The War in Ukraine and Its Impact on Polymer Production and Supply in Russian Federation: First Impressions

1Department of Mechanical Engineering, Laboratory of Polymer Materials, Federal University of Paraná, Curitiba, Brazil

*Correspondence to: Harrison Lourenço Corrêa, PhD, Professor, Department of Mechanical Engineering, Laboratory of Polymer Materials, Federal University of Paraná, Rua XV de Novembro, 1299-Centro, Curitiba 80000-000, Brazil; Email: harrisoncorrea@ufpr.br

DOI: https://www.doi.org/10.53964/jmpcm.2022007

Abstract

The last three decades have laid the ground for the current ebbs and flows of the world market. Free trade agreements have blurred traditional geographic and financial borders, bringing greater movement of people and goods, and creating a more globalized world. Economic and political isolation is no longer an option for nations that wish to be more prosperous and want to take advantage of the global integration movement. Although there were benefits to this new model, countries also became more vulnerable to events that take place in other territories, be they political, economic, and even environmental. In the first months of 2022, one such event emerged and seems to have affected the rest of the world: the conflict between Russia and Ukraine. Through a survey of data obtained from technical reports and scientific articles, this paper aims to provide a preliminary assessment of how the current conflict may affect the production and supply of polymers. The firsts data reveal Russia is important supplier of oil and gas to Europe and has some chemical industrial complexes to be used for polymer industries.

Keywords: Russian Federation, polymers, market, distribution

1 INTRODUCTION

Globalization was fundamental to greater integration among nations, making it possible for many to boost certain economic sectors that had previously been stagnant[1]. Updated treaties and legislation have allowed the circulation of goods and commercial transactions to be more agile, with less bureaucracy and lower taxes. Although this new world order contributed to the dynamization of many productive sectors, it also made nations more dependent. Financial crises in a single country were no longer restricted to its own borders, but spilled over to others around the world. Likewise, political, environmental, and social issues have also come to permeate nations, even if the epicenter has come from the other side of the globe. Armed conflicts, regardless of the reasons that led to their outbreak, reverberate throughout the globalized system, affecting nations in different magnitudes, depending on the region or countries involved. The current conflict between two large countries (Russia and Ukraine), which began in the first months of 2022, has revealed one of the faces of the globalized world. The fact that one of the nations holds 6% of the world's crude oil proved reserves[2] and is responsible for much of the gas exploration and distribution in Europe[3], greatly impacts the petrochemical production chain. Situated in this context is the polymer sector. Considered to be mostly petrochemical, the production and processing of polymers and their composites may be impacted by the unfolding and duration of the current conflict. This paper aims to provide first impressions about the current state of the polymer production chain. To that end, technical reports and academic articles were consulted and used in support of the preliminary considerations herein put forth.

2 METHODOLOGY

The present work was based on a survey of technical information about the recent polymer and petrochemicals market in the Russian Federation, which is considered to be the epicenter of the current crisis. The panorama regarding the production/supply chain of each country was obtained by prospecting already published data available on the world wide web. Platform like sciencedirect.com was used for this purpose, as well some relevant site for industrial news.

