd |

0.496*** (0.063) |

0.637*** (0.152) |

0.624*** (0.153) |

-0.528 (0.515) |

rpGDP |

0.159 (0.179) |

0.358 (0.274) |

0.282 (0.336) |

2.463*** (0.925) |

istru |

0.050 (0.227) |

-0.313 (0.294) |

1.819*** (0.552) |

-0.753 (0.995) |

pt |

0.242*** (0.078) |

0.015 (0.069) |

0.661*** (0.189) |

0.039 (0.232) |

Cons |

19.783*** (1.598) |

19.899*** (2.562) |

12.656*** (3.889) |

-7.379 (8.667) |

Observations |

143 |

143 |

143 |

143 |

Notes: All the variables included are in natural logarithms. ***, ** and * are significant at level 1%, 5% and 10%. The numbers in parentheses are clustered standard errors for cities. Istru, industry structure; pt, registered patents; ftd, trade openness.

Given the huge economic gap between regions in Jiangsu Province, a subregion analysis was performed in the current study. According to the analysis results in Table 3, trade openness is significantly related to the increment of IFDI in southern and central Jiangsu, while such changes were excluded in the Northern area. Results in columns (1) and (2) show that a 1% increment in trade openness will increase IFDI by 1.177% for the southern part and 1.115% for central Jiangsu. As for the control variables, rpGDP is significantly related to the increment of IFDI in central Jiangsu as shown in column (2). Besides, the increment in technology level (registered patents) increases the FDI inflow to the whole province. As in columns (1)(2)(3), a 1% increment in the number of registered patents increases IFDI by 0.284%, 0.263%, and 0.284% in southern, central and northern Jiangsu. In recent decades, technology development has boosted the inward investment attractiveness of Jiangsu Province, and local preferential policies on technological industries have also secured this positive effect. However, no significant relationship was identified between the improvement in industry structure and the changes in IFDI in Jiangsu, indicating less inflow of high-quality FDI in Jiangsu province, which constitutes a challenge to be addressed in terms of industry structure upgrade.

Table 3. Results of Subregion Analysis (Fixed Effect)

|

IFDI |

OFDI |

||||

|

(1) Southern |

(2) Central |

(3) Northern |

(4) Southern |

(5) Central |

(6) Northern |

ftd |

1.177*** (0.424) |

1.115** (0.469) |

0.373 (0.231) |

-3.695*** (0.721) |

-2.489 (2.149) |

0.092 (0.852) |

rpGDP |

-0.129 (0.648) |

1.552*** (0.430) |

-0.772 (0.553) |

1.464 (1.102) |

-2.363 (1.973) |

6.646*** (2.040) |

istru |

0.192 (0.583) |

-0.948 (0.592) |

0.294 (0.573) |

-1.038 (0.992) |

2.960 (2.715) |

-3.518 (2.113) |

pt |

0.284** (0.138) |

0.263** (0.097) |

0.284** (0.137) |

-0.849*** (0.235) |

0.181 (0.446) |

-0.694 (0.506) |

Cons |

23.173*** (6.633) |

9.813** (4.406) |

29.131* (4.743) |

11.373 (11.290) |

44.565** (20.205) |

-45.127** (17.484) |

Obs |

55 |

33 |

55 |

55 |

33 |

55 |

Notes: All the variables included are in natural logarithms. ***, ** and * are significant at level 1%, 5% and 10%. The numbers in parentheses are clustered standard errors for cities. Istru, industry structure; pt, registered patents; ftd, trade openness.

We also conducted a subregion analysis for OFDI by regions of Jiangsu Province. The results in columns (4) to (6) show that trade openness is negatively related to OFDI in southern Jiangsu, excluding central and northern Jiangsu. This is reasonable with the fact that after 2016, the decrease in OFDI in the southern part of the SU substantially outweighed the change in foreign trade dependence. As for the control variables, rpGDP is positively related to the change in OFDI in northern Jiangsu as shown in column (6), and a 1% increment in rpGDP increases OFDI by 6.646%. Besides, results in column (4) show that the increment in technology level (registered patents) is negatively related to the OFDI in southern Jiangsu. Nonetheless, no significant correlation was observed between industry structure and OFDI.

4 CONCLUSION

This study investigated the impact of trade openness on two-way direct investment in Jiangsu Province by using panel data with a fixed effect model. Results indicate that trade openness only significantly increases IFDI in Jiangsu, suggesting that Jiangsu Province has obtained progress in introducing FDI but is still facing challenges in promoting OFDI through international trade. For all the control variables, significant correlations were only observed between rpGDP and OFDI. The subregion analysis found that trade openness is significantly related to the increment of IFDI in southern and central Jiangsu, and the trade openness level is negatively correlated with OFDI in southern Jiangsu. Besides, the control variables rpGDP and registered patents also have an impact on IFDI and OFDI in specific regions.