3 RESULTS

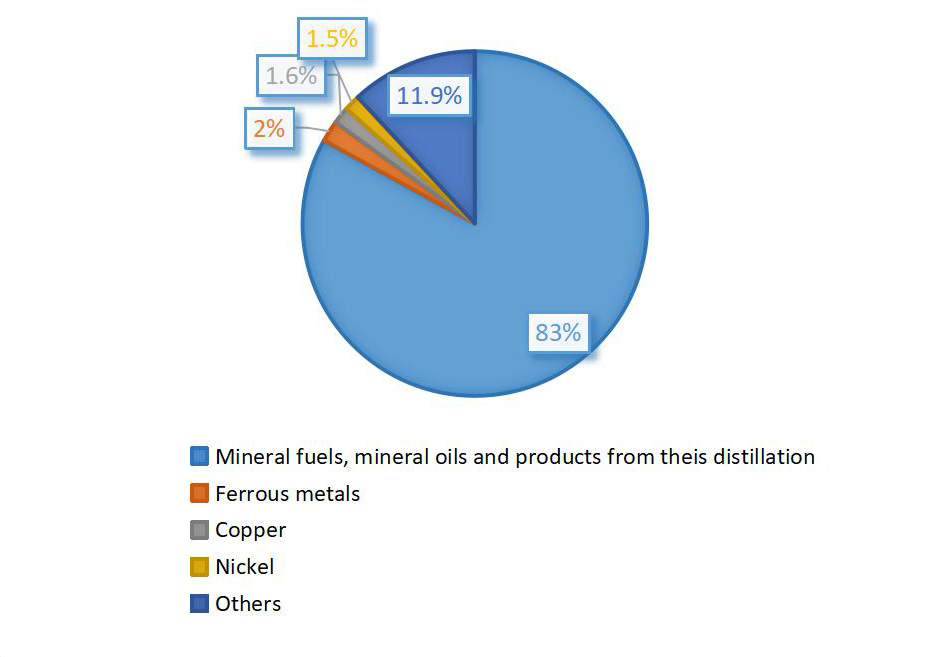

Russia is one of the largest holders of crude oil reserves and deposits in the world[3-5]. Due to its particularities, for many it is considered as a country dependent on these natural resources. Analyzing the production indicators of this country, one can see a Russian competitive advantage with regard to chemicals, fuels, lubricants and natural gas. Between the years 2000 and 2004, these items alone accounted for just over 35% of all Russian exports[6]. Eight years later, over 80% of Russian exports were concentrated in mineral products, including crude oil and derivatives[7]. The Figure 1 shows the main exports of the Russian Federation. Of the total crude oil exported, about 60% was destined for Europe[8], serving different purposes, including supplying the petrochemical chain and production of polymers. The main exporters of oil and gas in Russia are the companies Gazprom, Lukoil, and NK Rosneft. Lukoil is noteworthy for owning the companies Saratov Organic Synthesis and Stravolen, which produce polyethylene (PE), more than 70 grades of polypropylene, vinylacetate, acrylonitrile, acrylamide and polyacrylamide. Lukoil is also a major exporter of chemicals to over 30 countries[3].

|

Figure 1. Main exports items of the Russian Federation in trade with EU in 2014 (Adapted from Ref[7]).

Currently, Russian industry is grounded in chemical and petrochemical companies[9], requiring major innovations to sustain itself[10]. In their surveys of innovation activities in Russian industry, Bessarabov et al.[10] considered the tire industry implemented due to Russian demand for automobiles[11], polymers, and synthetic rubber and plastics. Over the period studied (1995-2015), the authors concluded that the Russian petrochemical sector expanded even after a long period of industrial recession. In an analysis of the Russian chemical industry, Klyuev[11] highlighted the evolution of industrial chemical complexes for the production of polypropylene (PP), located in Omsk, and for the production of ethylene, propylene, and PE, in the city of Tobolski, in addition to a chemical gas complex under construction in Novy Urengoy, capable of producing PE and PP. These chemical companies emerged from oil and gas fields located in East Siberia[12]. Also noteworthy is the potential for developing polyvinyl chloride (PVC) plants in the Kuzbass region from coal chemistry technologies[13]. In a study on competitiveness of Russian products, including organic chemicals and polymers, Fal'tsman[14] noted an increase in Russian exports in the first decade of the 21st century. Added to this scenario of apparent growth of chemical complexes are the efforts of the Russian government to boost the fluoropolymer segment by integrating academic and industrial research institutes through the Fluoropolymer Materials and Nanotechnology Consortium[15,16], in addition to efforts to structure its petrochemical chain[17].

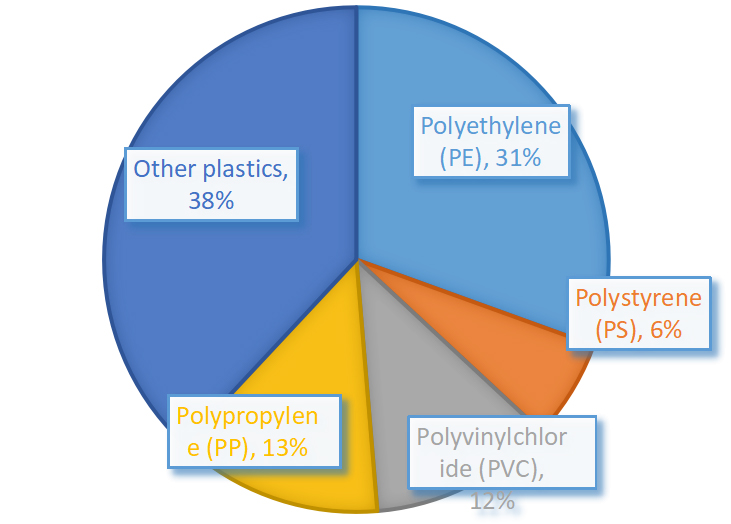

Despite signs of strengthening industrial chemical complexes, this expansion still seems to be insufficient to redress the trade imbalance between Russia and the European Union (EU). In his studies on the Russian market, Terebova[7] showed a disparity in the flow of goods between Russia and the EU, concluding that Russia is a major exporter of commodities and an importer of products with added value, such as machinery[14] and vehicles, representing almost 50% of the imported volume. Considering the level of commercialization of chemical goods, Russia ranks 12th in the world, with the following inputs standing out: ethylene, benzene, methanol, PE, PP, PVC, PS, and synthetic rubber. Polymer exports represent less than 1% of Russia's total trade[3]. In 2011, the primary plastics were among the largest chemical produced in Russia, as can be noted by Figure 2.

|

Figure 2. Percentual of primary plastics produced in Russia in 2011[18].

Even with this imbalance, Russia will still have bargaining power in the global chemicals market and even some influence over the polymer sector. As Melnikova et al.[19] have pointed out, the oil and gas industry, based on crude oil, condensate gas, and natural gas products, occupies a prominent position in many countries, contributing between 5% and 10% to some countries' economies. Currently, the world market for chemical inputs is estimated to be around $4.5 trillion, and is expected to double by 2030[3].

4 CONCLUSION

Despite recent studies indicating diversification and expansion of the chemical industrial complex in Russia, especially to meet the needs of the polymer production sector, such as PE and PP, the Russian industry is still lagging behind in terms of industrial units for the production of polymeric artifacts. This scenario, while weakening the polymer production chain in Russia, may be an opportunity for the emergence of new plants to meet the demands of the domestic market, given the current sanctions imposed.

Russian exports are characterized by commodities, among them crude oil and gas, the main raw materials for the production of chemical intermediates needed to obtain polymers. Depending on the prolongation of the current crisis between Russia and Ukraine, and its ramifications, the polymer production chain in Europe may be harmed, creating price increases among finished products and even shortages of certain polymeric artifacts.

The current conflict, regardless of its duration, is already impacting the Russian domestic market. The recent economic sanctions imposed, such as removing banks from the Swift system and blocking international credit, will affect any attempt of the chemical industrial complex in Russia to innovate. Naturally, that includes the polymer sector, which is so dependent on foreign capital. At the same time, this challenging scenario may stimulate the strengthening of industrial plants in Russia that are necessary to supply the domestic market - which, in the long run, may help in a process of eventual resumption of business with the West.

Regardless of the scenario that takes shape in the coming months, not only will geopolitics be transformed, but also the oil and gas market itself and its chemical derivatives such as polymers and their intermediates. This will require strategic assessment by countries to remain competitive in the sector without compromising their current and future demands for oil/gas.

Not applicable.

Conflicts of Interest

The author declared no conflict of interest.

Author Contribution

Corrêa HL solely contributed to this manuscript.

Abbreviation List

EU, European Union

PE, Polyethylene

PP, Polypropylene

PVC, Polyvinyl chloride

References

[1] Bresser-Pereira L. Globalization, nation-state and catching up. Braz J Polit Econ, 2008; 28: 557-576. DOI: 10.1590/S0101-31572008000400002.