Based on the results of empirical analysis, we would like to provide some suggestions for policymakers to improve the dynamic development of two-way direct investment (FDI inflow and outflow) in Jiangsu Province, as well as for other provinces in China. Firstly, the local government should follow the principle of “opening to the outside world at a higher level” and the guidelines of the central government. The government should make good use of trade opening as an important tool to attract higher quality FDI and conduct more extensive OFDI activities, especially in fields such as infrastructure. Secondly, the government should be committed to using advanced technology to carry out investment activities, especially foreign investment in other developing countries. Currently, the impact of technology improvement on OFDI is not statistically significant and requires development with the upgrade of our industry structure. Last but not least, the government should rationally use the benefits of regional cooperation agreements (such as RCEP), to ensure a stable economic environment and gain the production welfare and consumption welfare of international trade.

Despite the scope of this study focusing only on the impact of trade openness on foreign direct investment in Jiangsu Province, it provides development suggestions for economic and investment development in other developing countries. Globalization and international trade bring the welfare of a large amount of foreign investment in developing countries, along with rapid economic development. However, The challenges posed by the demand for high-quality international direct investment and the willingness to undertake OFDI will soon emerge. Therefore, for developing countries, to achieve sustainable economic development, international cooperation and the upgrade of domestic industries are necessary.

Acknowledgements

Thanks for the support from Education Department of Jiangsu Province and Jiangsu Ocean University. This work was supported by General Project of Philosophy and Social Science Research in Colleges and Universities of Jiangsu Province [2022SJYB1836] and Scientific Research Startup Project of Jiangsu Ocean University [KQ19060].

Conflicts of Interest

The authors have no conflict of interest.

Author Contribution

Wang Z collected the data, conducted the analysis and wrote the first draft of this paper. He B designed this study, provided suggestions in the analysis and as well revised and improve the content. All the authors approved the final version of this study.

Abbreviation List

FDI, Foreign direct investment

IFDI, Inward foreign direct investment

OFDI, Outward foreign direct investment

rpGDP, Real GDP per capita

References

[1] Sabir S, Rafique A, Abbas K. Institutions and FDI: evidence from developed and developing countries. Financ Innov, 2019; 5: 1-20. DOI: 10.1186/s40854-019-0123-7

[2] Nguyen VB. The difference in the FDI inflows-Income inequality relationship between developed and developing countries. J Int Trade Econ Dev, 2021; 30: 1123-1137. DOI: 10.1080/09638199.2021.1925331

[3] Contractor FJ, Nuruzzaman N, Dangol R et al. How FDI inflows to emerging markets are influenced by country regulatory factors: An exploratory study. J Int Manag, 2021; 27: 100834. DOI: 10.1016/j.intman.2021.100834

[4] Chen J, Zhan W, Tong Z et al. The effect of inward FDI on outward FDI over time in China: A contingent and dynamic perspective. Int Bus Rev, 2020; 29: 101734. DOI: 10.1016/j.ibusrev.2020.101734

[5] Hou L, Li K, Li Q et al. Revisiting the location of FDI in China: A panel data approach with heterogeneous shocks. J Econometrics, 2021; 221: 483-509. DOI: 10.1016/j.jeconom.2020.04.047

[6] Wang C, Hong J, Kafouros M et al. What drives outward FDI of Chinese firms? Testing the explanatory power of three theoretical frameworks. Int Bus Rev, 2012; 21: 425-438. DOI: 10.1016/j.ibusrev.2011.05.004

[7] Kayalvizhi PN, Thenmozhi M. Does quality of innovation, culture and governance drive FDI? Evidence from emerging markets. Emerg Mark Rev, 2018; 34: 175-191. DOI: 10.1016/j.ememar.2017.11.007

[8] Saini N, Singhania M. Determinants of FDI in developed and developing countries: A quantitative analysis using GMM. Emerg Mark Rev, 2018; 45: 348-382. DOI: 10.1108/JES-07-2016-0138

[9] Kong Q, Peng D, Ni Y et al. Trade openness and economic growth quality of China: Empirical analysis using ARDL model. Financ Res Lett, 2021; 38: 101488. DOI: 10.1016/j.frl.2020.101488

[10] Ministry of Commerce, National Bureau of Statistics and State Administration of Foreign Exchange. 2021. 2020 Statistical Bulletin of China's Foreign Direct Investment. Beijing, China.

[11] Xu J, Zhou M. Research on the dynamic coordinated development and influencing factors of China’s two-way FDI (In Chinese). Soft Sci, 2021; 35: 63-69. DOI: 10.13956/j.ss.1001-8409.2021.05.10

[12] Zhang D, Yasin G, Zaman S et al. Trade openness and FDI inflows: A comparative study of Asian countries. Eur Online J Nat Soc Sci, 2018; 7: 386-396.

Copyright ©2022 The Author(s). This open-access article is licensed under a Creative Commons Attribution 4.0 International License (https://creativecommons.org/licenses/by/4.0), which permits unrestricted use, sharing, adaptation, distribution, and reproduction in any medium, provided the original work is properly cited.

Copyright ©

Copyright ©