[2] Instituto Brasileiro de Petróleo e Gás. Maiores reservas provadas de petróleo em 2020. Accessed March 15th 2022. Available at https://www.ibp.org.br/observatorio-do-setor/snapshots/maiores-reservas-provadas-de-petroleo-em-2020

[3] Golubeva I, Kryuchkov M. Oil and gas chemistry in Russia: State, problems and prospects of development. Chem Tech Fuels Oil+, 2021; 57: 72-82. DOI: 10.1007/s10553-021-01228-9.

[4] Paik KW. Sino-Russian gas and oil cooperation: Entering into a new era of strategic partnership? The Oxford Institute for Energy Studies: Oxford, UK, 2015. DOI: 10.26889/9781784670290.

[5] Kryukov V, Shmat V. Petro-gas chemistry in Russia's East: Growth driver or ballast? Region Res Russ, 2021; 11: 174-186. DOI: 10.1134/S2079970521020076.

[6] Cooper J. Can Russia compete in the global economy? Eurasian Geogr Econ, 2006; 47: 407-425. DOI: 10.2747/1538-7216.47.4.407.

[7] Terebova S. Cooperation between Russia and the European Union: From importing to exporting technology. Stud Russ Econ Dev, 2017; 28: 327-337. DOI: 10.1134/S1075700717030145.

[8] IEA. Russian supplies to global energy markets. Accessed 2022. Available at https://www.iea.org/reports/russian-supplies-to-global-energy-markets

[9] Bessarabov A, Vendilo I, Zaremba G et al. Computer analysis of innovation of the chemical complex of Russia.

[10] Bessarabov AM, Kvasyuk АV, Kochetygov AL. System analysis of innovation activities by leading companies of the chemical industry (1995 to 2007). Theor Found Chem En+, 2009; 43: 444-452. DOI: 10.1134/S0040579509040149.

[11] Klyuev N. Current changes on the industrial map of Russia. Region Res Russ, 2020; 10: 494-505. DOI: 10.1134/S2079970520040140.

[12] Kontorovich A, Kashirtsev V, Korzhubaev A et al. General scheme for the formation of the oil and gas complex of Eastern Siberia and the Sakha Republic. Vestn Ross Akad Nauk, 2007; 3: 205-210.

[13] Kudryashova I, Zakharova N, Kharlampenkov E. Innovative production of polyvinyl chloride on the basis of vertical integration of business and cluster organization. E3S Web of Conferences 21. E3S Web Conferences, 2017; 21: 02016. DOI: 10.1051/e3sconf/20172102016.

[14] Fal’tsman V. Evaluation of the competitiveness of Russian products in world, CIS, EAEC and non-CIS market. Stud Russ Econ Dev, 2014; 25: 69-76. DOI: 10.1134/S1075700714010055.

[15] Pugachev A. Analysis of development of russian fluoropolymer chemistry, production and fields of fluoropolymers application: Some aspects of the history of creating russian fluoropolymers. Russ J Gen Chem+, 2009; 79: 517-519. DOI: 10.1134/S1070363209030323.

[16] Nicolaeva N, Grinev N, Barabano P et al. Prospects for the development of the innovative market of chemical technologies in Russia. NORDSCI International Conference 2021, 11-13 October 2021.

[17] Golysheva E, Zhdaneev O, Korenev V et al. Petrochemical industry in Russia: State of the art and propects for development. Russ J Appl Chem+, 2020; 93: 1596-1603. DOI: 10.1134/s107042722010158.

[18] Dyakonov G, Ziyatdinov N, Lyzhina N. The growth of a chemicals industry in Russia. Glob Outlook Am Inst Chem Eng, 2014: 45-49.

[19] Melnikova S. Oil and Gas Chemistry. Oil and Gas Processing in Russian Federation. Alyans Analitika. Moscow (2014).

Copyright ©2022 The Author(s). This open-access article is licensed under a Creative Commons Attribution 4.0 International License (https://creativecommons.org/licenses/by/4.0), which permits unrestricted use, sharing, adaptation, distribution, and reproduction in any medium, provided the original work is properly cited.

Copyright ©

Copyright ©